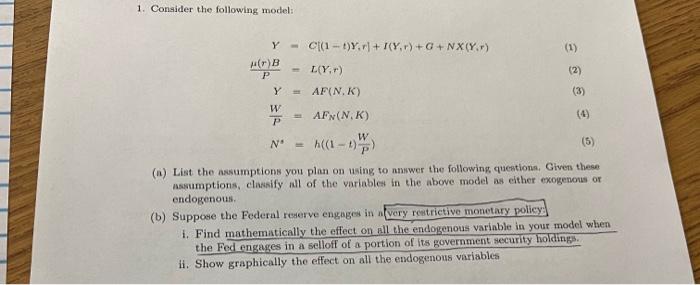

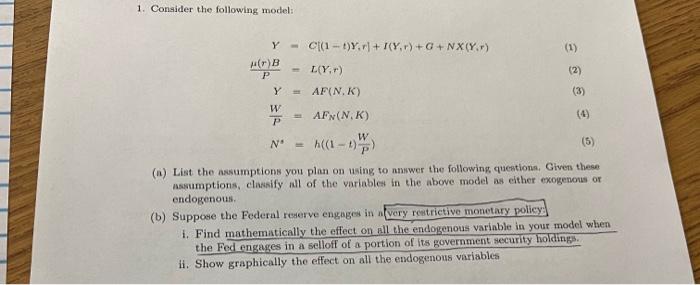

Question: can be answerd in classical or Keynesian. 1. Conaider the following model: YP(r)BYPWN=C[(1t)Y,r]+I(Y,r)+G+NX(Y,r)=L(Y,r)=AF(N,K)=AFN(N,K)=h((1t)PW) (a) List the assumptions you plan on using to answer the following

can be answerd in classical or Keynesian.

1. Conaider the following model: YP(r)BYPWN=C[(1t)Y,r]+I(Y,r)+G+NX(Y,r)=L(Y,r)=AF(N,K)=AFN(N,K)=h((1t)PW) (a) List the assumptions you plan on using to answer the following questiona. Gives these assumptions, classify all of the variables in the above model as either exogenous or endogenous. (b) Suppose the Federal reserve engages in alyery reatrictive monetary policy. i. Find mathematically the effect on all the endogenous variable in your model when the Fed engages in a selloff of a portion of its government security holdings. ii. Show graphically the effect on all the endogenous variables

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock