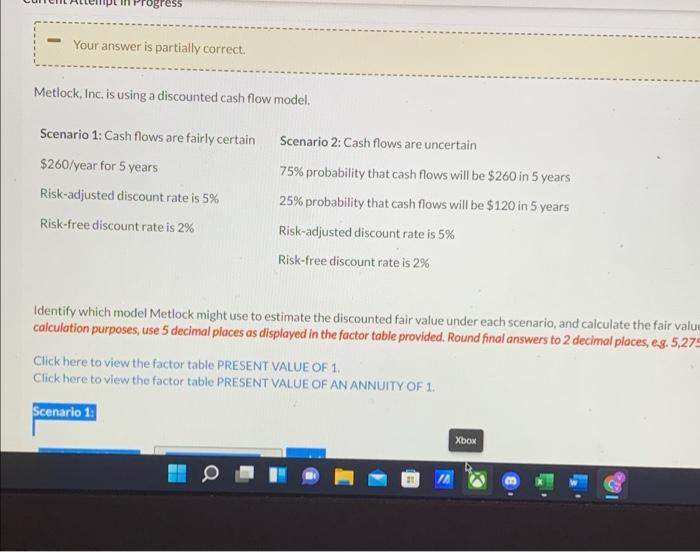

Question: can anyone help me with this question please? Progress Your answer is partially correct. Metlock, Inc. is using a discounted cash flow model. Scenario 1:

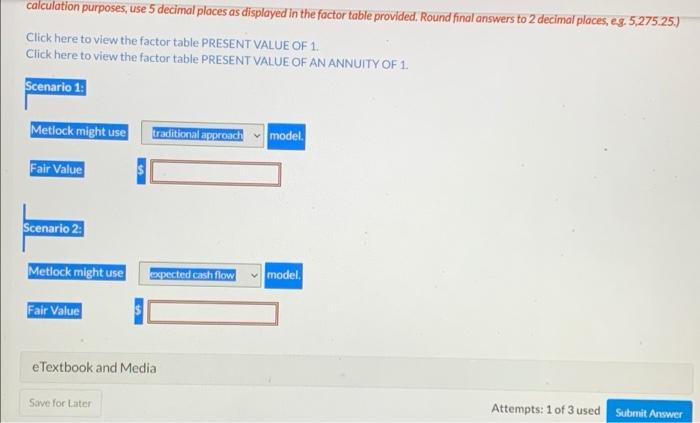

Progress Your answer is partially correct. Metlock, Inc. is using a discounted cash flow model. Scenario 1: Cash flows are fairly certain Scenario 2: Cash flows are uncertain $260/year for 5 years 75% probability that cash flows will be $260 in 5 years Risk-adjusted discount rate is 5% 25% probability that cash flows will be $120 in 5 years Risk-free discount rate is 2% Risk-adjusted discount rate is 5% Risk-free discount rate is 2% Identify which model Metlock might use to estimate the discounted fair value under each scenario, and calculate the fair value calculation purposes, use 5 decimal places as displayed in the factor table provided. Round final answers to 2 decimal places, eg. 5,275 Click here to view the factor table PRESENT VALUE OF 1. Click here to view the factor table PRESENT VALUE OF AN ANNUITY OF 1. Scenario 1 Xbox calculation purposes, use 5 decimal places as displayed in the factor table provided. Round final answers to 2 decimal places, eg. 5,275.25.) Click here to view the factor table PRESENT VALUE OF 1. Click here to view the factor table PRESENT VALUE OF AN ANNUITY OF 1. Scenario 1 Metlock might use traditional approach model Fair Value Scenario 2: Metlock might use expected cash flow model. Fair Value e Textbook and Media Save for later Attempts: 1 of 3 used Submit

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts