Question: Can Help Me To Solve This Question By Tomorrow ? Question 5 Syazani Enterprise is involved in selling computers since 2017. Syazani, the owner of

Can Help Me To Solve This Question By Tomorrow ?

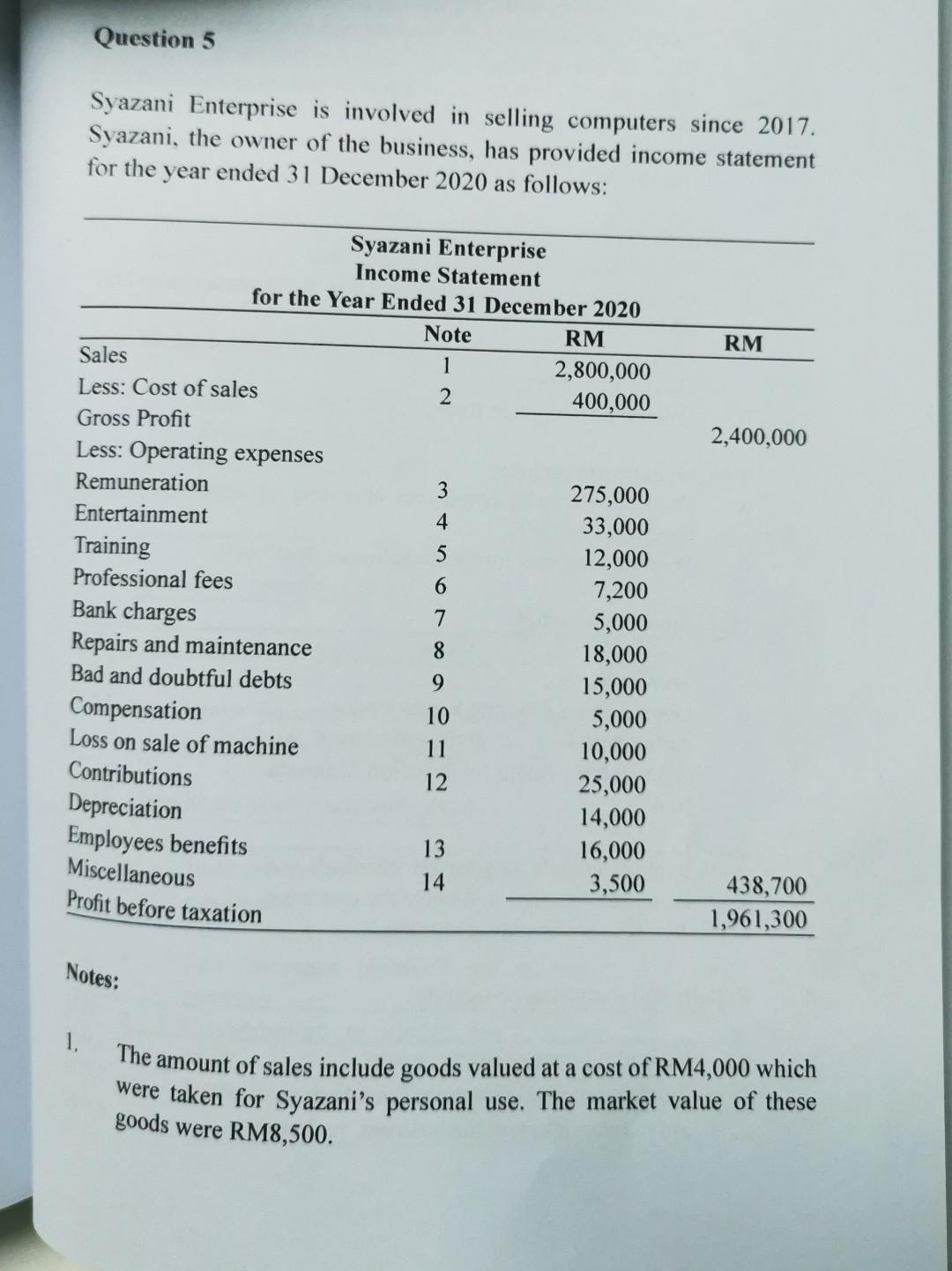

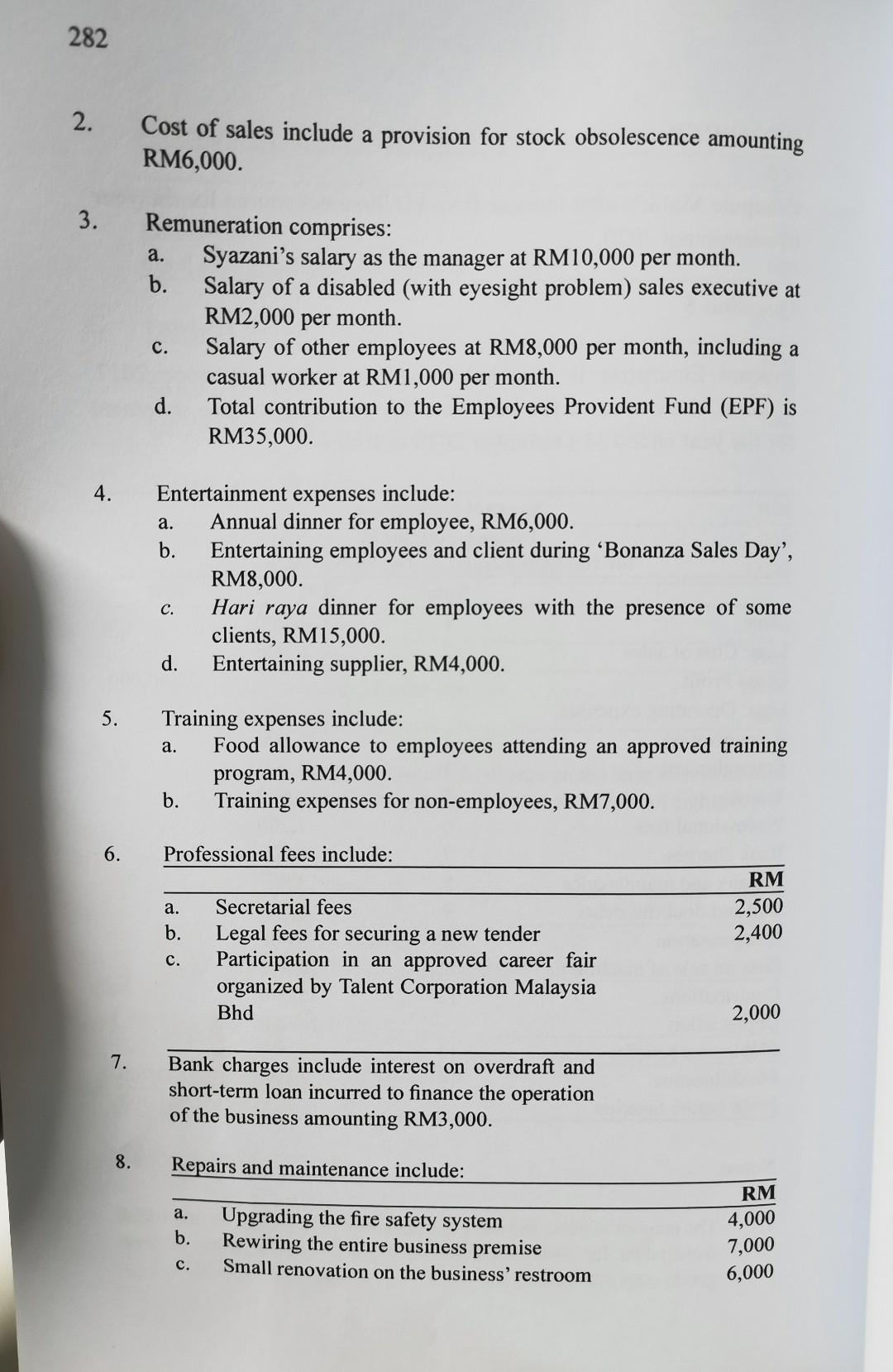

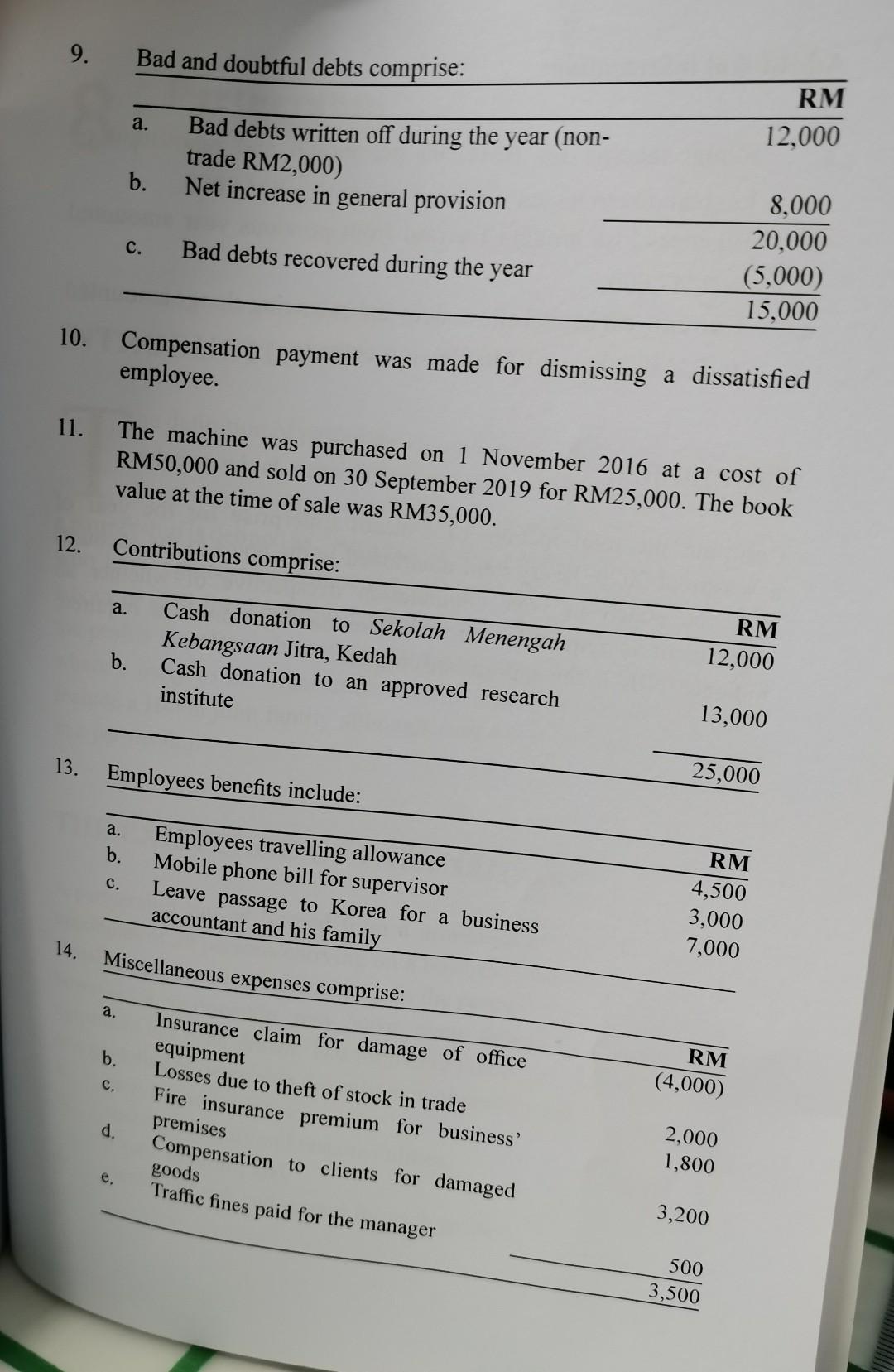

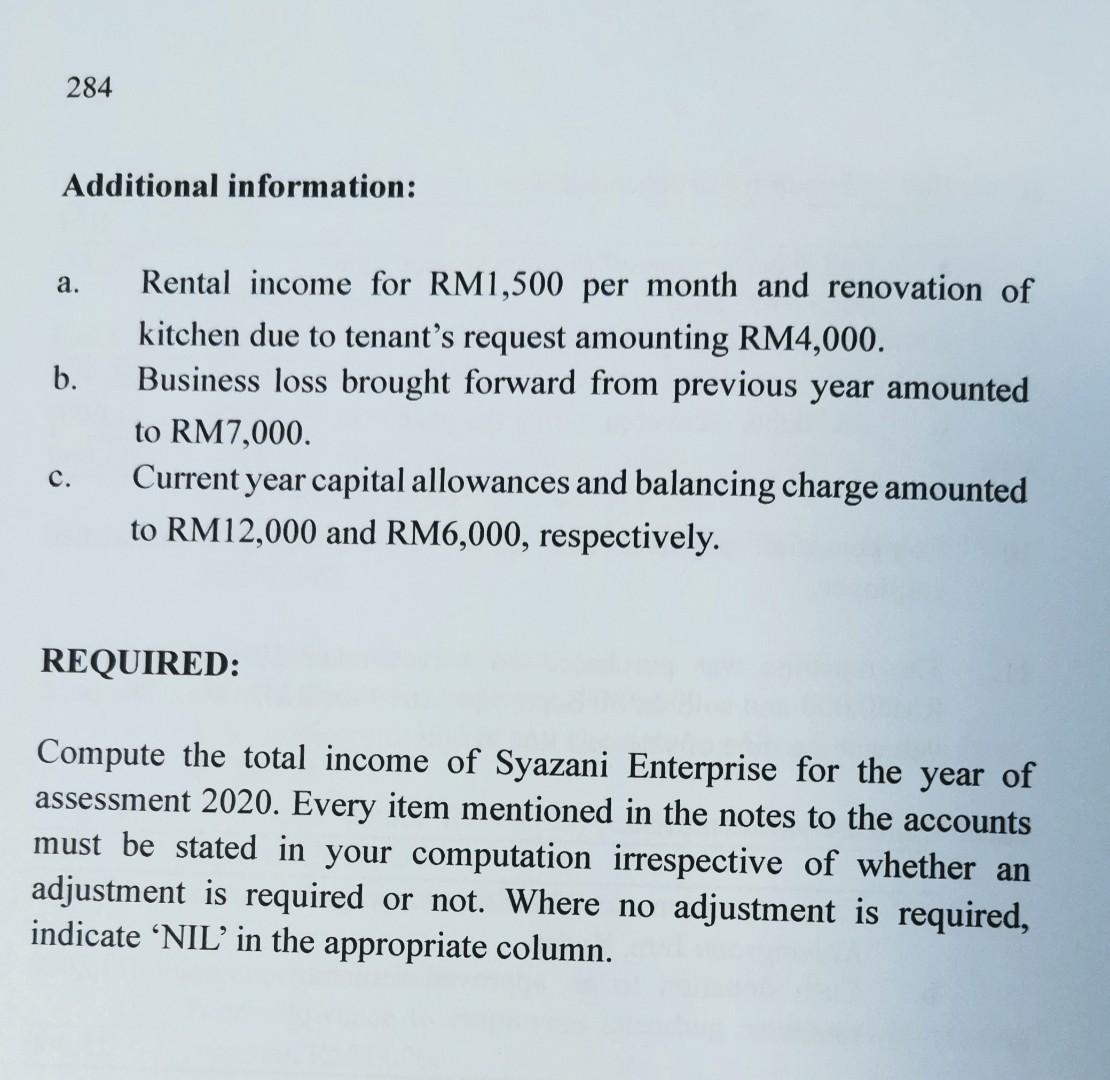

Question 5 Syazani Enterprise is involved in selling computers since 2017. Syazani, the owner of the business, has provided income statement for the year ended 31 December 2020 as follows: RM 2,400,000 Syazani Enterprise Income Statement for the Year Ended 31 December 2020 Note RM Sales 1 2,800,000 Less: Cost of sales 2 400,000 Gross Profit Less: Operating expenses Remuneration 3 275,000 Entertainment 4 33,000 Training 12,000 Professional fees 6 7,200 Bank charges 7 5,000 Repairs and maintenance 8 18,000 Bad and doubtful debts 9 15,000 Compensation 10 5,000 Loss on sale of machine 11 10,000 Contributions 12 25,000 14,000 Employees benefits 13 16,000 14 3,500 Depreciation Miscellaneous Profit before taxation 438,700 1,961,300 Notes: 1. The amount of sales include goods valued at a cost of RM4,000 which were taken for Syazani's personal use. The market value of these goods were RM8,500. 282 2. Cost of sales include a provision for stock obsolescence amounting RM6,000. 3. a. Remuneration comprises: Syazani's salary as the manager at RM10,000 per month. b. Salary of a disabled (with eyesight problem) sales executive at RM2,000 per month. Salary of other employees at RM8,000 per month, including a casual worker at RM1,000 per month. d. Total contribution to the Employees Provident Fund (EPF) is RM35,000. C. 4. a. Entertainment expenses include: Annual dinner for employee, RM6,000. b. Entertaining employees and client during 'Bonanza Sales Day', RM8,000. Hari raya dinner for employees with the presence of some clients, RM15,000. d. Entertaining supplier, RM4,000. c. 5. a. Training expenses include: Food allowance to employees attending an approved training program, RM4,000. b. Training expenses for non-employees, RM7,000. 6. Professional fees include: a. b. RM 2,500 2,400 c. Secretarial fees Legal fees for securing a new tender Participation in an approved career fair organized by Talent Corporation Malaysia Bhd 2,000 7. Bank charges include interest on overdraft and short-term loan incurred to finance the operation of the business amounting RM3,000. 8. Repairs and maintenance include: a. b. Upgrading the fire safety system Rewiring the entire business premise Small renovation on the business' restroom RM 4,000 7,000 6,000 C. 9. Bad and doubtful debts comprise: a. RM 12,000 Bad debts written off during the year (non- trade RM2,000) Net increase in general provision b. C. Bad debts recovered during the year 8,000 20,000 (5,000) 15,000 10. Compensation payment was made for dismissing a dissatisfied employee. 11. The machine was purchased on 1 November 2016 at a cost of RM50,000 and sold on 30 September 2019 for RM25,000. The book value at the time of sale was RM35,000. 12. Contributions comprise: a. Cash donation to Sekolah Menengah Kebangsaan Jitra, Kedah Cash donation to an approved research institute RM 12,000 b. 13,000 13. Employees benefits include: 25,000 a. b. c. Employees travelling allowance Mobile phone bill for supervisor Leave passage to Korea for a business accountant and his family RM 4,500 3,000 7,000 14. Miscellaneous expenses comprise: a. b. RM (4,000) C. Insurance claim for damage of office equipment Losses due to theft of stock in trade Fire insurance premium for business? premises Compensation to clients for damaged goods Traffic fines paid for the manager d. 2,000 1,800 e. 3,200 500 3,500 284 Additional information: a. b. Rental income for RM1,500 per month and renovation of kitchen due to tenant's request amounting RM4,000. Business loss brought forward from previous year amounted to RM7,000. Current year capital allowances and balancing charge amounted to RM12,000 and RM6,000, respectively. c. REQUIRED: Compute the total income of Syazani Enterprise for the year of assessment 2020. Every item mentioned in the notes to the accounts must be stated in your computation irrespective of whether an adjustment is required or not. Where no adjustment is required, indicate NIL' in the appropriate column

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts