Question: can anyone please do this asap... the answer to this in chegg was wrong preciously Problem 1 13 marks The following are transactions which were

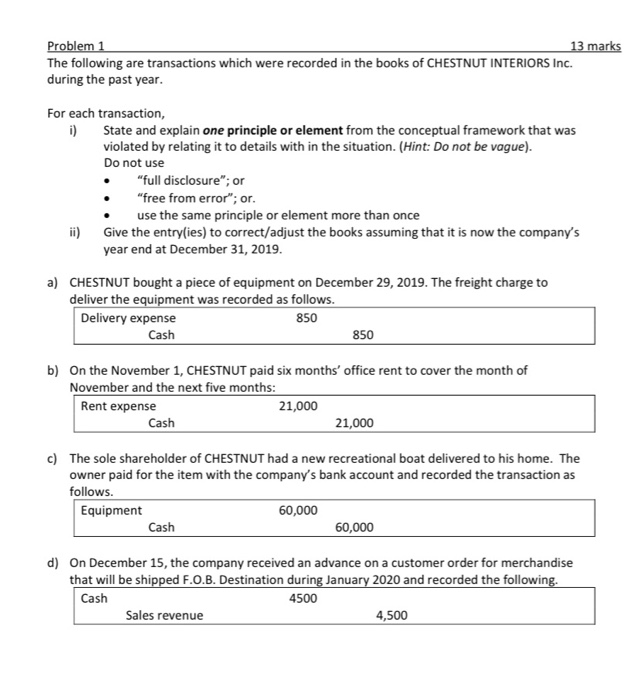

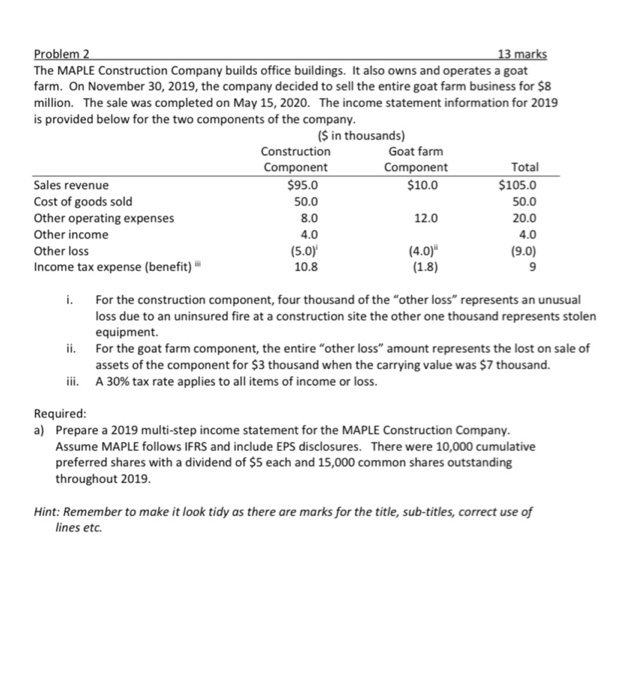

Problem 1 13 marks The following are transactions which were recorded in the books of CHESTNUT INTERIORS Inc. during the past year. For each transaction, i) State and explain one principle or element from the conceptual framework that was violated by relating it to details with in the situation. (Hint: Do not be vague). Do not use "full disclosure"; or "free from error"; or. use the same principle or element more than once ii) Give the entry(ies) to correct/adjust the books assuming that it is now the company's year end at December 31, 2019. a) CHESTNUT bought a piece of equipment on December 29, 2019. The freight charge to deliver the equipment was recorded as follows. Delivery expense 850 Cash 850 b) On the November 1, CHESTNUT paid six months' office rent to cover the month of November and the next five months: Rent expense 21,000 21,000 Cash c) The sole shareholder of CHESTNUT had a new recreational boat delivered to his home. The owner paid for the item with the company's bank account and recorded the transaction as follows. Equipment 60,000 Cash 60,000 d) On December 15, the company received an advance on a customer order for merchandise that will be shipped F.O.B. Destination during January 2020 and recorded the following. Cash 4500 Sales revenue 4,500 Problem 2 13 marks The MAPLE Construction Company builds office buildings. It also owns and operates a goat farm. On November 30, 2019, the company decided to sell the entire goat farm business for $8 million. The sale was completed on May 15, 2020. The income statement information for 2019 is provided below for the two components of the company. ($ in thousands) Construction Goat farm Component Component Total Sales revenue $95.0 $10.0 $105.0 Cost of goods sold 50.0 50.0 Other operating expenses 8.0 12.0 20.0 Other income 4.0 Other loss (5.0) (9.0) Income tax expense (benefit) 10.8 (1.8) 9 4.0 (4.0)" i. For the construction component, four thousand of the "other loss" represents an unusual loss due to an uninsured fire at a construction site the other one thousand represents stolen equipment. ii. For the goat farm component, the entire "other loss amount represents the lost on sale of assets of the component for $3 thousand when the carrying value was $7 thousand. iii. A 30% tax rate applies to all items of income or loss. Required: a) Prepare a 2019 multi-step income statement for the MAPLE Construction Company. Assume MAPLE follows IFRS and include EPS disclosures. There were 10,000 cumulative preferred shares with a dividend of $5 each and 15,000 common shares outstanding throughout 2019. Hint: Remember to make it look tidy as there are marks for the title, sub-titles, correct use of lines etc

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts