Question: can i get help on this Summary Information from the financial statements of two companies competing in the same industry follows. Barco Company Barco Company

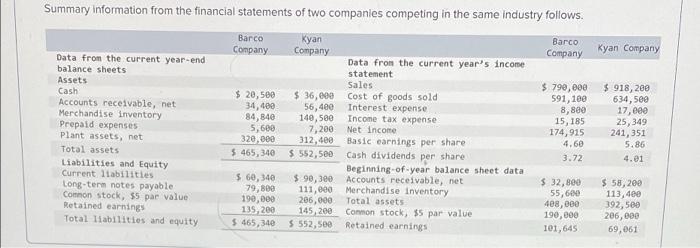

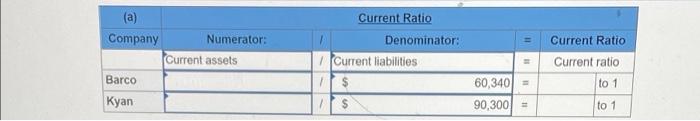

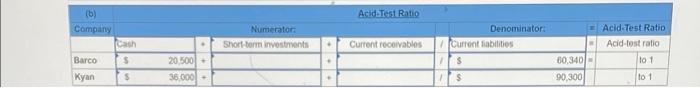

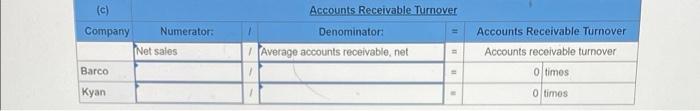

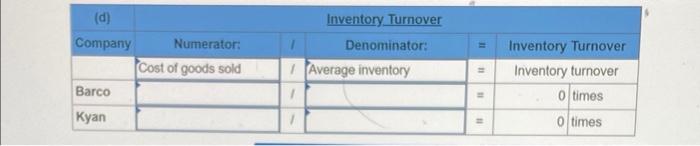

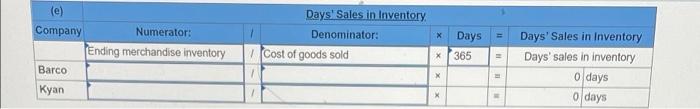

Summary Information from the financial statements of two companies competing in the same industry follows. Barco Company Barco Company Kyan Company Data from the current year-end balance sheets Assets Cash Accounts receivable, net Merchandise inventory Prepaid expenses Plant assets, net Total assets Liabilities and Equity Current liabilities Long-term notes payable Comon stock, 35 par value Retained earnings Total liabilities and equity $ 20,500 34,400 84,840 5,600 320.000 $ 465,340 kyan Company Data from the current year's income statement Sales $ 36,000 Cost of goods sold 56,400 Interest expense 140,500 Income tax expense 7,200 Net Income 312,400 Basic earnings per share $ 552,500 Cash dividends per share Beginning-of-year balance sheet data $ 90,300 Accounts receivable, net 111,000 Merchandise Inventory 206,000 Total assets 145,200 Connon stock, $5 par value 5 552, See Retained earnings $ 790,000 591,100 8,888 15,185 174,915 4.60 3.72 $ 918,200 634,500 17, eee 25, 349 241,351 5.86 4.01 $ 60, 340 79,800 190,000 135, 200 $ 465,340 $ 32,800 55,600 488, eee 190,000 101,645 $ 58,200 113,400 392,500 206,000 69,061 11 Current Ratio Company Numerator: Current assets Current Ratio Denominator: Current liabilities $ $ 11 Current ratio Barco to 1 Kyan 60,340 = 90,300] = to 1 Acid-Test Ratio (6) Company Numerator Short term investments Current receivables Denominator: Current liabilities S Is Acid-Test Ratio Acid-lost ratio 101 Barco Kyan $ $ 20500 - 36.000 10,3401 90,300 to 1 (c) Company Numerator: Net sales Accounts Receivable Tumover Denominator Average accounts receivable, net Accounts Receivable Turnover Accounts receivable turnover Barco o times Kyan oltimos Inventory Turnover Denominator: Average inventory (d) Company Numerator: Cost of goods sold Barco Kyan 11 Inventory Turnover Inventory turnover o times 0 times = 1 11 Days Sales in Inventory Denominator: Cost of goods sold (e) Company Numerator: Ending merchandise inventory Barco Kyan X Days 365 X Days' Sales in Inventory Days' sales in inventory 0 days 0 days X x

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts