Question: Can anyone help me with this problem, please. ACC 502 Accounting for Management Assignment 5 1. The following excerpt is from Note 3 of the

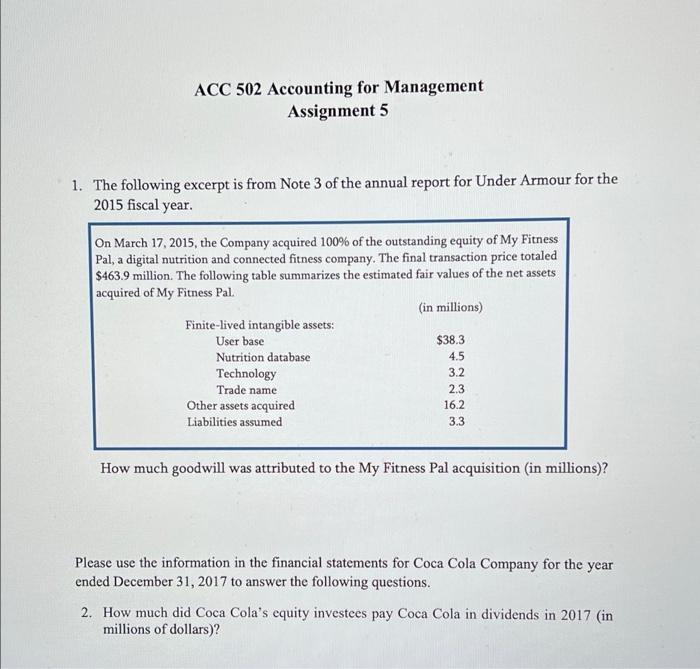

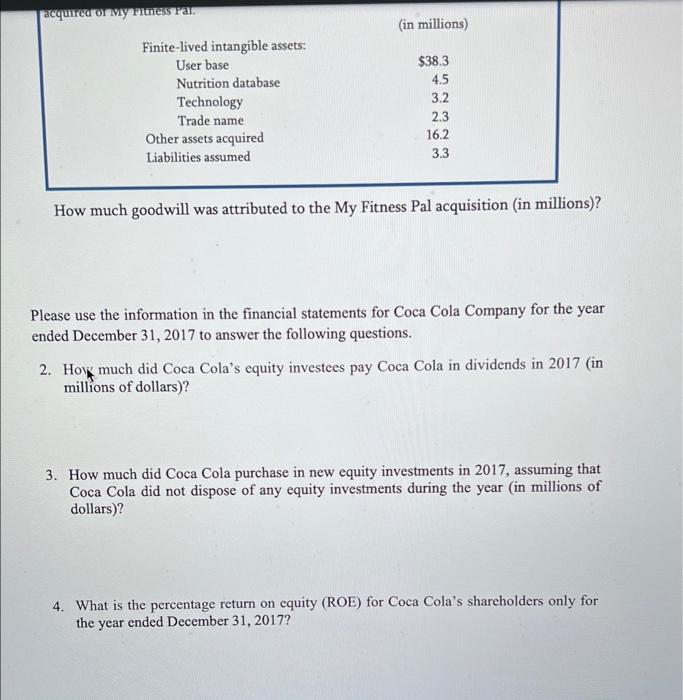

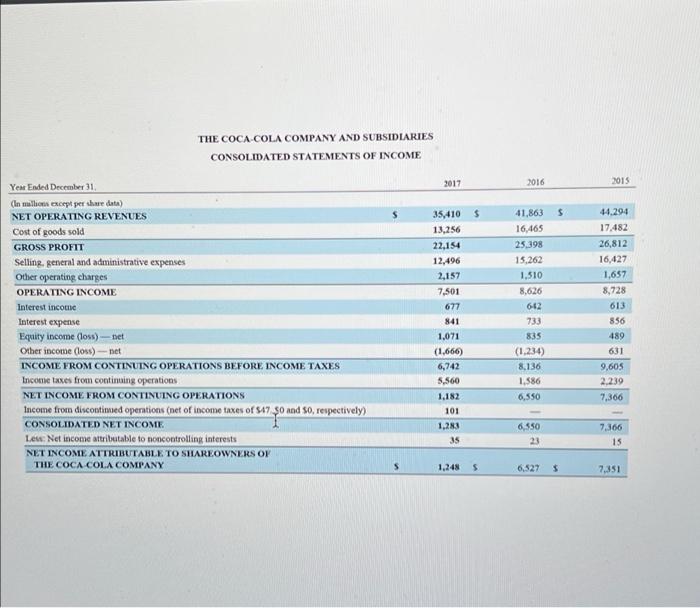

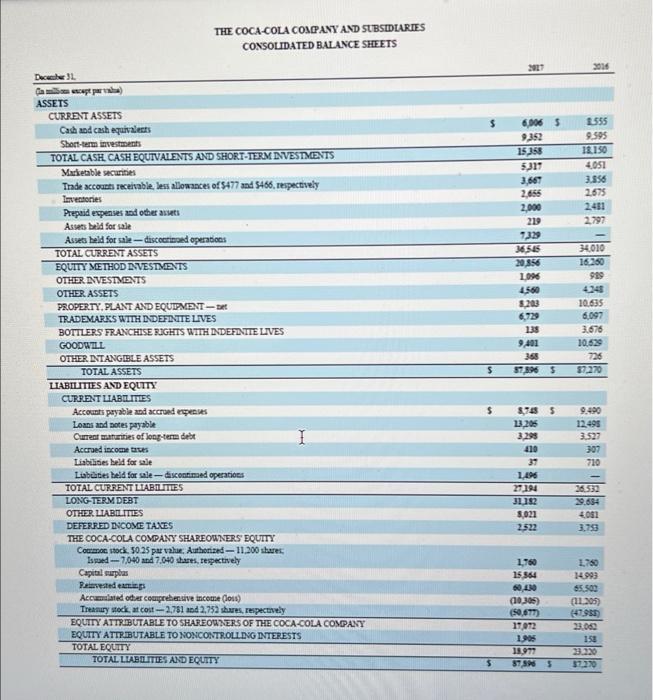

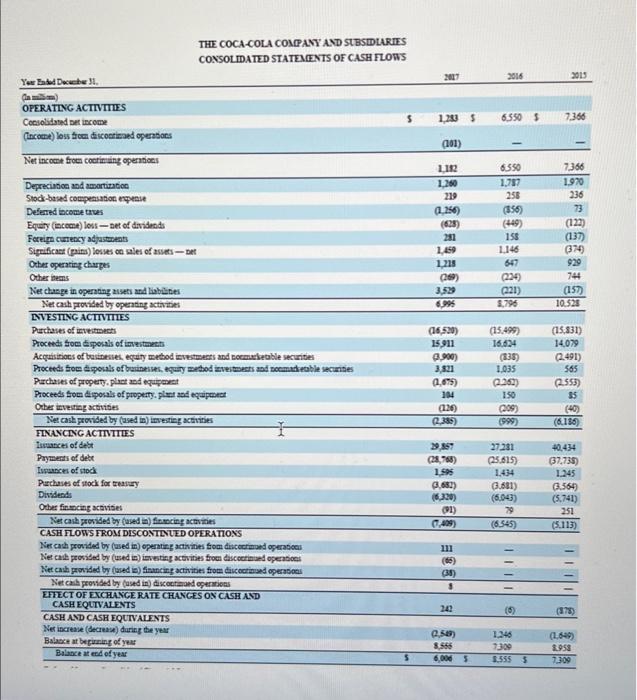

ACC 502 Accounting for Management Assignment 5 1. The following excerpt is from Note 3 of the annual report for Under Armour for the 2015 fiscal year. On March 17, 2015, the Company acquired 100% of the outstanding equity of My Fitness Pal, a digital nutrition and connected fitness company. The final transaction price totaled $463.9 million. The following table summarizes the estimated fair values of the net assets acquired of My Fitness Pal. (in millions) Finite-lived intangible assets: User base $38.3 Nutrition database 4.5 Technology 3.2 Trade name 2.3 Other assets acquired 16.2 Liabilities assumed 3.3 How much goodwill was attributed to the My Fitness Pal acquisition in millions)? Please use the information in the financial statements for Coca Cola Company for the year ended December 31, 2017 to answer the following questions. 2. How much did Coca Cola's cquity investees pay Coca Cola in dividends in 2017 (in millions of dollars)? acquired on my Fitness Par (in millions) Finite-lived intangible assets: User base Nutrition database Technology Trade name Other assets acquired Liabilities assumed $38.3 4.5 3.2 2.3 16.2 3.3 How much goodwill was attributed to the My Fitness Pal acquisition (in millions)? Please use the information in the financial statements for Coca Cola Company for the year ended December 31, 2017 to answer the following questions. 2. How much did Coca Cola's equity investees pay Coca Cola in dividends in 2017 (in millions of dollars)? 3. How much did Coca Cola purchase in new equity investments in 2017, assuming that Coca Cola did not dispose of any equity investments during the year (in millions of dollars)? 4. What is the percentage return on equity (ROE) for Coca Cola's shareholders only for the year ended December 31, 2017? THE COCA COLA COMPANY AND SUBSIDIARIES CONSOLIDATED STATEMENTS OF INCOME 2017 2016 2015 $ $ Yem Ended December 31 (In millions except per share data) NET OPERATING REVENUES Cost of goods sold GROSS PROFIT Selling, gerveral and administrative expenses Other operating charges OPERATING INCOME Interest income Interest expense Equity income (loss)-net Other income (oss) - net INCOME FROM CONTINUING OPERATIONS BEFORE INCOME TAXES Income taxes from continuing operations NET INCOME FROM CONTINUING OPERATIONS Income from discontimed operations (net of income taxes of 547 90 and 80, respectively) CONSOLIDATED NET INCOME Les: Net income attributable to noncontrolling interests NET INCOME ATTRIBUTABLE TO SHAREOWNERS OF THE COCA COLA COMPANY 35,410 13,256 22.154 12.496 2,157 7,501 677 841 1,071 (1,666) 6,742 5.560 1.182 101 1,283 35 41,863 16,465 25.398 15.262 1.510 8.626 642 733 835 (1.234) 8,136 1.586 6,550 44.294 17.482 26,812 16,427 1,657 8,728 613 856 489 631 9,605 2.239 7,366 6.550 23 7.366 15 S 1.248 $ 6,527 $ 7,351 THE COCA-COLA COMPANY AND SUBSIDIARIES CONSOLIDATED BALANCE SHEETS 2016 1.555 9.595 18.150 4,051 3.556 2.675 2411 2.797 Dec 31 da scapp ASSETS CURRENT ASSETS Cash and cash equivalent Short-term investments TOTAL CASH CASH EQUIVALENTS AND SHORT-TERM INVESTMENTS Marketable securities Trade accounts receivable, less allowances of S477 and 5466, respectively Lovestories Prepaid espenses and other assets Assets bald for sale Assets held for sale-discerned operations TOTAL CURRENT ASSETS EQUITY METHOD INVESTMENTS OTHER INVESTMENTS OTHER ASSETS PROPERTY.PLANT AND EQUIPMENT DE TRADEMARKS WITH INDEFINITE LIVES BOTTLERS FRANCHISE RIGHTS WITH INDEFINITE LIVES GOODWILL OTHER INTANGIBLE ASSETS TOTAL ASSETS LIABILITIES AND EQUITY CURRENT LIABILITIES Accounts payable and accred expenses Loans and notes payable Current maturities of long-term debt Accrued income Liabilisies held for sale Lubaties held for sale - discontimed operations TOTAL CURRENT LIABILITIES LONG-TERM DEBT OTHER LIABILITIES DEFERRED INCOME TAXES THE COCA-COLA COMPANY SHAREOWNERS EQUITY Common stock. 50.25 per value Authorized - 11.200 shares Isused -7,040 and 7.040 shares, respectively Capital surplus Rasesteder Accumulated or comprehensive income (los) Treasy stock at cost -2,751 and 2,752 shares, respectively EQUITY ATTRIBUTABLE TO SHAREOWNERS OF THE COCA-COLA COMPANY EQUITY ATTRIBUTABLE TO NONCONTROLLING INTERESTS TOTAL EQUITY TOTAL LIABILITIES AND EQUITY 6.9065 9352 15358 5317 3.667 2,655 2,000 219 7329 36565 20,856 1096 4.560 203 6,739 138 9,401 360 57.3965 34.010 16.250 999 10.635 6,097 3.676 10.529 726 37.270 $ $ 9.490 12495 3.527 307 710 8,7435 13,205 3.298 410 37 1.196 27194 31 152 8,021 2.522 26.550 29.694 4081 3,75 1,760 15564 60,480 (10,305) (5067) 17012 1905 18.977 57 58 5 2.750 14993 65.500 (11.205) (47.955 33.000 150 3.320 $ THE COCA-COLA COMPANY AND SUBSIDLARIES CONSOLIDATED STATEMENTS OF CASH FLOWS 2013 You Dec 31 120 $ 6.550 $ 7.366 (101) 6.550 1.787 258 (356) 1112 1.260 219 (1.256) (625) 201 1.450 1.215 269) 3.599 6.995 7386 1.970 236 73 (122) (137) (374 929 158 1146 647 (234) (221) 5,796 7:44 (157 10.525 OPERATING ACTIVITIES Consolidated be income (income) loss from discontinued operations Net income from continuing operations Depreciation and amortization Stock-based compensation pense Defensed income true Equity (income) less ---Det of dividende Foreign currency adjustments Significant (prins) lesses on sales of assets De Other operating charpes Other thens Net change in operating assets and liabilities Netcash provided by operating activities INVESTING ACTIVITIES Purchases of met Proceeds from disposals of lovestors Acquisitions of businesses eury method investments and booketable securities Proceeds from disposals of businesses, equiry bod investments and sommarkable securities Purchases of property, plant and equat Proceeds from disposals of property, plant and equipment Other even actives Net cash provided by (ased in) investing activities FINANCING ACTIVITIES Issuances of debt Payments of debt Isances of stock Purchases of stock for treasury Dividends Other financing activities Net cash provided by usedia financing activities CASH FLOWS FROM DESCONTINUED OPERATIONS Ner cash provided by used in operating activities from disce ad operations Net cache provided by used in) lavesting activities from discontinuand operations Netcash provided by used is) financing activities from discocinand operations Net cash provided by used in discomand operations EFFECT OF EXCHANGE RATE CHANGES ON CASH AND CASH EQUIVALENTS CASH AND CASH EQUIVALENTS Net increase (dec) during the year Balaceat bumangoy Balance at end of year (16.520) 15,911 2.900) 3.821 2.695) 104 (126) 0.385) (15.499) 16.624 (838) 1.035 (2.262) 150 009) 1999) (15.831) 14.079 (2.491) 565 2.553) 35 (40) (6.185) 29,889 (28.768 1.595 0.682) (6,320) 091) 0,409) 27.231 25.615) 1.434 3.581) (6.043) 79 (6.545) 40,434 37.738) 1.245 0.564) (5.741) 251 (5.113) 111 (6) (38) 3 24 (0 (878) 0.58) 8,566 6,000 5 1.246 7300 1.5555 (1.649) 3.958 7309 5 ACC 502 Accounting for Management Assignment 5 1. The following excerpt is from Note 3 of the annual report for Under Armour for the 2015 fiscal year. On March 17, 2015, the Company acquired 100% of the outstanding equity of My Fitness Pal, a digital nutrition and connected fitness company. The final transaction price totaled $463.9 million. The following table summarizes the estimated fair values of the net assets acquired of My Fitness Pal. (in millions) Finite-lived intangible assets: User base $38.3 Nutrition database 4.5 Technology 3.2 Trade name 2.3 Other assets acquired 16.2 Liabilities assumed 3.3 How much goodwill was attributed to the My Fitness Pal acquisition in millions)? Please use the information in the financial statements for Coca Cola Company for the year ended December 31, 2017 to answer the following questions. 2. How much did Coca Cola's cquity investees pay Coca Cola in dividends in 2017 (in millions of dollars)? acquired on my Fitness Par (in millions) Finite-lived intangible assets: User base Nutrition database Technology Trade name Other assets acquired Liabilities assumed $38.3 4.5 3.2 2.3 16.2 3.3 How much goodwill was attributed to the My Fitness Pal acquisition (in millions)? Please use the information in the financial statements for Coca Cola Company for the year ended December 31, 2017 to answer the following questions. 2. How much did Coca Cola's equity investees pay Coca Cola in dividends in 2017 (in millions of dollars)? 3. How much did Coca Cola purchase in new equity investments in 2017, assuming that Coca Cola did not dispose of any equity investments during the year (in millions of dollars)? 4. What is the percentage return on equity (ROE) for Coca Cola's shareholders only for the year ended December 31, 2017? THE COCA COLA COMPANY AND SUBSIDIARIES CONSOLIDATED STATEMENTS OF INCOME 2017 2016 2015 $ $ Yem Ended December 31 (In millions except per share data) NET OPERATING REVENUES Cost of goods sold GROSS PROFIT Selling, gerveral and administrative expenses Other operating charges OPERATING INCOME Interest income Interest expense Equity income (loss)-net Other income (oss) - net INCOME FROM CONTINUING OPERATIONS BEFORE INCOME TAXES Income taxes from continuing operations NET INCOME FROM CONTINUING OPERATIONS Income from discontimed operations (net of income taxes of 547 90 and 80, respectively) CONSOLIDATED NET INCOME Les: Net income attributable to noncontrolling interests NET INCOME ATTRIBUTABLE TO SHAREOWNERS OF THE COCA COLA COMPANY 35,410 13,256 22.154 12.496 2,157 7,501 677 841 1,071 (1,666) 6,742 5.560 1.182 101 1,283 35 41,863 16,465 25.398 15.262 1.510 8.626 642 733 835 (1.234) 8,136 1.586 6,550 44.294 17.482 26,812 16,427 1,657 8,728 613 856 489 631 9,605 2.239 7,366 6.550 23 7.366 15 S 1.248 $ 6,527 $ 7,351 THE COCA-COLA COMPANY AND SUBSIDIARIES CONSOLIDATED BALANCE SHEETS 2016 1.555 9.595 18.150 4,051 3.556 2.675 2411 2.797 Dec 31 da scapp ASSETS CURRENT ASSETS Cash and cash equivalent Short-term investments TOTAL CASH CASH EQUIVALENTS AND SHORT-TERM INVESTMENTS Marketable securities Trade accounts receivable, less allowances of S477 and 5466, respectively Lovestories Prepaid espenses and other assets Assets bald for sale Assets held for sale-discerned operations TOTAL CURRENT ASSETS EQUITY METHOD INVESTMENTS OTHER INVESTMENTS OTHER ASSETS PROPERTY.PLANT AND EQUIPMENT DE TRADEMARKS WITH INDEFINITE LIVES BOTTLERS FRANCHISE RIGHTS WITH INDEFINITE LIVES GOODWILL OTHER INTANGIBLE ASSETS TOTAL ASSETS LIABILITIES AND EQUITY CURRENT LIABILITIES Accounts payable and accred expenses Loans and notes payable Current maturities of long-term debt Accrued income Liabilisies held for sale Lubaties held for sale - discontimed operations TOTAL CURRENT LIABILITIES LONG-TERM DEBT OTHER LIABILITIES DEFERRED INCOME TAXES THE COCA-COLA COMPANY SHAREOWNERS EQUITY Common stock. 50.25 per value Authorized - 11.200 shares Isused -7,040 and 7.040 shares, respectively Capital surplus Rasesteder Accumulated or comprehensive income (los) Treasy stock at cost -2,751 and 2,752 shares, respectively EQUITY ATTRIBUTABLE TO SHAREOWNERS OF THE COCA-COLA COMPANY EQUITY ATTRIBUTABLE TO NONCONTROLLING INTERESTS TOTAL EQUITY TOTAL LIABILITIES AND EQUITY 6.9065 9352 15358 5317 3.667 2,655 2,000 219 7329 36565 20,856 1096 4.560 203 6,739 138 9,401 360 57.3965 34.010 16.250 999 10.635 6,097 3.676 10.529 726 37.270 $ $ 9.490 12495 3.527 307 710 8,7435 13,205 3.298 410 37 1.196 27194 31 152 8,021 2.522 26.550 29.694 4081 3,75 1,760 15564 60,480 (10,305) (5067) 17012 1905 18.977 57 58 5 2.750 14993 65.500 (11.205) (47.955 33.000 150 3.320 $ THE COCA-COLA COMPANY AND SUBSIDLARIES CONSOLIDATED STATEMENTS OF CASH FLOWS 2013 You Dec 31 120 $ 6.550 $ 7.366 (101) 6.550 1.787 258 (356) 1112 1.260 219 (1.256) (625) 201 1.450 1.215 269) 3.599 6.995 7386 1.970 236 73 (122) (137) (374 929 158 1146 647 (234) (221) 5,796 7:44 (157 10.525 OPERATING ACTIVITIES Consolidated be income (income) loss from discontinued operations Net income from continuing operations Depreciation and amortization Stock-based compensation pense Defensed income true Equity (income) less ---Det of dividende Foreign currency adjustments Significant (prins) lesses on sales of assets De Other operating charpes Other thens Net change in operating assets and liabilities Netcash provided by operating activities INVESTING ACTIVITIES Purchases of met Proceeds from disposals of lovestors Acquisitions of businesses eury method investments and booketable securities Proceeds from disposals of businesses, equiry bod investments and sommarkable securities Purchases of property, plant and equat Proceeds from disposals of property, plant and equipment Other even actives Net cash provided by (ased in) investing activities FINANCING ACTIVITIES Issuances of debt Payments of debt Isances of stock Purchases of stock for treasury Dividends Other financing activities Net cash provided by usedia financing activities CASH FLOWS FROM DESCONTINUED OPERATIONS Ner cash provided by used in operating activities from disce ad operations Net cache provided by used in) lavesting activities from discontinuand operations Netcash provided by used is) financing activities from discocinand operations Net cash provided by used in discomand operations EFFECT OF EXCHANGE RATE CHANGES ON CASH AND CASH EQUIVALENTS CASH AND CASH EQUIVALENTS Net increase (dec) during the year Balaceat bumangoy Balance at end of year (16.520) 15,911 2.900) 3.821 2.695) 104 (126) 0.385) (15.499) 16.624 (838) 1.035 (2.262) 150 009) 1999) (15.831) 14.079 (2.491) 565 2.553) 35 (40) (6.185) 29,889 (28.768 1.595 0.682) (6,320) 091) 0,409) 27.231 25.615) 1.434 3.581) (6.043) 79 (6.545) 40,434 37.738) 1.245 0.564) (5.741) 251 (5.113) 111 (6) (38) 3 24 (0 (878) 0.58) 8,566 6,000 5 1.246 7300 1.5555 (1.649) 3.958 7309 5

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts