Question: can help me fill out this chart please? During the month of June, Ace Incorporated purchased goods from two suppliers. The sequence of events was

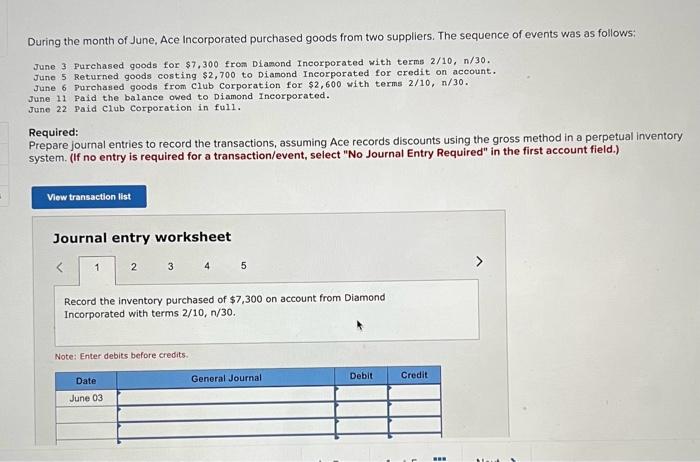

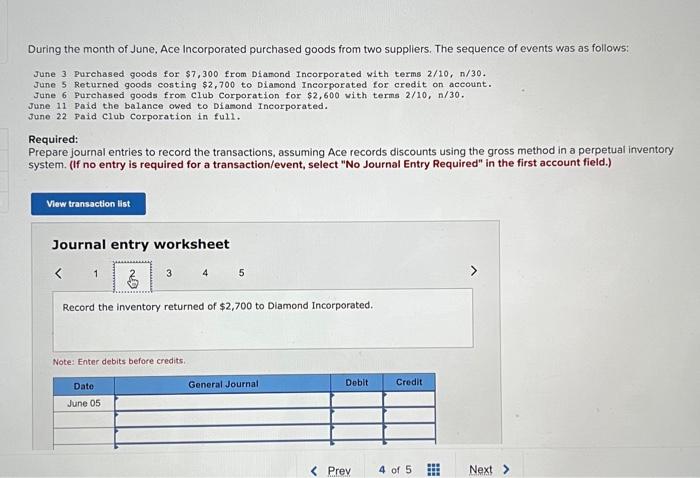

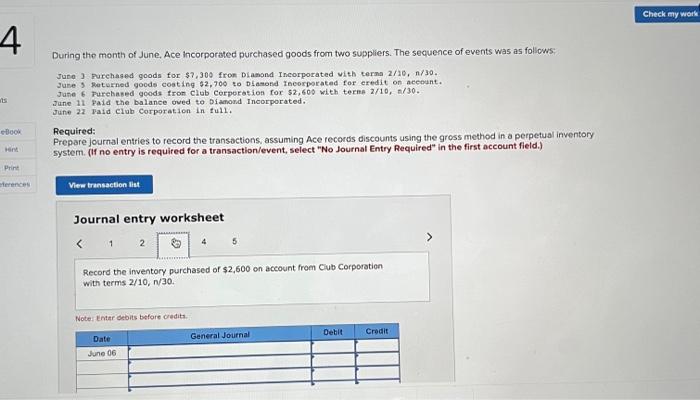

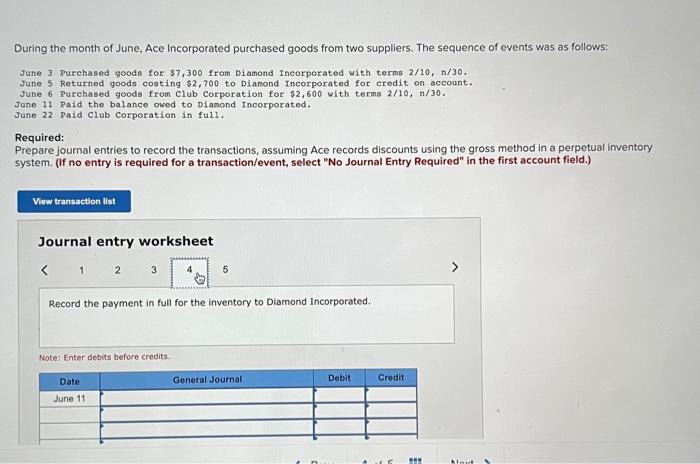

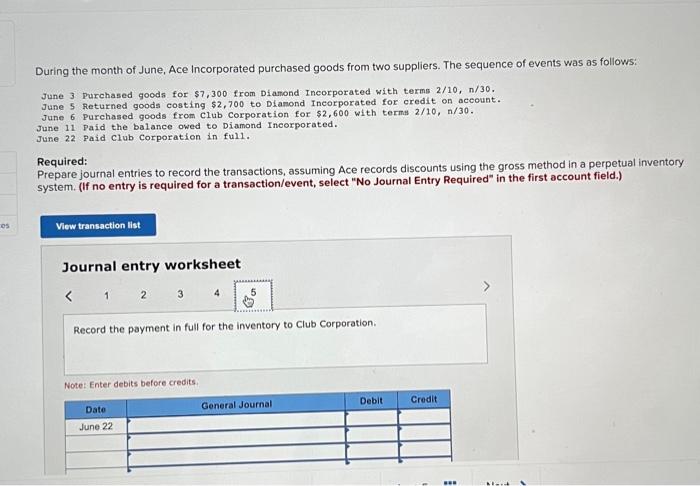

During the month of June, Ace Incorporated purchased goods from two suppliers. The sequence of events was as follows: June 3 Purchased goods for $7,300 from Diamond Incorporated with terms 2/10,n/30. June 5 Returned goods costing $2,700 to Diamond Incorporated for credit on account. June 6 purchased goods from club Corporation for $2,600 with terms 2/10,n/30. June 11 Paid the balance owed to Diamond Incorporated. June 22 paid club corporation in full. Required: Prepare joumal entries to record the transactions, assuming Ace records discounts using the gross method in a perpetual inventory system. (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.) Journal entry worksheet Record the inventory purchased of $7,300 on account from Diamond Incorporated with terms 2/10,n/30. Note: Enter debits before credits. During the month of June, Ace Incorporated purchased goods from two suppliers. The sequence of events was as follows: June 3 Purchased goods for $7,300 from Dfamond Incorporated with terms 2/10,n/30. June 5 Returned goods costing $2,700 to Dianond Incorporated for credit on account. June 6 Purchased goods from club Corporation for $2,600 with terms 2/10,n/30. June 11 Paid the balance owed to Diamond Incorporated. June 22 Paid Club corporation in full. Required: Prepare journal entries to record the transactions, assuming Ace records discounts using the gross method in a perpetual inventory system. (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.) Journal entry worksheet Record the inventory returned of $2,700 to Diamond Incorporated. Notes Enter debits before credits. During the month of June, Ace incorporated purchased goods from two suppliers. The sequence of events was as folliows: Juce 3 Purchased goods for $7,300 fron Dianond incorporated vith terna 2/20,n/30. 3use 9 . foturned goods costing $2,700 to Dfasond theorporated for eredit on accednt. June 6 rurehased goods tron Club Corporation for $2,600 with terme 2/10,/30. June 11 Paid the balance oved to bianond Incorporated. June 22 Vaid club corporation in tull. Required: Prepare journal entries to record the transoctions, assuming Ace reconds discounts using the gross method in a perpetual inventory system. (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.) Journal entry worksheet Record the inventory purchased of $2,600 on account from Cub Corporation with terms 2/10,n/30. Note: Entar debits before credits. During the month of June, Ace Incorporated purchased goods from two suppliers. The sequence of events was as follows: June 3 Purchased goods for $7,300 from Diamond Incorporated with terms 2/10, n/30. June 5 Returned goods costing $2,700 to Diamond Incorporated for eredit on account. June 6 Purchased goods from Club Corporation for $2,600 with terms 2/10,n/30. June 11 paid the balance owed to Diamond Incorporated. June 22 paid club corporation in full. Required: Prepare journal entries to record the transactions, assuming Ace records discounts using the gross method in a perpetual inventory system. (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.) Journal entry worksheet Record the payment in full for the inventory to Diamond Incorporated. Note: Enter debits before credits. During the month of June, Ace incorporated purchased goods from two suppliers. The sequence of events was as follows: June 3 Purchased goods for $7,300 from Diamond Incorporated with terms 2/10,n/30. June 5 Returned goods costing $2,700 to Dianond Incorporated for credit on account. June 6 purchased goods from club Corporation for $2,600 with terms 2/10,n/30. June 11 Paid the balance owed to Diamond Incorporated. June 22 Paid club corporation in full. Required: Prepare journal entries to record the transactions, assuming Ace records discounts using the gross method in a perpetual inventory system. (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.) Journal entry worksheet Record the payment in full for the inventory to Club Corporation. Note: Enter debits before credits

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts