Question: can anyone solve this ? statement 1 and 2 , r they true or false ? I) The weight of AAPL in Bobs portfolio is

can anyone solve this ?

statement 1 and 2 , r they true or false ?

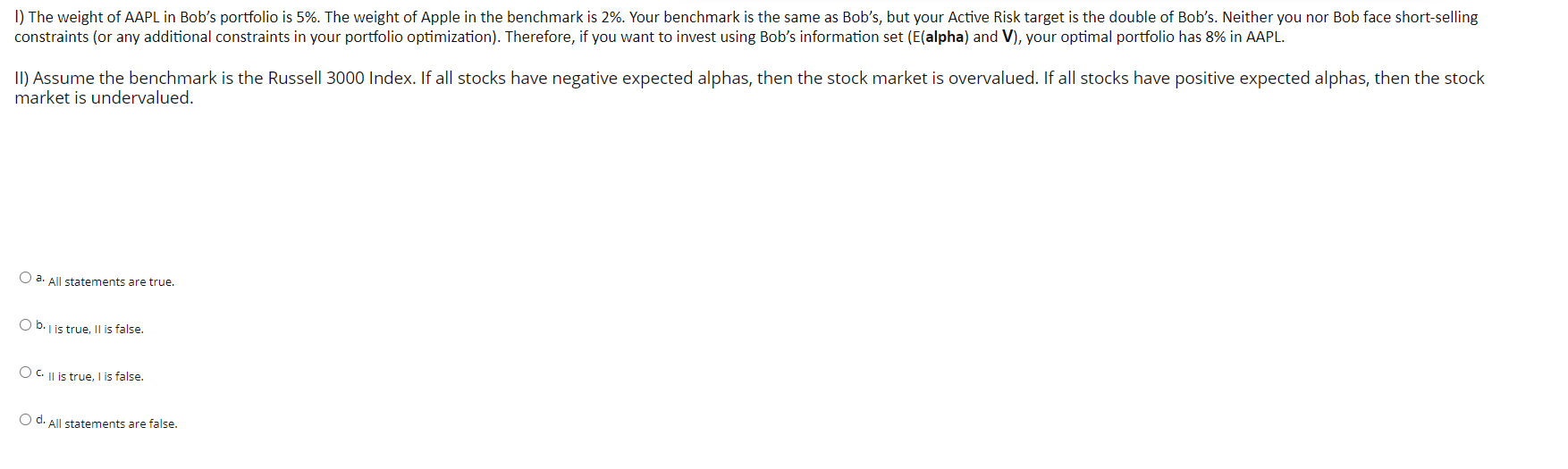

I) The weight of AAPL in Bobs portfolio is 5%. The weight of Apple in the benchmark is 2%. Your benchmark is the same as Bobs, but your Active Risk target is the double of Bobs. Neither you nor Bob face short-selling constraints (or any additional constraints in your portfolio optimization). Therefore, if you want to invest using Bobs information set (E(alpha) and V), your optimal portfolio has 8% in AAPL.

II) Assume the benchmark is the Russell 3000 Index. If all stocks have negative expected alphas, then the stock market is overvalued. If all stocks have positive expected alphas, then the stock market is undervalued.

1) The weight of AAPL in Bob's portfolio is 5%. The weight of Apple in the benchmark is 2%. Your benchmark is the same as Bob's, but your Active Risk target is the double of Bob's. Neither you nor Bob face short-selling constraints (or any additional constraints in your portfolio optimization). Therefore, if you want to invest using Bob's information set (E(alpha) and V), your optimal portfolio has 8% in AAPL. II) Assume the benchmark is the Russell 3000 Index. If all stocks have negative expected alphas, then the stock market is overvalued. If all stocks have positive expected alphas, then the stock market is undervalued. O a. All statements are true. b. is true. Il is false. OC. Il is true, I is false. Od. All statements are false

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts