Question: Can anyone please help me solve part 4 in excel with the formula for calculating P0? Thank you and appreciate it. Problem: Valuing Common Shares

Can anyone please help me solve part 4 in excel with the formula for calculating P0? Thank you and appreciate it.

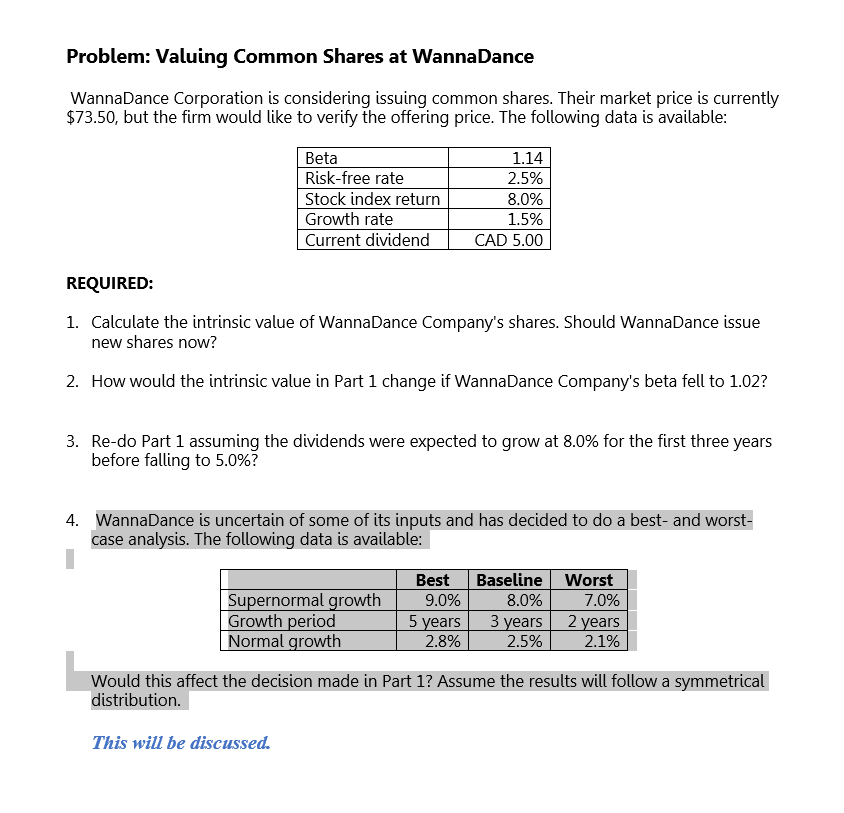

Problem: Valuing Common Shares at WannaDance WannaDance Corporation is considering issuing common shares. Their market price is currently $73.50, but the firm would like to verify the offering price. The following data is available: REQUIRED: 1. Calculate the intrinsic value of WannaDance Company's shares. Should WannaDance issue new shares now? 2. How would the intrinsic value in Part 1 change if WannaDance Company's beta fell to 1.02 ? 3. Re-do Part 1 assuming the dividends were expected to grow at 8.0% for the first three years before falling to 5.0% ? 4. WannaDance is uncertain of some of its inputs and has decided to do a best- and worstcase analysis. The following data is available: Would this affect the decision made in Part 1? Assume the results will follow a symmetrical distribution. This will be discussed

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts