Question: Can I ask help for solution thank you Question 30 The following Oduction data come from the records of Olympic Enterprises for the year ended

Can I ask help for solution thank you

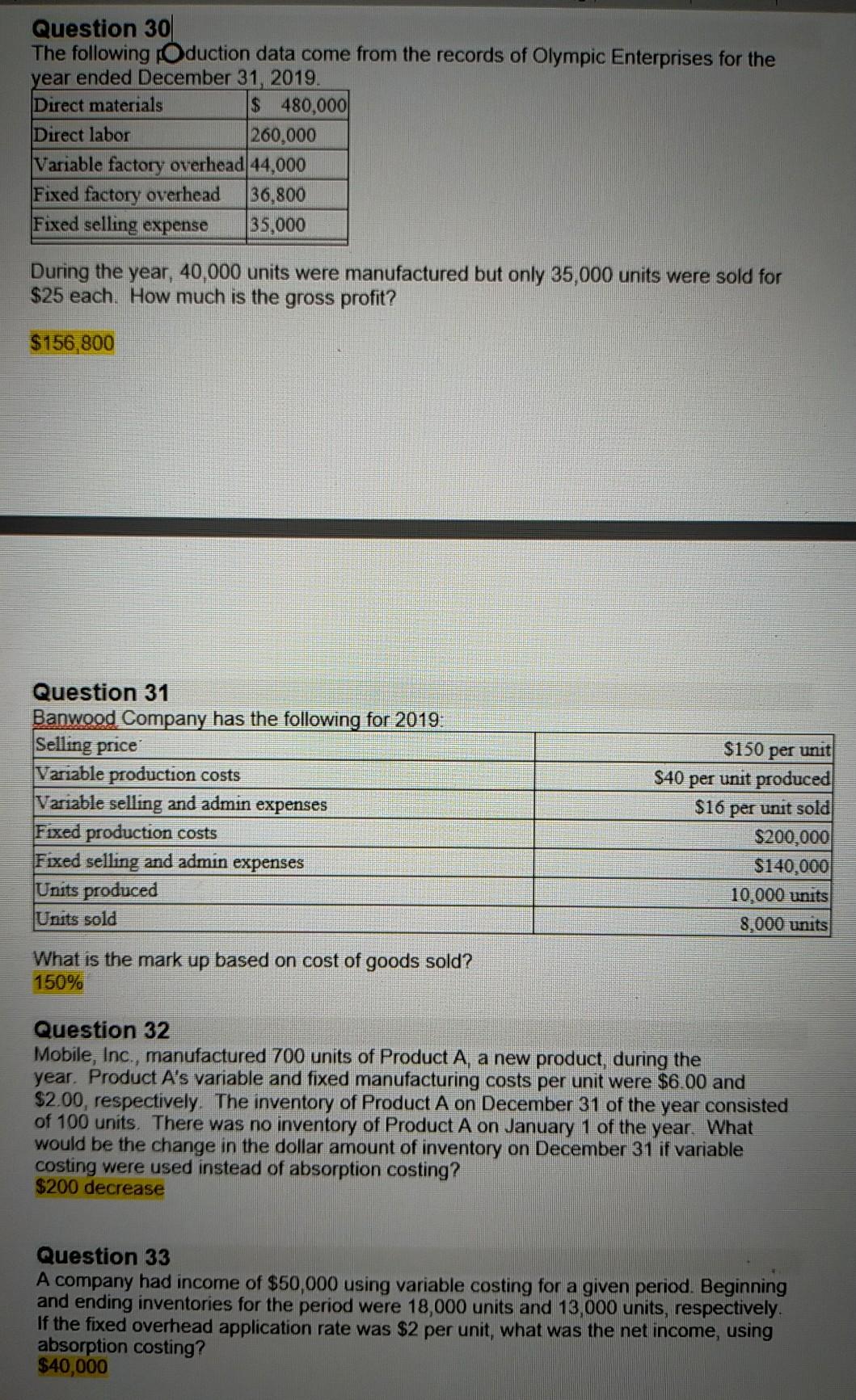

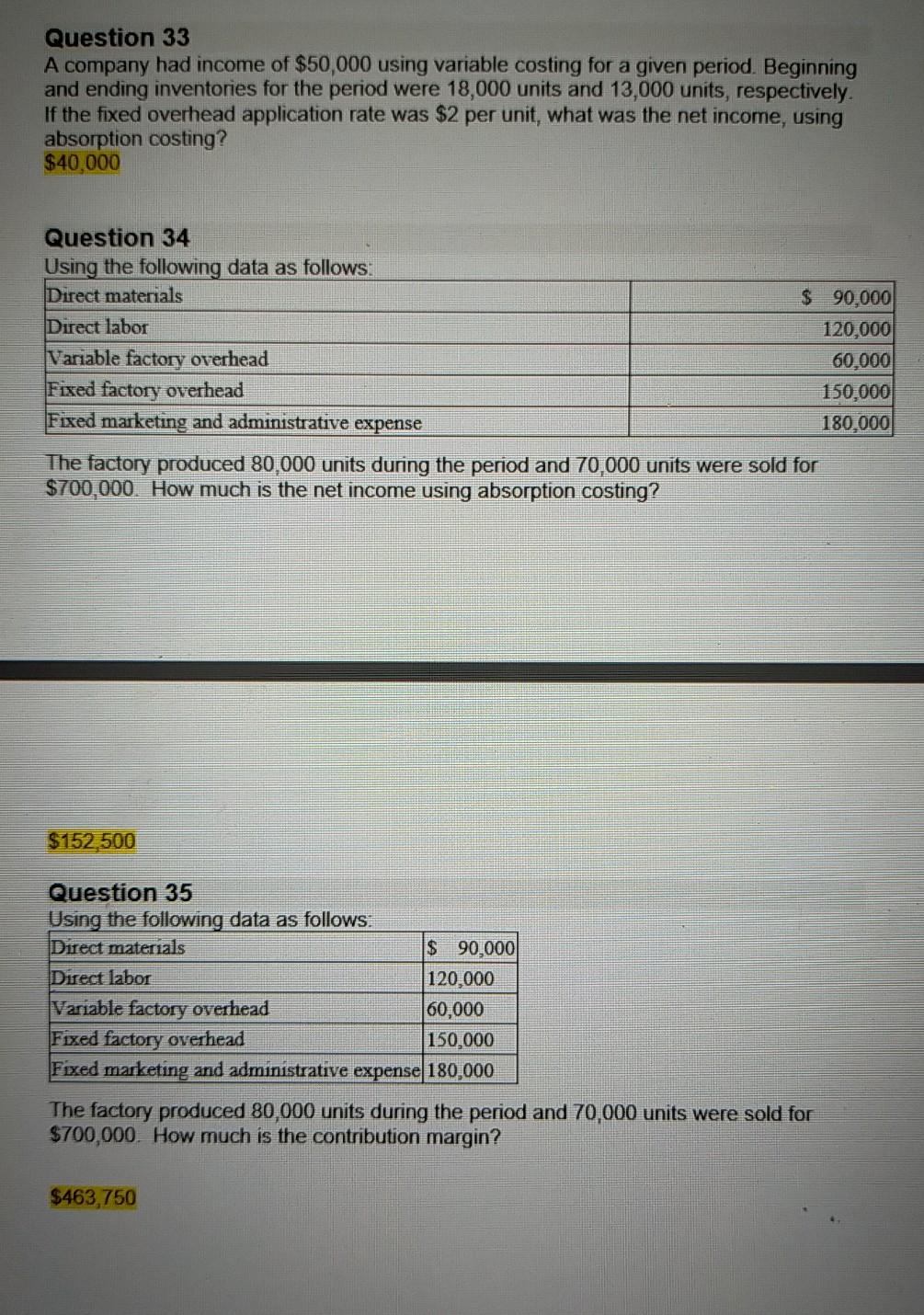

Question 30 The following Oduction data come from the records of Olympic Enterprises for the year ended December 31, 2019 Direct materials $ 480,000 Direct labor 260,000 Variable factory overhead 44,000 Fixed factory overhead 36,800 Fixed selling expense 35,000 During the year, 40,000 units were manufactured but only 35,000 units were sold for $25 each. How much is the gross profit? $156,800 $150 per unit S40 per unit produced Question 31 Banwood Company has the following for 2019: Selling price Variable production costs Variable selling and admin expenses Fixed production costs Fixed selling and admin expenses Units produced Units sold $16 per unit sold $200,000 $140,000 10,000 units 8,000 units What is the mark up based on cost of goods sold? 150% Question 32 Mobile, Inc., manufactured 700 units of Product A, a new product, during the year. Product A's variable and fixed manufacturing costs per unit were $6.00 and $2.00, respectively. The inventory of Product A on December 31 of the year consisted of 100 units. There was no inventory of Product A on January 1 of the year. What would be the change in the dollar amount of inventory on December 31 if variable costing were used instead of absorption costing? $200 decrease Question 33 A company had income of $50,000 using variable costing for a given period. Beginning and ending inventories for the period were 18,000 units and 13,000 units, respectively. If the fixed overhead application rate was $2 per unit, what was the net income, using absorption costing? $40,000 Question 33 A company had income of $50,000 using variable costing for a given period. Beginning and ending inventories for the period were 18,000 units and 13,000 units, respectively If the fixed overhead application rate was $2 per unit, what was the net income, using absorption costing? $40,000 Question 34 Using the following data as follows: Direct materials $ 90,000 Direct labor 120,000 Variable factory overhead 60,000 Fixed factory overhead 150,000 Fixed marketing and administrative expense 180,000 The factory produced 80,000 units during the period and 70,000 units were sold for $700,000. How much is the net income using absorption costing? $152,500 Question 35 Using the following data as follows: Direct materials $ 90,000 Direct labor 120,000 Variable factory overhead 60,000 Fixed factory overhead 150,000 Fixed marketing and administrative expense 180,000 The factory produced 80,000 units during the period and 70,000 units were sold for $700,000. How much is the contribution margin? $463,750

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts