Question: Can i find out how to do question 5b? Question 5: Boeing and Airbus are two aircraft manufacturers competing to fill an order of long-

Can i find out how to do question 5b?

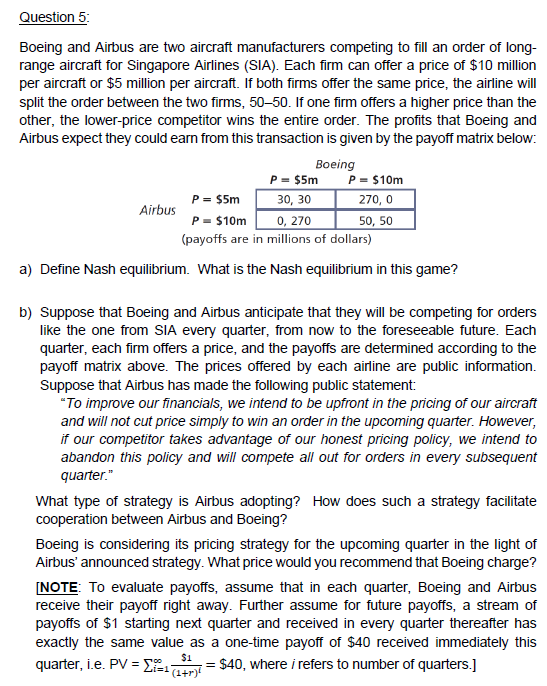

Question 5: Boeing and Airbus are two aircraft manufacturers competing to fill an order of long- range aircraft for Singapore Airlines (SIA). Each firm can offer a price of $10 million per aircraft or $5 million per aircraft. If both firms offer the same price, the airline will split the order between the two firms, 50-50. If one firm offers a higher price than the other, the lower-price competitor wins the entire order. The profits that Boeing and Airbus expect they could earn from this transaction is given by the payoff matrix below: Boeing P = $5m P = $10m Airbus P = $5m 30, 30 270, 0 P - $10m 0, 270 50, 50 (payoffs are in millions of dollars) a) Define Nash equilibrium. What is the Nash equilibrium in this game? b) Suppose that Boeing and Airbus anticipate that they will be competing for orders like the one from SIA every quarter, from now to the foreseeable future. Each quarter, each firm offers a price, and the payoffs are determined according to the payoff matrix above. The prices offered by each airline are public information. Suppose that Airbus has made the following public statement: "To improve our financials, we intend to be upfront in the pricing of our aircraft and will not cut price simply to win an order in the upcoming quarter. However, if our competitor takes advantage of our honest pricing policy, we intend to abandon this policy and will compete all out for orders in every subsequent quarter." What type of strategy is Airbus adopting? How does such a strategy facilitate cooperation between Airbus and Boeing? Boeing is considering its pricing strategy for the upcoming quarter in the light of Airbus' announced strategy. What price would you recommend that Boeing charge? [NOTE: To evaluate payoffs, assume that in each quarter, Boeing and Airbus receive their payoff right away. Further assume for future payoffs, a stream of payoffs of $1 starting next quarter and received in every quarter thereafter has exactly the same value as a one-time payoff of $40 received immediately this quarter, i.e. PV = Zi=17 $1 =$40, where / refers to number of quarters.]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts