Question: Can I Get Help Please Exercise 6-13 (Algo) Time value of money for deferred revenue [LO6-6] Arctic Cat soid Seneca Motor Sports a shipment of

![money for deferred revenue [LO6-6] Arctic Cat soid Seneca Motor Sports a](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/10/66fbacaa7e504_77066fbacaa229e9.jpg)

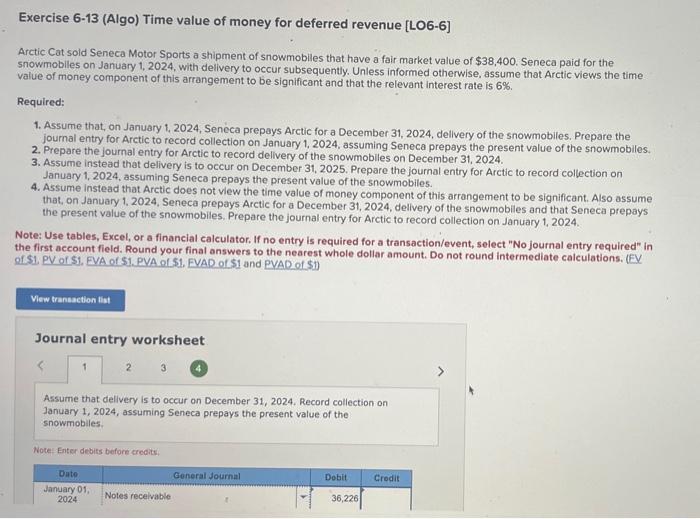

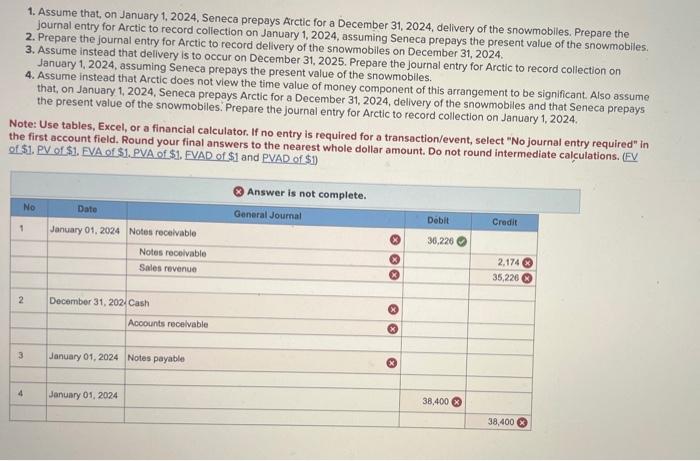

Exercise 6-13 (Algo) Time value of money for deferred revenue [LO6-6] Arctic Cat soid Seneca Motor Sports a shipment of snowmobiles that have a fair market value of $38,400. Seneca paid for the snowmobiles on January 1,2024 , with delivery to occur subsequently. Unless informed otherwise, assume that Arctic views the time value of money component of this arrangement to be significant and that the relevant interest rate is 6%. Required: 1. Assume that, on January 1, 2024, Seneca prepays Arctic for a December 31, 2024, dellvery of the snowmobiles. Prepare the joumal entry for Arctic to record collection on January 1, 2024, assuming Seneca prepays the present value of the snowmobiles. 2. Prepare the journal entry for Arctic to record delivery of the snowmobiles on December 31,2024. 3. Assume instead that delivery is to occur on December 31, 2025. Prepare the journal entry for Arctic to record collection on January 1,2024, assuming Seneca prepays the present value of the snowmobiles. 4. Assume instead that Arctic does not view the time value of money component of this arrangement to be significant. Also assume that, on January 1. 2024, Seneca prepays Arctic for a December 31, 2024, delivery of the snowmobiles and that Seneca prepays the present value of the snowmobiles. Prepare the journal entry for Arctic to record collection on January 1,2024. Note: Use tables, Excel, or a financial calculator. If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Round your final answers to the nearest whole dollar amount. Do not round intermediate calculations. (EV of S1. PV of S1, EVA of S1. PVA of S1, EVAD of S1 and PVAD of \$1) Journal entry worksheet Assume that dellvery is to occur on December 31, 2024. Record collection on January 1, 2024, assuming Seneca prepays the present value of the snowmobiles. Note: Enter debits before credits. Arctic Cat sold Seneca Motor Sports a shipment of snowmobiles that have a fair market value of $38,400. Seneca paid for the snowmobiles on January 1,2024, with delivery to occur subsequently. Unless informed otherwise, assume that Arctic views the time value of money component of this arrangement to be significant and that the relevant interest rate is 6%. Required: 1. Assume that, on January 1, 2024, Seneca prepays Arctic for a December 31,2024 , dellvery of the snowmobiles. Prepare the journal entry for Arctic to record collection on January 1, 2024, assuming Seneca prepays the present value of the snowmobiles. 2. Prepare the journal entry for Arctic to record delivery of the snowmobiles on December 31,2024. 3. Assume instead that delivery is to occur on December 31, 2025. Prepare the journal entry for Arctic to record colfection on January 1, 2024, assuming Seneca prepays the present value of the snowmobiles. 4. Assume instead that Arctic does not view the time value of money component of this arrangement to be significant. Also assume that, on January 1, 2024. Seneca prepays Arctic for a December 31, 2024, delivery of the snowmobiles and that Seneca prepays the present value of the snowmoblies. Prepare the journal entry for Arctic to record collection on January 1,2024. Note: Use tables, Excel, or a financial calculator. If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Round your final answers to the nearest whole dollar amount. Do not round intermediate calculations. (FV of \$1. PV of \$1. EVA of \$1. PVA of \$1, EVAD of $1 and PVAD of \$1) 1. Assume that, on January 1, 2024, Seneca prepays Arctic for a December 31, 2024, delivery of the snowmoblles. Prepare the journal entry for Arctic to record collection on January 1, 2024, assuming Seneca prepays the present value of the snowmobiles. 2. Prepare the joumal entry for Arctic to record dellvery of the snowmobiles on December 31,2024. 3. Assume instead that delivery is to occur on December 31,2025 . Prepare the Journal entry for Arctic to record collection on 4. Assume instead that Arctic Seneca prepays the present value of the snowmobiles. that, on January 1, 2024, Seneca prepays Arctie for a De money component of this arrangement to be significant. Also assume the present value of the snowmobiles. Prepare the journel December 31,2024, delivery of the snowmobiles and that Seneca prepays journal entry for Arctic to record collection on January 1,2024. the first account field. Round your final answers to the entry is required for a transaction/event, select "No journal entry required" in of \$1. PV of \$1. EVA of \$1. PVA of \$1. EVAD of \$1 and PVAD nearest whole dollar amount. Do not round intermediate calculations. (EV Exercise 6-13 (Algo) Time value of money for deferred revenue [LO6-6] Arctic Cat soid Seneca Motor Sports a shipment of snowmobiles that have a fair market value of $38,400. Seneca paid for the snowmobiles on January 1,2024 , with delivery to occur subsequently. Unless informed otherwise, assume that Arctic views the time value of money component of this arrangement to be significant and that the relevant interest rate is 6%. Required: 1. Assume that, on January 1, 2024, Seneca prepays Arctic for a December 31, 2024, dellvery of the snowmobiles. Prepare the joumal entry for Arctic to record collection on January 1, 2024, assuming Seneca prepays the present value of the snowmobiles. 2. Prepare the journal entry for Arctic to record delivery of the snowmobiles on December 31,2024. 3. Assume instead that delivery is to occur on December 31, 2025. Prepare the journal entry for Arctic to record collection on January 1,2024, assuming Seneca prepays the present value of the snowmobiles. 4. Assume instead that Arctic does not view the time value of money component of this arrangement to be significant. Also assume that, on January 1. 2024, Seneca prepays Arctic for a December 31, 2024, delivery of the snowmobiles and that Seneca prepays the present value of the snowmobiles. Prepare the journal entry for Arctic to record collection on January 1,2024. Note: Use tables, Excel, or a financial calculator. If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Round your final answers to the nearest whole dollar amount. Do not round intermediate calculations. (EV of S1. PV of S1, EVA of S1. PVA of S1, EVAD of S1 and PVAD of \$1) Journal entry worksheet Assume that dellvery is to occur on December 31, 2024. Record collection on January 1, 2024, assuming Seneca prepays the present value of the snowmobiles. Note: Enter debits before credits. Arctic Cat sold Seneca Motor Sports a shipment of snowmobiles that have a fair market value of $38,400. Seneca paid for the snowmobiles on January 1,2024, with delivery to occur subsequently. Unless informed otherwise, assume that Arctic views the time value of money component of this arrangement to be significant and that the relevant interest rate is 6%. Required: 1. Assume that, on January 1, 2024, Seneca prepays Arctic for a December 31,2024 , dellvery of the snowmobiles. Prepare the journal entry for Arctic to record collection on January 1, 2024, assuming Seneca prepays the present value of the snowmobiles. 2. Prepare the journal entry for Arctic to record delivery of the snowmobiles on December 31,2024. 3. Assume instead that delivery is to occur on December 31, 2025. Prepare the journal entry for Arctic to record colfection on January 1, 2024, assuming Seneca prepays the present value of the snowmobiles. 4. Assume instead that Arctic does not view the time value of money component of this arrangement to be significant. Also assume that, on January 1, 2024. Seneca prepays Arctic for a December 31, 2024, delivery of the snowmobiles and that Seneca prepays the present value of the snowmoblies. Prepare the journal entry for Arctic to record collection on January 1,2024. Note: Use tables, Excel, or a financial calculator. If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Round your final answers to the nearest whole dollar amount. Do not round intermediate calculations. (FV of \$1. PV of \$1. EVA of \$1. PVA of \$1, EVAD of $1 and PVAD of \$1) 1. Assume that, on January 1, 2024, Seneca prepays Arctic for a December 31, 2024, delivery of the snowmoblles. Prepare the journal entry for Arctic to record collection on January 1, 2024, assuming Seneca prepays the present value of the snowmobiles. 2. Prepare the joumal entry for Arctic to record dellvery of the snowmobiles on December 31,2024. 3. Assume instead that delivery is to occur on December 31,2025 . Prepare the Journal entry for Arctic to record collection on 4. Assume instead that Arctic Seneca prepays the present value of the snowmobiles. that, on January 1, 2024, Seneca prepays Arctie for a De money component of this arrangement to be significant. Also assume the present value of the snowmobiles. Prepare the journel December 31,2024, delivery of the snowmobiles and that Seneca prepays journal entry for Arctic to record collection on January 1,2024. the first account field. Round your final answers to the entry is required for a transaction/event, select "No journal entry required" in of \$1. PV of \$1. EVA of \$1. PVA of \$1. EVAD of \$1 and PVAD nearest whole dollar amount. Do not round intermediate calculations. (EV

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts