Question: can explain the problem? please! thank you! Exercise 13-06 nts Your answer is partially correct. Try again. (Part As an auditor for the CPA firm

can explain the problem? please! thank you!

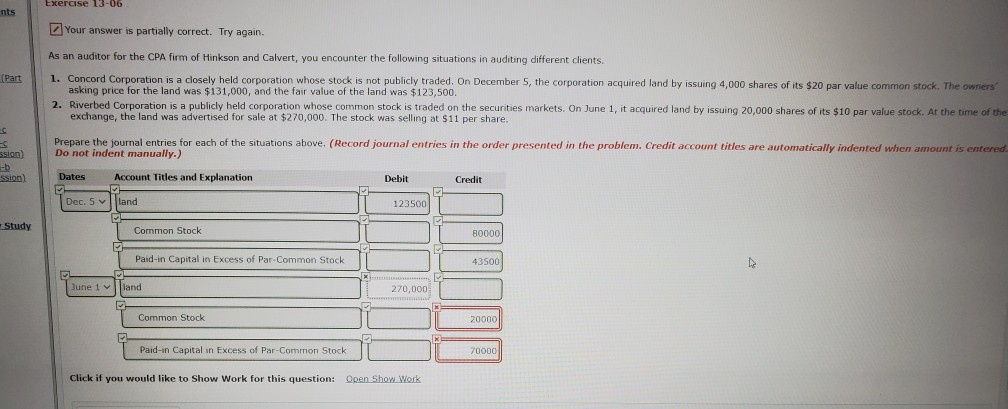

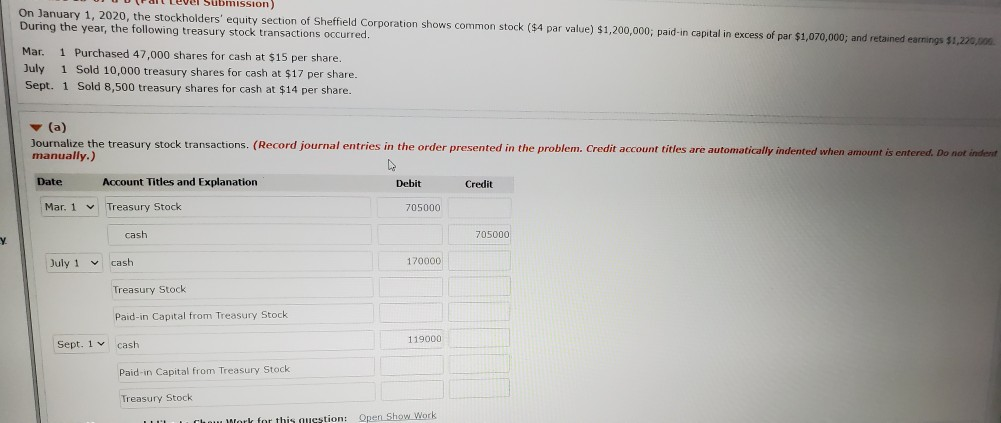

Exercise 13-06 nts Your answer is partially correct. Try again. (Part As an auditor for the CPA firm of Hinkson and Calvert, you encounter the following situations in auditing different clients. 1. Concord Corporation is a closely held corporation whose stock is not publicly traded on December 5, the corporation acquired land by issuing 4,000 shares of its $20 par value common stock. The owners asking price for the land was $131,000, and the fair value of the land was $123,500. 2. Riverbed Corporation is a publicly held corporation whose common stock is traded on the securities markets. On June 1, it acquired land by issuing 20,000 shares of its $10 par value stock. At the time of the exchange, the land was advertised for sale at $270,000. The stock was selling at $11 per share. Prepare the journal entries for each of the situations above. (Record journal entries in the order presented in the problem. Credit account titles are automatically indented when amount is entered. Do not indent manually.) ssion) ssion) Dates Account Titles and Explanation Debit Credit Dec. 5 land 123500 Study Common Stock 80000 Paid-in Capital in Excess of Par-Common Stock 43500 June 1 land 270,000 Common Stock 20000 Paid-in Capital in Excess of Par-Common Stock 70000 Click if you would like to Show Work for this question: Open Show Work Submission) On January 1, 2020, the stockholders' equity section of Sheffield Corporation shows common stock ($4 par value) $1,200,000; paid-in capital in excess of par $1,070,000; and retained earnings 51,220,000 During the year, the following treasury stock transactions occurred. Mar. 1 Purchased 47,000 shares for cash at $15 per share. July 1 Sold 10,000 treasury shares for cash at $17 per share. Sept. 1 Sold 8,500 treasury shares for cash at $14 per share. (a) Journalize the treasury stock transactions. (Record journal entries in the order presented in the problem. Credit account titles are automatically indented when amount is entered. Do not indert manually.) Date Account Titles and Explanation Debit Credit Mar. 1 Treasury Stock 705000 cash 705000 y July 1 cash 170000 Treasury Stock Paid-in Capital from Treasury Stock 119000 Sept. 1 cash Paid in Capital from Treasury Stock Treasury Stock Chom work for this question: Open Show Work

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts