Question: Can I get explained on to how to know what goes under each permanent account? For example I know under retained earnings we have service

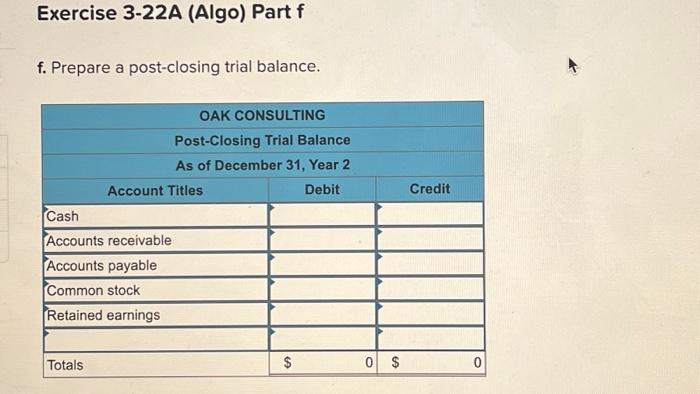

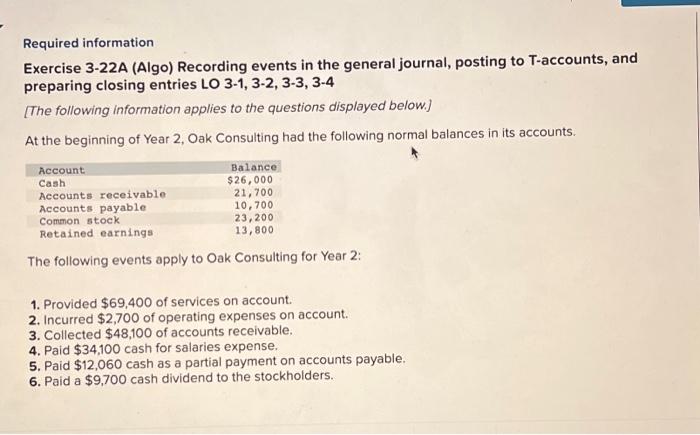

f. Prepare a post-closing trial balance. Required information Exercise 3-22A (Algo) Recording events in the general journal, posting to T-accounts, and preparing closing entries LO 31,32,33,34 [The following information applies to the questions displayed below.] At the beginning of Year 2, Oak Consulting had the following normal balances in its accounts. The following events apply to Oak Consulting for Year 2: 1. Provided $69,400 of services on account. 2. Incurred $2,700 of operating expenses on account. 3. Collected $48,100 of accounts receivable. 4. Paid $34,100 cash for salaries expense. 5. Paid $12,060 cash as a partial payment on accounts payable. 6. Paid a $9,700 cash dividend to the stockholders

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts