Question: can anyone solve this ? 1) My benchmark is the S&P500 stock Index. But I only have 10 S&P 500 stocks in my portfolio. So

can anyone solve this ?

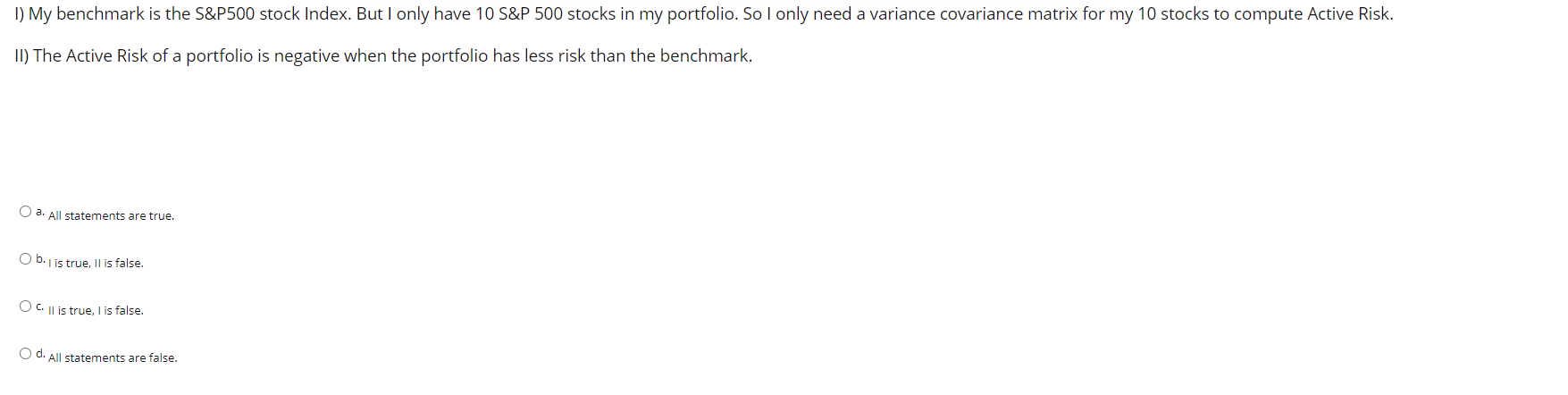

1) My benchmark is the S&P500 stock Index. But I only have 10 S&P 500 stocks in my portfolio. So I only need a variance covariance matrix for my 10 stocks to compute Active Risk. II) The Active Risk of a portfolio is negative when the portfolio has less risk than the benchmark. O a. All statements are true. O b. is true, Il is false. OC. Il is true, I is false. O d. All statements are false

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock