Question: Can anyone plz help me with C plz Note: Unless told otherwise, all companies in this course have a calendar year-end. In addition, round all

Can anyone plz help me with C plz

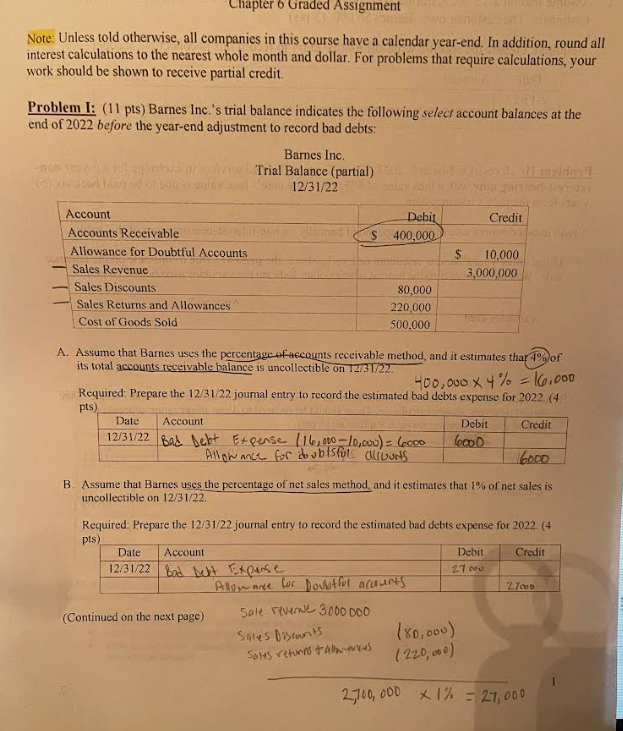

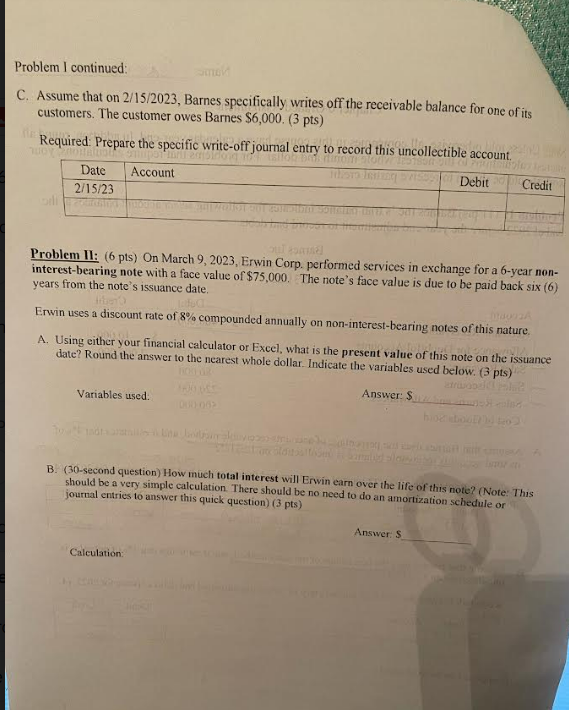

Note: Unless told otherwise, all companies in this course have a calendar year-end. In addition, round all interest calculations to the nearest whole month and dollar. For problems that require calculations, your work should be shown to receive partial credit. Problem I: (11 pts) Barnes Inc.'s trial balance indicates the following select account balances at the end of 2022 before the year-end adjustment to record bad debts: Barnes Inc. Trial Balance (partial) 12/31/22 A. Assume that Barnes uses the percentage of aecounts receivable method, and it estimates than 4% of its total accounts receivable balance is uncollectible on 12/31/22. 400,0004%=16,000 Required: Prepare the 12/31/22 joumal entry to record the estimated bad debts expense for 2022 . (4) B. Assume that Barnes uses the percentage of net sales method and it estimates that 1% of net sales is uncollectible on 12/31/22. Required: Prepare the 12/31/22 journal entry to record the estimated bad debts expense for 2022 . (4 Problem I continued: C. Assume that on 2/15/2023, Barnes specifically writes off the receivable balance for one of its customers. The customer owes Barnes $6,000. (3 pts) Required: Prepare the specific write-off journal entry to record this uncollectible acconnt Problem II: (6 pts) On March 9, 2023, Erwin Corp. performed services in exchange for a 6-year noninterest-bearing note with a face value of $75,000. The note's face value is due to be paid back six (6) years from the note's issuance date. Erwin uses a discount rate of 8% compounded annually on non-interest-bearing notes of this nature. A. Using either your financial calculator or Excel, what is the present value of this note on the issuance date? Round the answer to the nearest whole dollar. Indicate the variables used below. (3 pts) Variables used. Answer: $ B. (30-second question) How much total interest will Erwin earn over the life of this note? (Note: This should be a very simple calculation. There should be no need to do an amortization schedule or journal entries to answer this quick question) (3pts) Answer: 5 Calculation

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts