Question: can anyone help me with this? Problem 9-4A (Part Level Submission) At January 1, 2017, Carla Vista Co. reported the following property, plant, and equipment

can anyone help me with this?

can anyone help me with this?

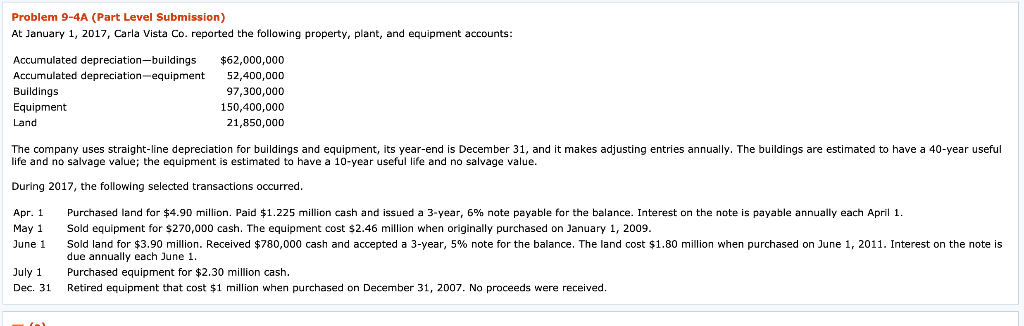

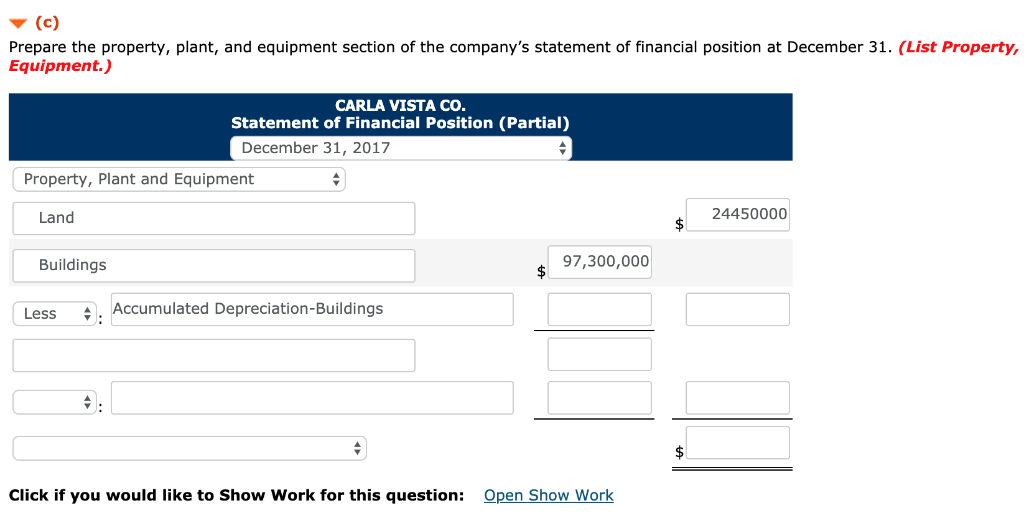

Problem 9-4A (Part Level Submission) At January 1, 2017, Carla Vista Co. reported the following property, plant, and equipment accounts Accumulated depreciation-buildings $62,000,000 Accumulated depreciation-equipment 52,400,000 Buildings Equipment Land 97,300,000 150,400,000 21,850,000 The company uses straight-line depreciation for buildings and equipment, its year-end is December 31, and it makes adjusting entries annually. The buildings are estimated to have a 40-year useful life and no salvage value; the equipment is estimated to have a 10-year useful life and no salvage value. During 2017, the following selected transactions occurred Purchased land for $4.90 million. Paid $1.225 million cash and issued a 3-year, 6% note payable for the balance. Interest on the note is payable annually each Apnl 1. Sold equipment for $270,000 cash. The equipment cost $2.46 million when originally purchased on anuary 1, 2009. Sold land for $3.90 million. Received $780,000 cash and accepted a 3-year, 5% note for the balance. The land cost $1.80 million when purchased on June 1, 2011, Interest on the note is due annually each June 1. Apr. May 1 June 1 July 1 Purchased equipment for $2.30 million cash. Dec. 31 Retired equipment that cost $1 mlon when purchased on December 31, 2007. No proceeds were received Prepare the property, plant, and equipment section of the company's statement of financial position at December 31. (List Property, Equipment.) CARLA VISTA CO Statement of Financial Position (Partial) December 31, 2017 Property, Plant and Equipment 24450000 Land 97,300,000 Buildings Less Accumulated Depreciation-Buildings Click if you would like to Show Work for this question: Open Show Work

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts