Question: Can help me to find the current ratio, quick asset ratio and gearing ratio? Thank you You are given below, in draft form, the financial

Can help me to find the current ratio, quick asset ratio and gearing ratio?

Thank you

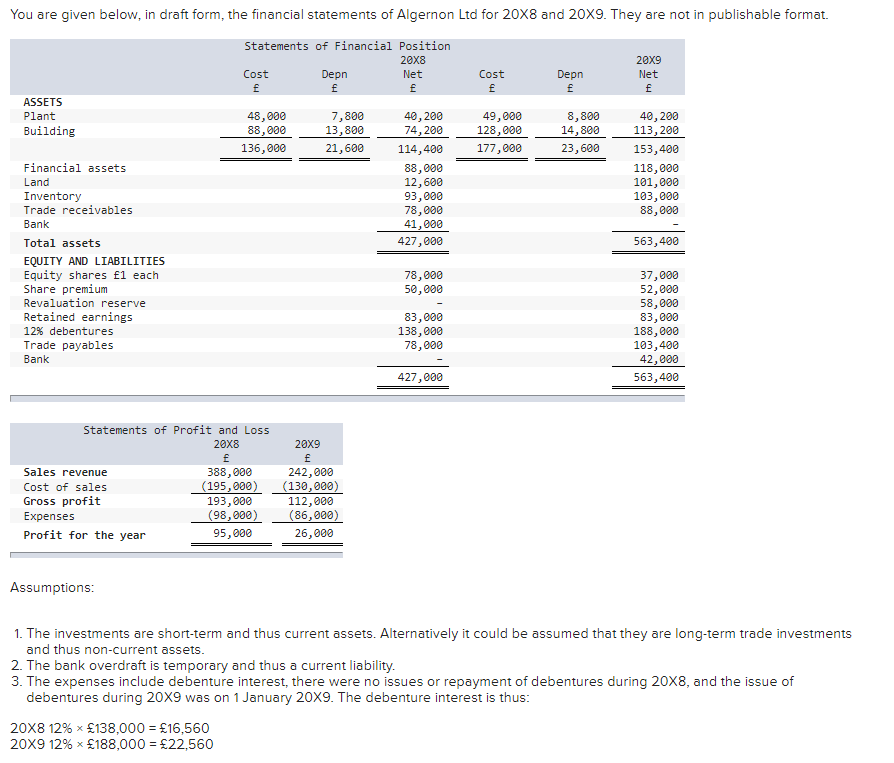

You are given below, in draft form, the financial statements of Algernon Ltd for 20X8 and 20X9. They are not in publishable format. Statements of Financial Position 20x8 20x9 Cost f Depn f Net f Cost f Depn f Net f ASSETS Plant Building 48,000 88,000 136,000 7,800 13,800 21,600 49,000 128,000 177,000 8,800 14,800 23,600 40,200 74,200 114,400 88,000 12,600 93,000 78,000 41,000 427,000 40,200 113,200 153,400 118,000 101,000 103,000 88,000 563,400 Financial assets Land Inventory Trade receivables Bank Total assets EQUITY AND LIABILITIES Equity shares 1 each Share premium Revaluation reserve Retained earnings 12% debentures Trade payables Bank 78,000 50,000 83,000 138,000 78,000 37,000 52,000 58,000 83,000 188,000 103,400 42,000 563,400 427,000 Statements of Profit and Loss 20x8 f Sales revenue 388,000 Cost of sales (195,000) Gross profit 193,000 Expenses (98,000) Profit for the year 95,000 20x9 f 242,000 (130,000) 112,000 (86,000) 26,000 Assumptions: 1. The investments are short-term and thus current assets. Alternatively it could be assumed that they are long-term trade investments and thus non-current assets. 2. The bank overdraft is temporary and thus a current liability. 3. The expenses include debenture interest, there were no issues or repayment of debentures during 20x8, and the issue of debentures during 20x9 was on 1 January 20X9. The debenture interest is thus: 20X8 12% * 138,000 = 16,560 20x9 12% * 188,000 = 22,560

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts