Question: Can anyone please help me by answering the question. Please give detailed explanation. Consider a 2 periods financial market under uncertainty. The model four states

Can anyone please help me by answering the question. Please give detailed explanation.

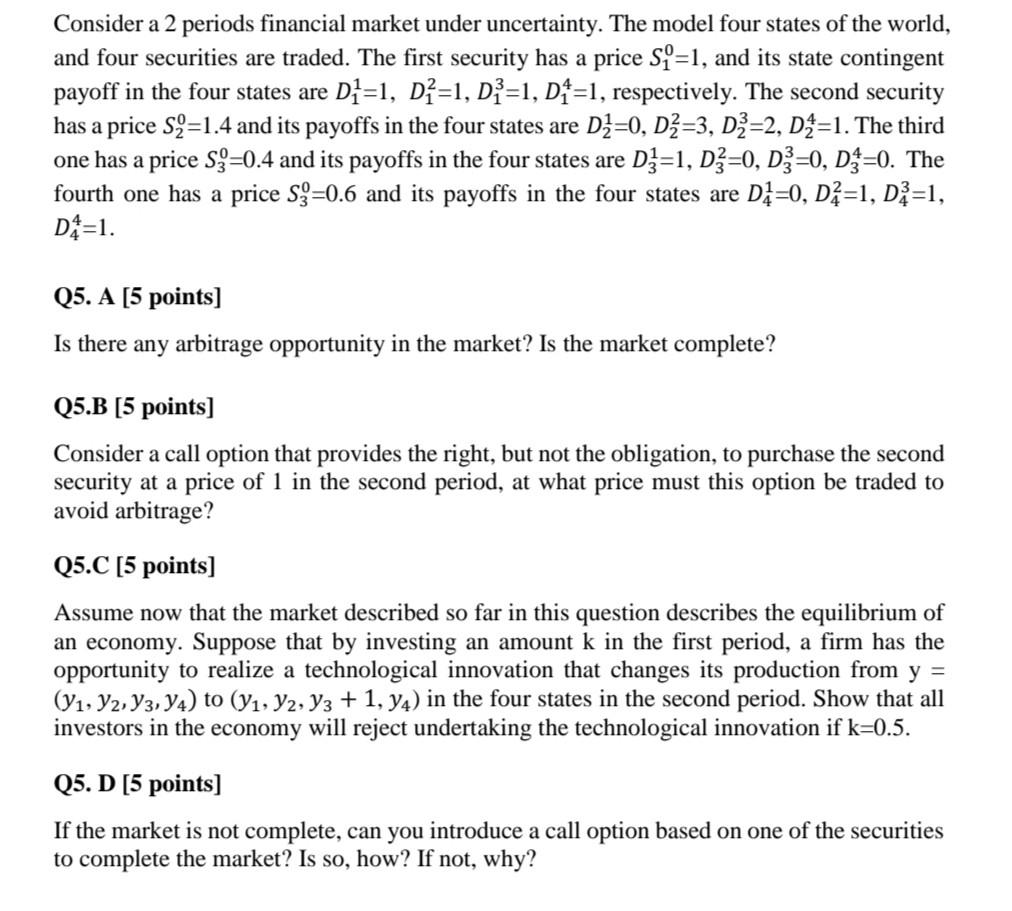

Consider a 2 periods financial market under uncertainty. The model four states of the world, and four securities are traded. The first security has a price S9=1, and its state contingent payoff in the four states are D1=1, D}=1, D}=1, D4=1, respectively. The second security has a price S2=1.4 and its payoffs in the four states are D2=0, D2=3, D3=2, D2=1. The third one has a price S9=0.4 and its payoffs in the four states are D3=1, D}=0, D3=0, D4=0. The fourth one has a price S;=0.6 and its payoffs in the four states are D=0, D=1, D2=1, D4=1. Q5. A [5 points] Is there any arbitrage opportunity in the market? Is the market complete? Q5.B [5 points] Consider a call option that provides the right, but not the obligation, to purchase the second security at a price of 1 in the second period, at what price must this option be traded to avoid arbitrage? Q5.C [5 points) Assume now that the market described so far in this question describes the equilibrium of an economy. Suppose that by investing an amount k in the first period, a firm has the opportunity to realize a technological innovation that changes its production from y = (91, 92, 93, 94) to (91, Y2, Yz + 1, yd) in the four states in the second period. Show that all investors in the economy will reject undertaking the technological innovation if k=0.5. Q5. D [5 points) If the market is not complete, can you introduce a call option based on one of the securities to complete the market? Is so, how? If not, why? Consider a 2 periods financial market under uncertainty. The model four states of the world, and four securities are traded. The first security has a price S9=1, and its state contingent payoff in the four states are D1=1, D}=1, D}=1, D4=1, respectively. The second security has a price S2=1.4 and its payoffs in the four states are D2=0, D2=3, D3=2, D2=1. The third one has a price S9=0.4 and its payoffs in the four states are D3=1, D}=0, D3=0, D4=0. The fourth one has a price S;=0.6 and its payoffs in the four states are D=0, D=1, D2=1, D4=1. Q5. A [5 points] Is there any arbitrage opportunity in the market? Is the market complete? Q5.B [5 points] Consider a call option that provides the right, but not the obligation, to purchase the second security at a price of 1 in the second period, at what price must this option be traded to avoid arbitrage? Q5.C [5 points) Assume now that the market described so far in this question describes the equilibrium of an economy. Suppose that by investing an amount k in the first period, a firm has the opportunity to realize a technological innovation that changes its production from y = (91, 92, 93, 94) to (91, Y2, Yz + 1, yd) in the four states in the second period. Show that all investors in the economy will reject undertaking the technological innovation if k=0.5. Q5. D [5 points) If the market is not complete, can you introduce a call option based on one of the securities to complete the market? Is so, how? If not, why

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts