Question: Can anyone please tell me which windows in Quickbboks do I have to record these transactions?Thank you. 7. The following activity occurred during the month

Can anyone please tell me which windows in Quickbboks do I have to record these transactions?Thank you.

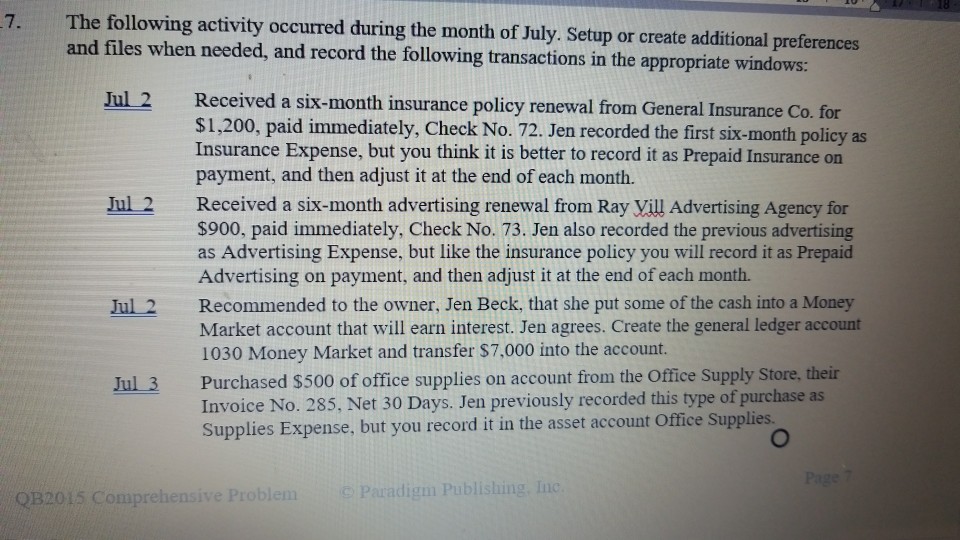

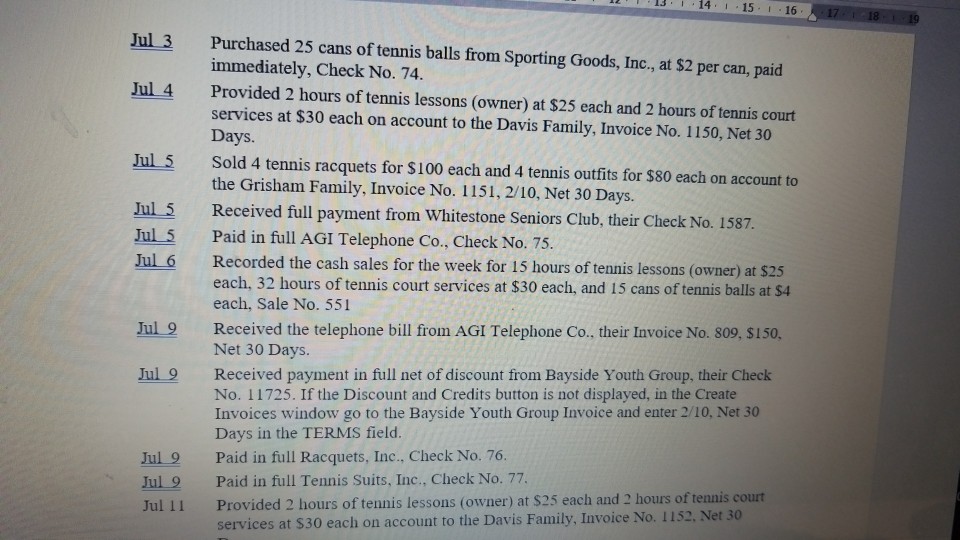

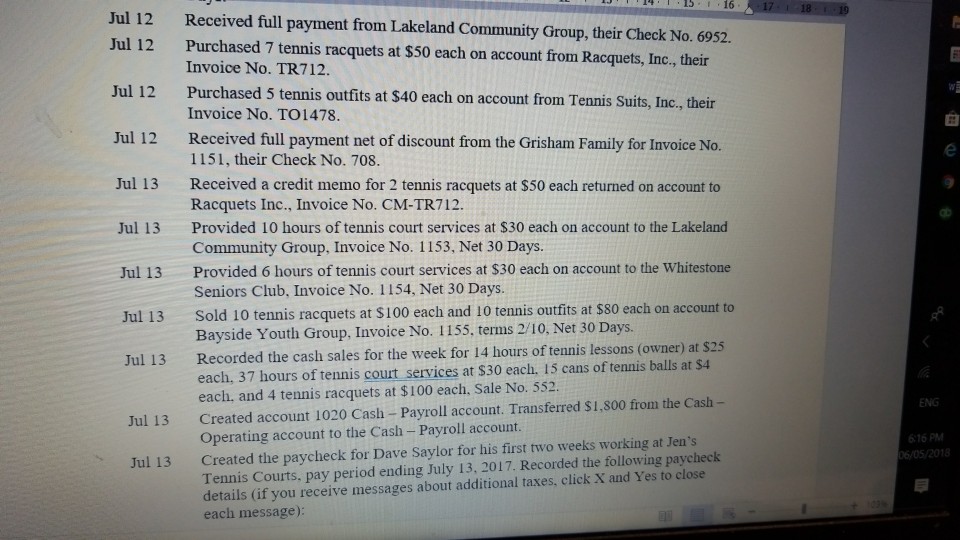

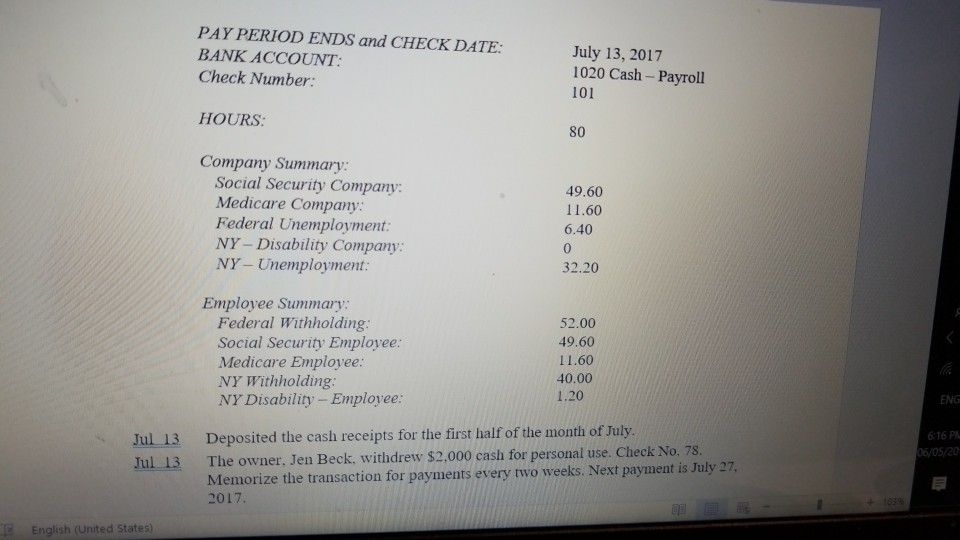

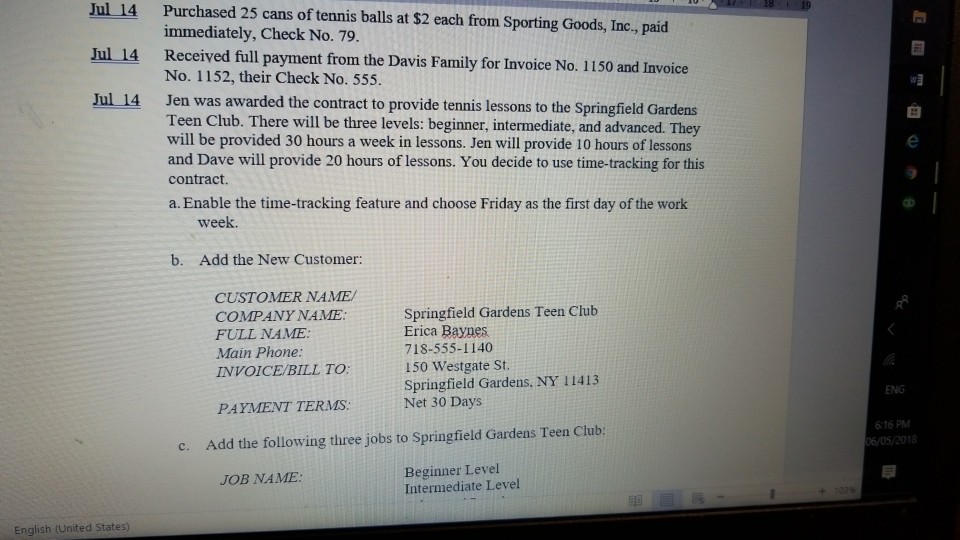

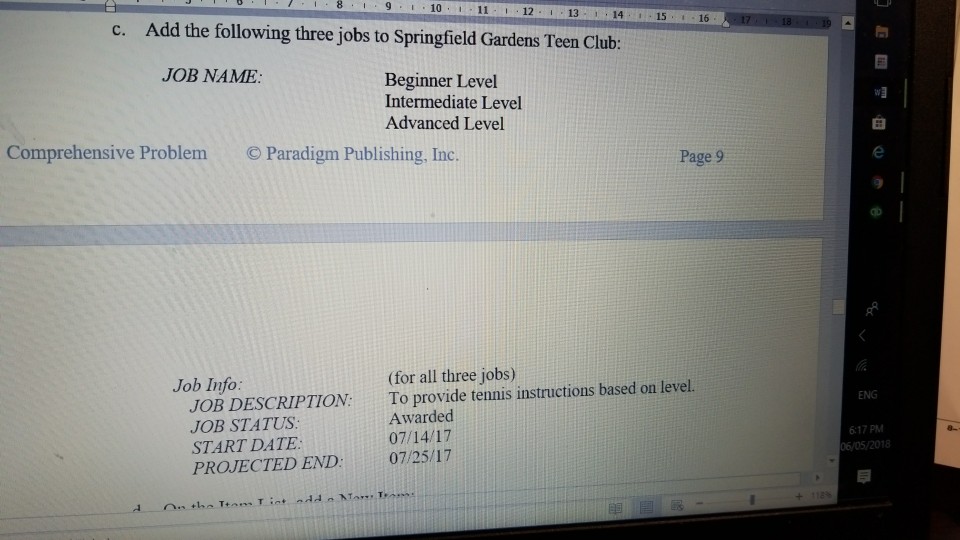

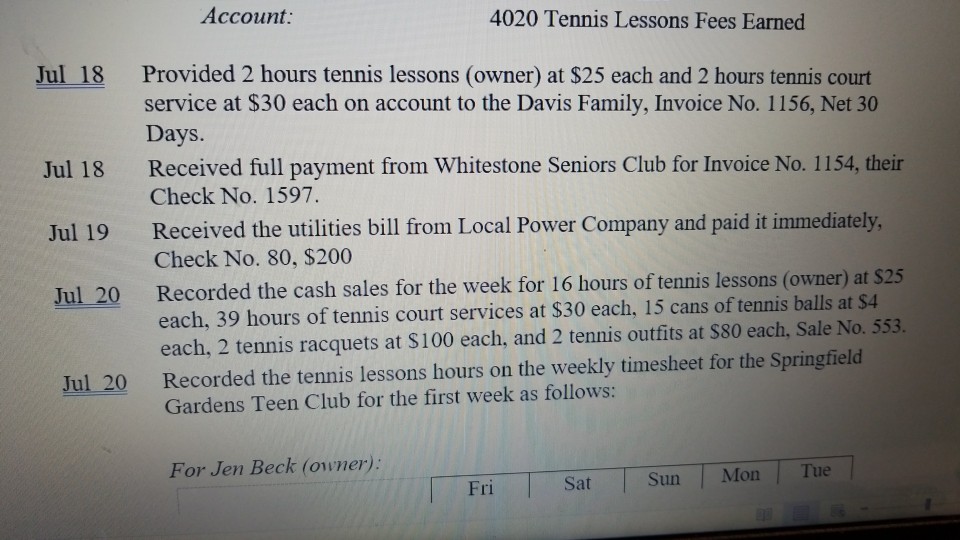

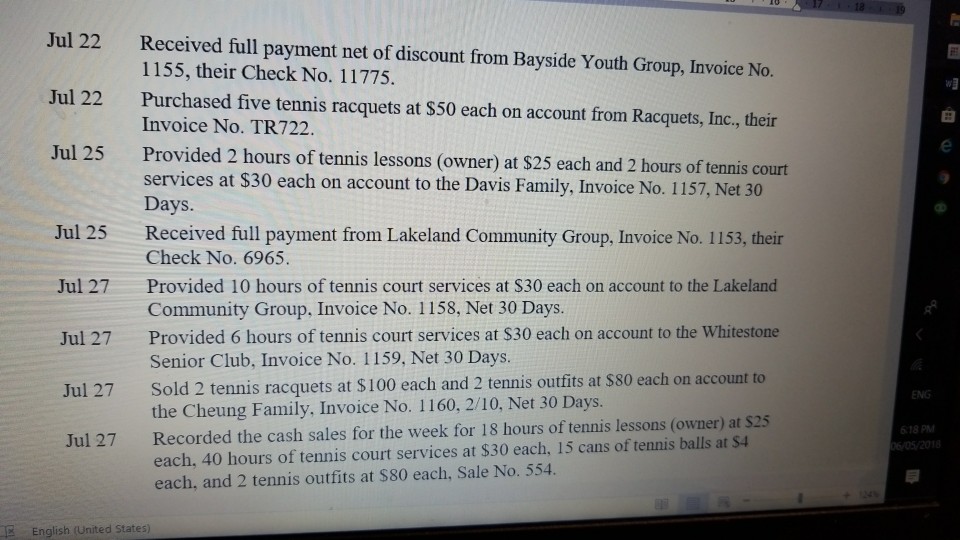

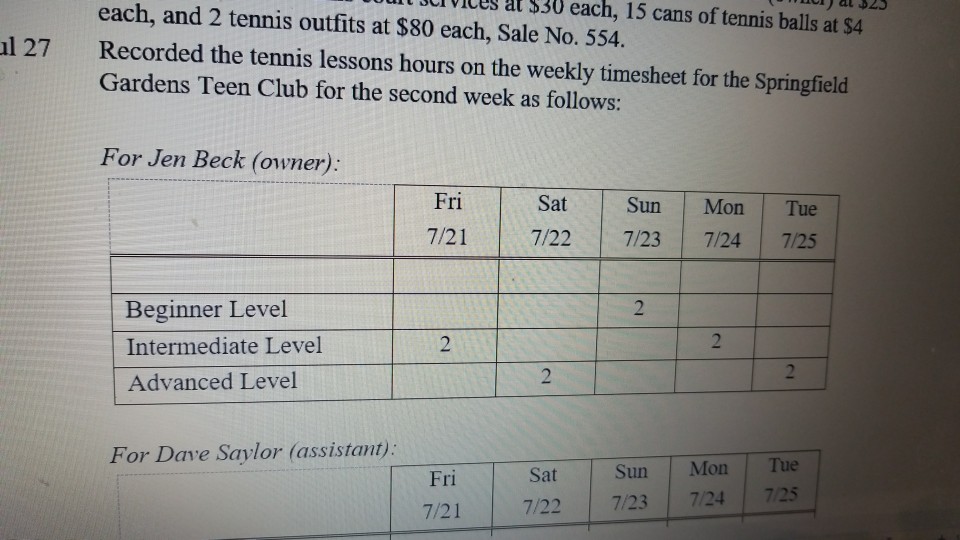

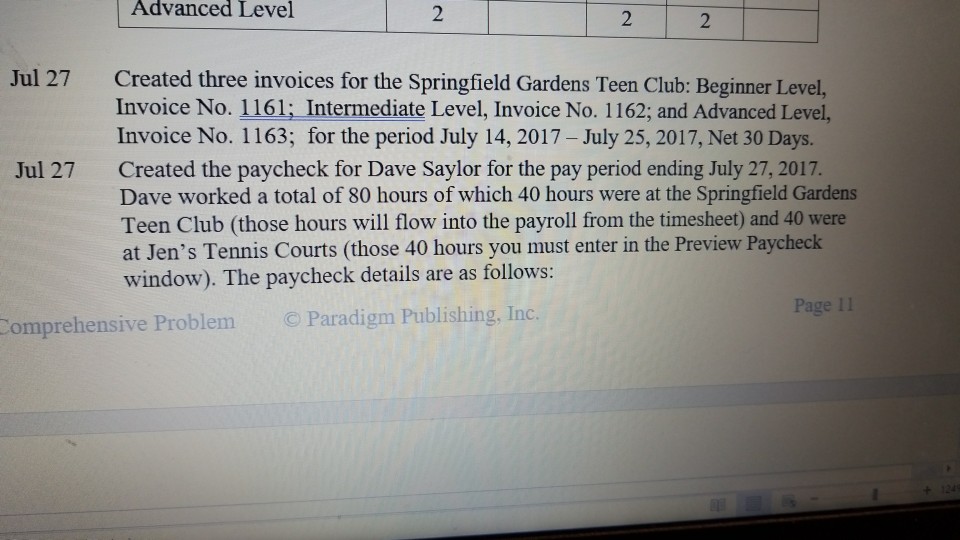

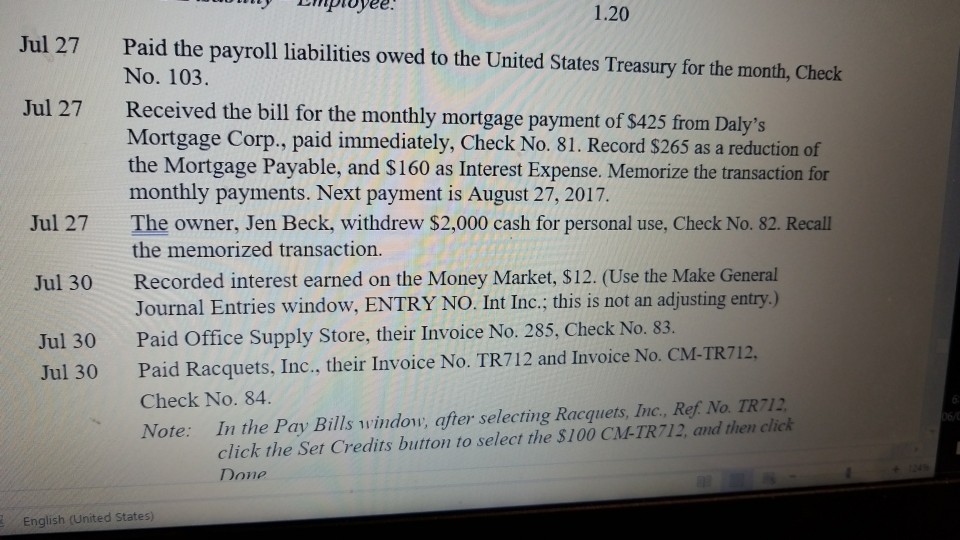

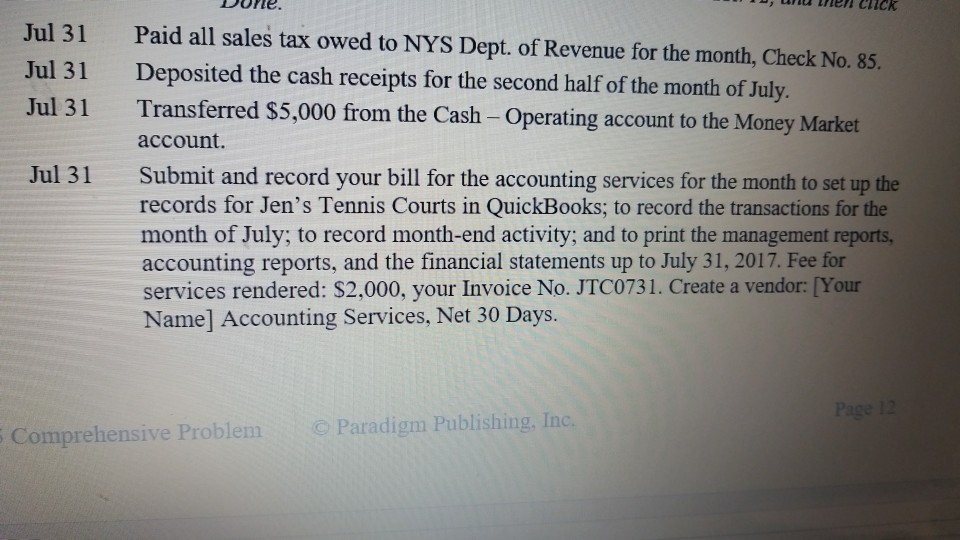

7. The following activity occurred during the month of July. Setup or create additional preferences and files when needed, and record the following transactions in the appropriate windows: Jul 2 Received a six-month insurance policy renewal from General Insurance Co. for $1,200, paid immediately, Check No. 72. Jen recorded the first six-month policy as Insurance Expense, but you think it is better to record it as Prepaid Insurance on payment, and then adjust it at the end of each month. Received a six-month advertising renewal from Ray Vill Advertising Agency for $900, paid immediately, Check No. 73. Jen also recorded the previous advertising as Advertising Expense, but like the insurance policy you will record it as Prepaid Advertising on payment, and then adjust it at the end of each month. Jul 2 ul 2 Recommended to the owner, Jen Beck, that she put some of the cash into a Money Market account that will earn interest. Jen agrees. Create the general ledger account 1030 Money Market and transfer $7,000 into the account. Purchased $500 of office supplies on account from the Office Supply Store, their Invoice No. 285, Net 30 Days. Jen previously recorded this type of purchase as Supplies Expense, but you record it in the asset account office Supplies Jul 3 Paradigm Publishing. Inc 7. The following activity occurred during the month of July. Setup or create additional preferences and files when needed, and record the following transactions in the appropriate windows: Jul 2 Received a six-month insurance policy renewal from General Insurance Co. for $1,200, paid immediately, Check No. 72. Jen recorded the first six-month policy as Insurance Expense, but you think it is better to record it as Prepaid Insurance on payment, and then adjust it at the end of each month. Received a six-month advertising renewal from Ray Vill Advertising Agency for $900, paid immediately, Check No. 73. Jen also recorded the previous advertising as Advertising Expense, but like the insurance policy you will record it as Prepaid Advertising on payment, and then adjust it at the end of each month. Jul 2 ul 2 Recommended to the owner, Jen Beck, that she put some of the cash into a Money Market account that will earn interest. Jen agrees. Create the general ledger account 1030 Money Market and transfer $7,000 into the account. Purchased $500 of office supplies on account from the Office Supply Store, their Invoice No. 285, Net 30 Days. Jen previously recorded this type of purchase as Supplies Expense, but you record it in the asset account office Supplies Jul 3 Paradigm Publishing. Inc

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts