Question: Can anyone solve this question? Operating costs : This model assumes that each piece of furniture will have an average selling price of 2,000. This

Can anyone solve this question?

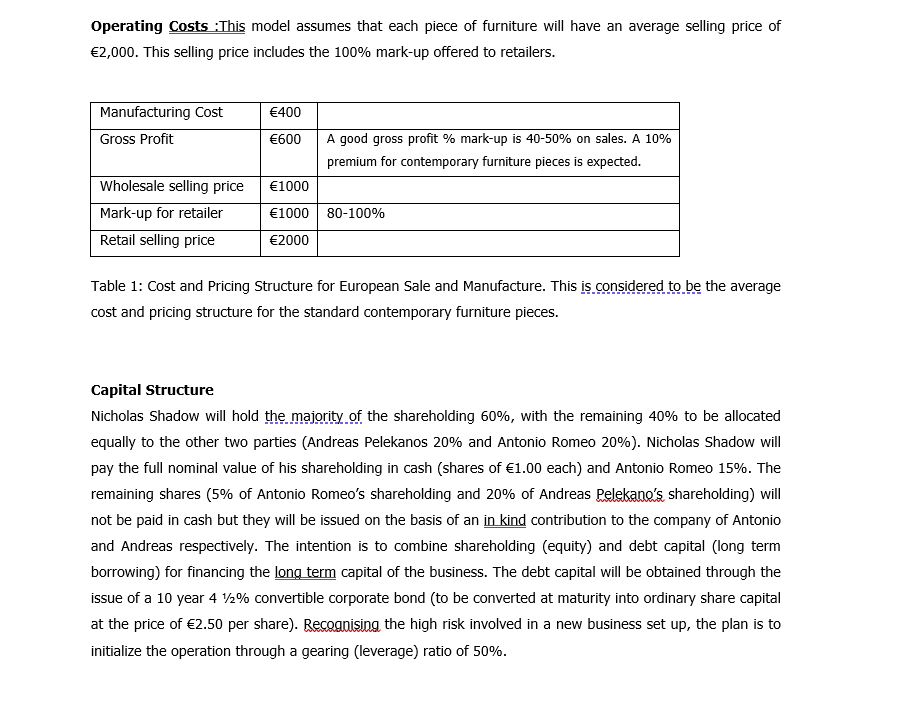

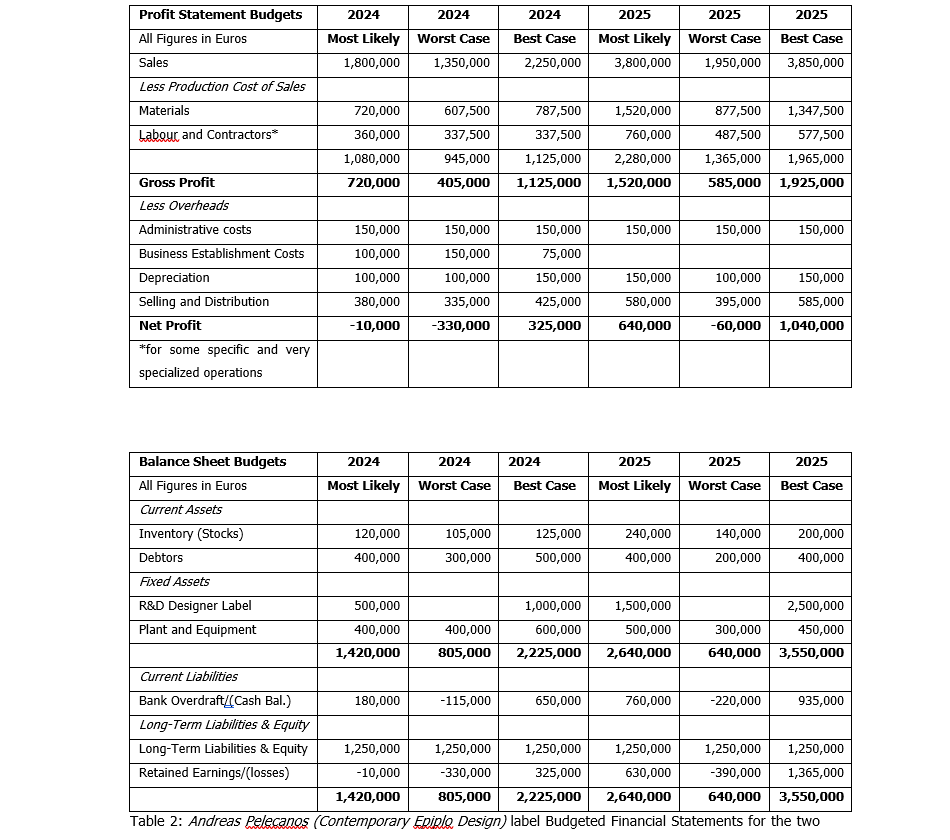

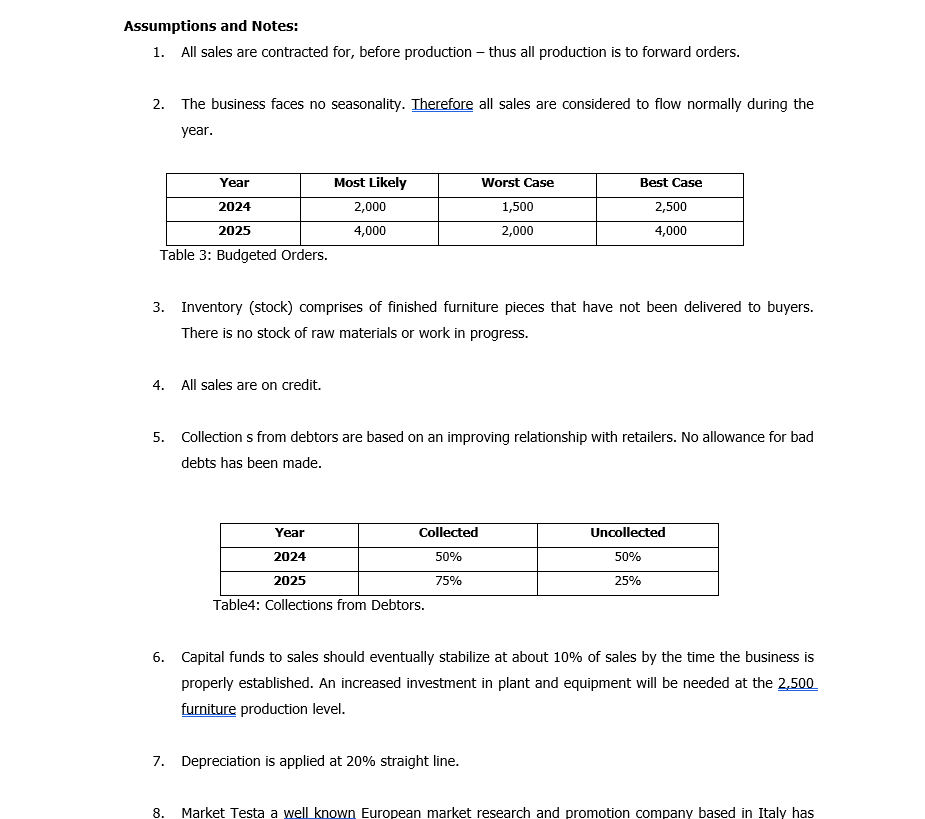

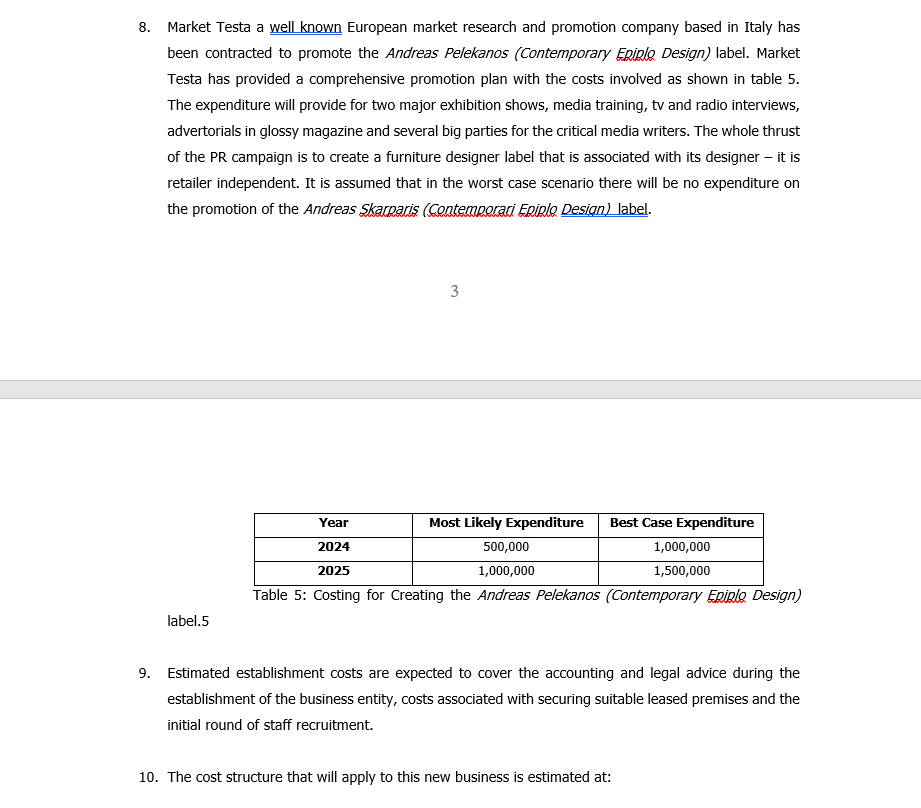

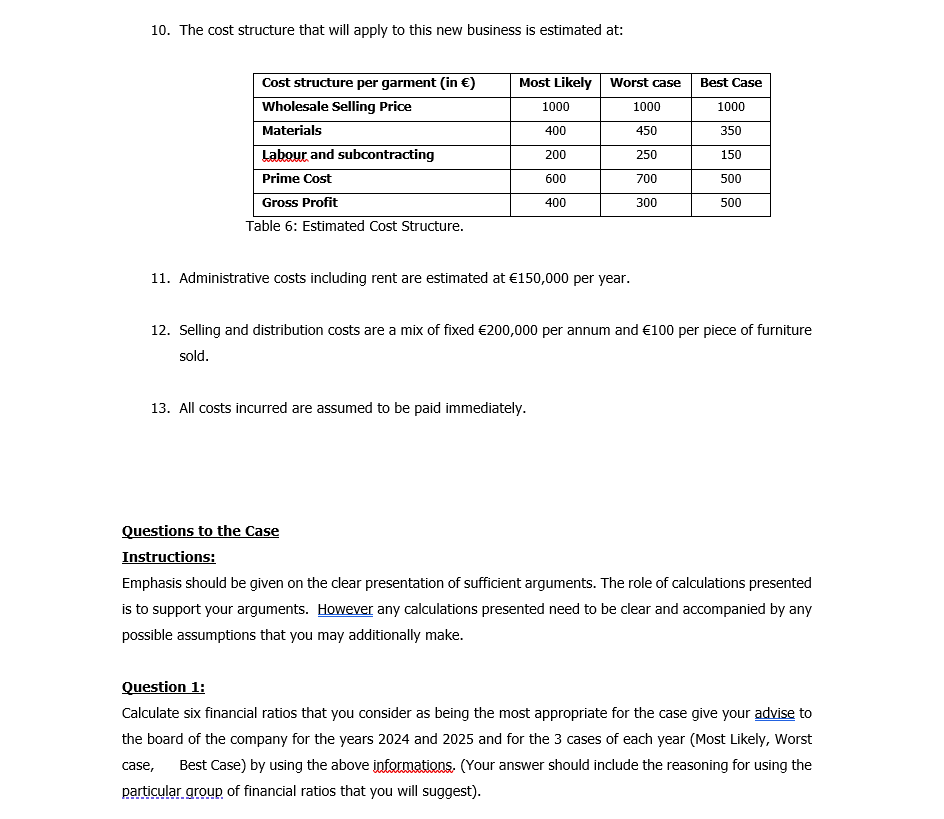

Operating costs : This model assumes that each piece of furniture will have an average selling price of 2,000. This selling price includes the 100% mark-up offered to retailers. Table 1: Cost and Pricing Structure for European Sale and Manufacture. This is considered to be the average cost and pricing structure for the standard contemporary furniture pieces. Capital Structure Nicholas Shadow will hold the majority of the shareholding 60%, with the remaining 40% to be allocated equally to the other two parties (Andreas Pelekanos 20% and Antonio Romeo 20\%). Nicholas Shadow will pay the full nominal value of his shareholding in cash (shares of 1.00 each) and Antonio Romeo 15%. The remaining shares ( 5% of Antonio Romeo's shareholding and 20% of Andreas Pelekano's shareholding) will not be paid in cash but they will be issued on the basis of an in kind contribution to the company of Antonio and Andreas respectively. The intention is to combine shareholding (equity) and debt capital (long term borrowing) for financing the lona term capital of the business. The debt capital will be obtained through the issue of a 10 year 41/21% convertible corporate bond (to be converted at maturity into ordinary share capital at the price of 2.50 per share). Recognising the high risk involved in a new business set up, the plan is to initialize the operation through a gearing (leverage) ratio of 50\%. Table 2: Andreas Relecanos (Contemporary EpiplQ Design) label Budgeted Financial Statements for the two issumptions and Notes: 1. All sales are contracted for, before production - thus all production is to forward orders. 2. The business faces no seasonality. Therefore all sales are considered to flow normally during the year. 1adie s : buagerea uraers. 3. Inventory (stock) comprises of finished furniture pieces that have not been delivered to buyers. There is no stock of raw materials or work in progress. 4. All sales are on credit. 5. Collection s from debtors are based on an improving relationship with retailers. No allowance for bad debts has been made. Table4: Collections trom Debtors. 6. Capital funds to sales should eventually stabilize at about 10% of sales by the time the business is properly established. An increased investment in plant and equipment will be needed at the 2,500 furniture production level. 7. Depreciation is applied at 20% straight line. 8. Market Testa a well known European market research and promotion company based in Italy has been contracted to promote the Andreas Pelekanos (Contemporary Epiplo Design) label. Market Testa has provided a comprehensive promotion plan with the costs involved as shown in table 5. The expenditure will provide for two major exhibition shows, media training, tv and radio interviews, advertorials in glossy magazine and several big parties for the critical media writers. The whole thrust of the PR campaign is to create a furniture designer label that is associated with its designer - it is retailer independent. It is assumed that in the worst case scenario there will be no expenditure on the promotion of the Andreas Skarparis (Contemporari Epiplo Desian) label. 3 Table 5: Costing for Creating the Andreas Pelekanos (Contemporary Epiplo Design) label.5 9. Estimated establishment costs are expected to cover the accounting and legal advice during the establishment of the business entity, costs associated with securing suitable leased premises and the initial round of staff recruitment. 10. The cost structure that will apply to this new business is estimated at: 10. The cost structure that will apply to this new business is estimated at: Table 6: Estimated Cost Structure. 11. Administrative costs including rent are estimated at 150,000 per year. 12. Selling and distribution costs are a mix of fixed 200,000 per annum and 100 per piece of furniture sold. 13. All costs incurred are assumed to be paid immediately. Questions to the Case Instructions: Emphasis should be given on the clear presentation of sufficient arguments. The role of calculations presented is to support your arguments. However any calculations presented need to be clear and accompanied by any possible assumptions that you may additionally make. Question 1: Calculate six financial ratios that you consider as being the most appropriate for the case give your advise to the board of the company for the years 2024 and 2025 and for the 3 cases of each year (Most Likely, Worst case, Best Case) by using the above informations. (Your answer should include the reasoning for using the particular group of financial ratios that you will suggest). Question 2: Calculate the WACC and prepare an income statement for year. 2024 and 2025 For the purpose of calculating the WACC you may assume a 12.5% corporation tax. The dividend policy is proposed to stand at the 30% of Earnings ( 79% of Earnings will be transferred to the relevant reserve account). All figures are stated exclusive of direct and/or indirect (sales) taxes. Question 3: Given the two proposed years which option would you suggest for the business to adopt? Your answers must be accompanied by adequate supporting data including profitability and scenarios analysis based on the costprofit-volume approach with specific references to margins of safety. Question 4: A third would be to create two separate companies. One company to take over the wholesale (manufacturing) part of the business and the other company to take over the retail part of the business. How would you assess this additional option and which are in your opinion the main advantages and disadvantages? Question 5: The working capital deficit of both options is proposed to be financed by using an overdraft facility. Evaluate the proposed overdraft facility level and advise Sophia on whether this is adequate on the basis of her estimates. Question 6: How would you assess the performance of the business should the worse case scenario prevails. On this basis would you suggest that the company may need to make second thoughts and not follow any of the two options? Operating costs : This model assumes that each piece of furniture will have an average selling price of 2,000. This selling price includes the 100% mark-up offered to retailers. Table 1: Cost and Pricing Structure for European Sale and Manufacture. This is considered to be the average cost and pricing structure for the standard contemporary furniture pieces. Capital Structure Nicholas Shadow will hold the majority of the shareholding 60%, with the remaining 40% to be allocated equally to the other two parties (Andreas Pelekanos 20% and Antonio Romeo 20\%). Nicholas Shadow will pay the full nominal value of his shareholding in cash (shares of 1.00 each) and Antonio Romeo 15%. The remaining shares ( 5% of Antonio Romeo's shareholding and 20% of Andreas Pelekano's shareholding) will not be paid in cash but they will be issued on the basis of an in kind contribution to the company of Antonio and Andreas respectively. The intention is to combine shareholding (equity) and debt capital (long term borrowing) for financing the lona term capital of the business. The debt capital will be obtained through the issue of a 10 year 41/21% convertible corporate bond (to be converted at maturity into ordinary share capital at the price of 2.50 per share). Recognising the high risk involved in a new business set up, the plan is to initialize the operation through a gearing (leverage) ratio of 50\%. Table 2: Andreas Relecanos (Contemporary EpiplQ Design) label Budgeted Financial Statements for the two issumptions and Notes: 1. All sales are contracted for, before production - thus all production is to forward orders. 2. The business faces no seasonality. Therefore all sales are considered to flow normally during the year. 1adie s : buagerea uraers. 3. Inventory (stock) comprises of finished furniture pieces that have not been delivered to buyers. There is no stock of raw materials or work in progress. 4. All sales are on credit. 5. Collection s from debtors are based on an improving relationship with retailers. No allowance for bad debts has been made. Table4: Collections trom Debtors. 6. Capital funds to sales should eventually stabilize at about 10% of sales by the time the business is properly established. An increased investment in plant and equipment will be needed at the 2,500 furniture production level. 7. Depreciation is applied at 20% straight line. 8. Market Testa a well known European market research and promotion company based in Italy has been contracted to promote the Andreas Pelekanos (Contemporary Epiplo Design) label. Market Testa has provided a comprehensive promotion plan with the costs involved as shown in table 5. The expenditure will provide for two major exhibition shows, media training, tv and radio interviews, advertorials in glossy magazine and several big parties for the critical media writers. The whole thrust of the PR campaign is to create a furniture designer label that is associated with its designer - it is retailer independent. It is assumed that in the worst case scenario there will be no expenditure on the promotion of the Andreas Skarparis (Contemporari Epiplo Desian) label. 3 Table 5: Costing for Creating the Andreas Pelekanos (Contemporary Epiplo Design) label.5 9. Estimated establishment costs are expected to cover the accounting and legal advice during the establishment of the business entity, costs associated with securing suitable leased premises and the initial round of staff recruitment. 10. The cost structure that will apply to this new business is estimated at: 10. The cost structure that will apply to this new business is estimated at: Table 6: Estimated Cost Structure. 11. Administrative costs including rent are estimated at 150,000 per year. 12. Selling and distribution costs are a mix of fixed 200,000 per annum and 100 per piece of furniture sold. 13. All costs incurred are assumed to be paid immediately. Questions to the Case Instructions: Emphasis should be given on the clear presentation of sufficient arguments. The role of calculations presented is to support your arguments. However any calculations presented need to be clear and accompanied by any possible assumptions that you may additionally make. Question 1: Calculate six financial ratios that you consider as being the most appropriate for the case give your advise to the board of the company for the years 2024 and 2025 and for the 3 cases of each year (Most Likely, Worst case, Best Case) by using the above informations. (Your answer should include the reasoning for using the particular group of financial ratios that you will suggest). Question 2: Calculate the WACC and prepare an income statement for year. 2024 and 2025 For the purpose of calculating the WACC you may assume a 12.5% corporation tax. The dividend policy is proposed to stand at the 30% of Earnings ( 79% of Earnings will be transferred to the relevant reserve account). All figures are stated exclusive of direct and/or indirect (sales) taxes. Question 3: Given the two proposed years which option would you suggest for the business to adopt? Your answers must be accompanied by adequate supporting data including profitability and scenarios analysis based on the costprofit-volume approach with specific references to margins of safety. Question 4: A third would be to create two separate companies. One company to take over the wholesale (manufacturing) part of the business and the other company to take over the retail part of the business. How would you assess this additional option and which are in your opinion the main advantages and disadvantages? Question 5: The working capital deficit of both options is proposed to be financed by using an overdraft facility. Evaluate the proposed overdraft facility level and advise Sophia on whether this is adequate on the basis of her estimates. Question 6: How would you assess the performance of the business should the worse case scenario prevails. On this basis would you suggest that the company may need to make second thoughts and not follow any of the two options

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts