Question: can anyone help solve these? someone else please help me answer this e equity sections for Atticus Group at the beginning of the year (January

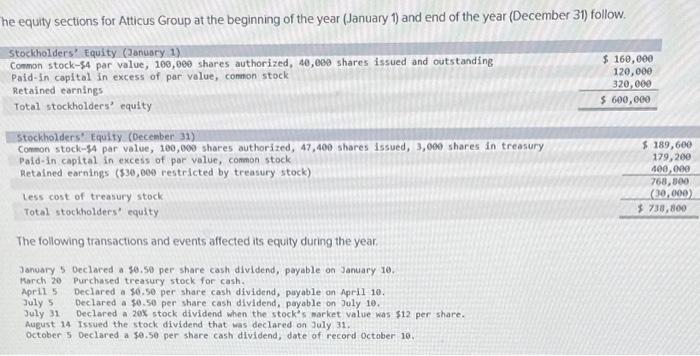

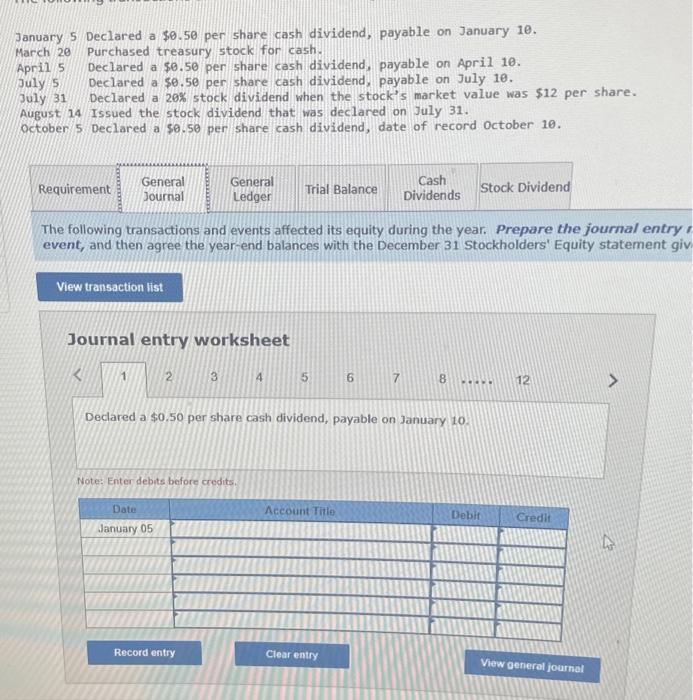

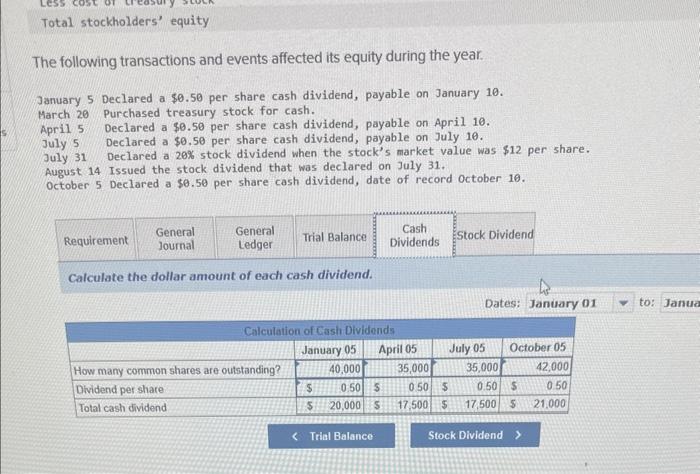

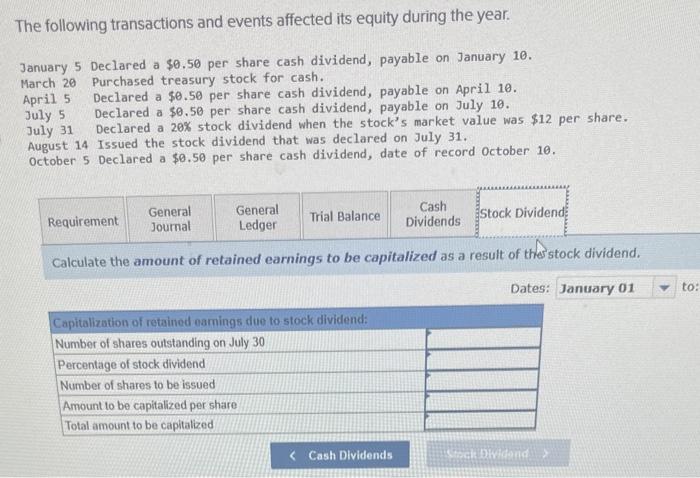

e equity sections for Atticus Group at the beginning of the year (January 1) and end of the year (December 31) follow. January 5 Declared a \$0.50 per share cash dividend, payable on January 10. March 20 Purchased treasury stock for cash. April 5 Declared a $0.50 per share cash dividend, payable on April 10. July 5 Declared a $0.50 per share cash dividend, payable on July 10. July 31 Declared a 20% stock dividend when the stock's market value was \$12 per share. August 14 Issued the stock dividend that was declared on July 31. October 5 Declared a $0.50 per share cash dividend, date of record October 10. The following transactions and events affected its equity during the year. Prepare the journal entr event, and then agree the year-end balances with the December 31 Stockholders' Equity statement Journal entry worksheet \begin{tabular}{|l|l|l|l|l|l|l|l} 4 & 5 & 6 & 7 & 8 & 12 \end{tabular} Declared a $0.50 per share cash dividend, payable on January 10. Note: Enter debits before credits. The following transactions and events affected its equity during the year. January 5 Declared a $0.50 per share cash dividend, payable on January 10. March 20 Purchased treasury stock for cash. April 5 Declared a $0.50 per share cash dividend, payable on April 10. July 5 Declared a $0.50 per share cash dividend, payable on July 10. July 31 Declared a 20% stock dividend when the stock's market value was $12 per share. August 14 Issued the stock dividend that was declared on July 31. October 5 Declared a $0.50 per share cash dividend, date of record october 10. Calculate the dollar amount of each cash dividend. The following transactions and events affected its equity during the year. January 5 Declared a $0.50 per share cash dividend, payable on January 10. March 20 Purchased treasury stock for cash. April 5 Declared a $0.50 per share cash dividend, payable on April 10. July 5 Declared a $0.50 per share cash dividend, payable on July 10. July 31 Declared a 20% stock dividend when the stock's market value was $12 per share. August 14 Issued the stock dividend that was declared on July 31. october 5 Declared a $0.50 per share cash dividend, date of record october 10. Calculate the amount of retained earnings to be capitalized as a result of thesstock dividend

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts