Question: Can anyone help with the while chart please? Help is needed Raleigh Department Store uses the conventional retail method for the year ended December 31,

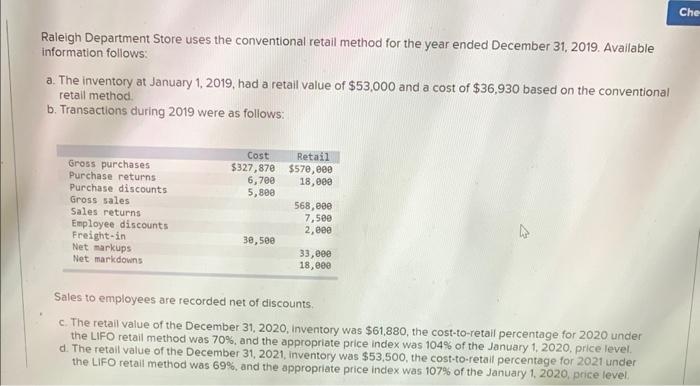

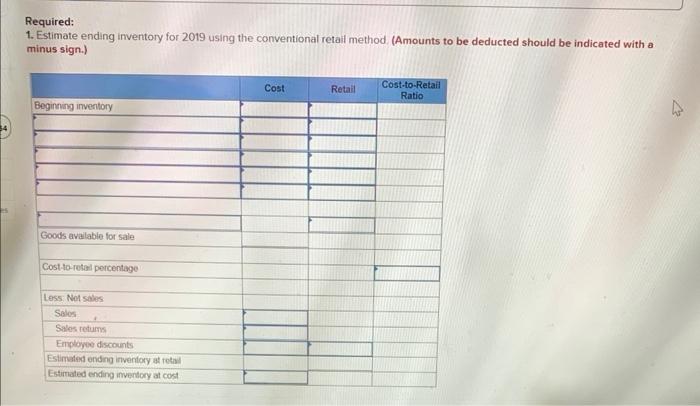

Raleigh Department Store uses the conventional retail method for the year ended December 31, 2019. Available information follows: a. The inventory at January 1, 2019, had a retail value of $53,000 and a cost of $36,930 based on the conventional retall method. b. Transactions during 2019 were as follows: Sales to employees are recorded net of discounts. c. The retail value of the December 31,2020 , inventory was $61,880, the cost-to-retail percentage for 2020 under the LIFO retail method was 70%, and the appropriate price index was 104% of the January 1,2020 , price level. d. The retail value of the December 31,2021 , inventory was $53,500, the cost-to-retail percentage for 2021 under the LIFO retail method was 69%, and the appropriate price index was 107% of the January 1,2020 , price level; Required: 1. Estimate ending inventory for 2019 using the conventional retail method. (Amounts to be deducted should be indicated with a minus sign.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts