Question: Can I get help solving this problem using excel? The first image is the question. The second image is the questions with the correct answers.

Can I get help solving this problem using excel? The first image is the question. The second image is the questions with the correct answers. Thank you!

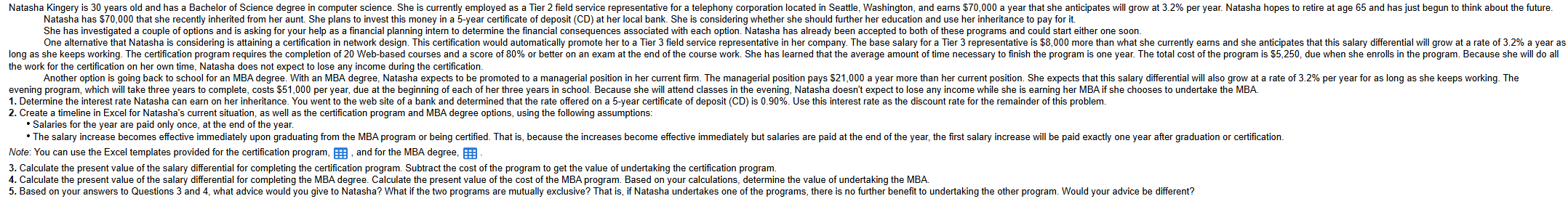

Natasha has $ that she recently inherititd from her aunt. She plans to invest this money in a year certificate of deposit CD at her local bank. She is considering whether she should further her education and use her inheritance to pay for it

Sne altemative that Natasha is considering is istaining a cerctification in network design. This certification would automatically promote her to a Tier field sencrice represesentative in her company. The base salary for a Tier representatative is $ more than what

the work for the certification on her own time, Natasha does not expect to lose any income during the certification.

Create a timeline in Excel for Natasha's current situation, as well as the certification program and MBA degree options, using the following assumptions:

Salaries for the year are paid only once, at the end of the year.

The salary increase becomes effective immediately upon graduating from the MBA program or being certified. That is because the increases become effective immediately but salaries are paid at the end of the year, the first salary increase will be paid exactly one year after graduation or certification.

Note: You can use the Excel templates provided for the certification program, and for the MBA degree,

Calculate the present value of the salary differential for completing the certification program. Subtract the cost of the program to get the value of undertaking the certification program.

Calculate the present value of the salary differential for completing the MBA degree Calculate the present value of the cost of the MBA program. Based on your calculations, determine the value of undertaking the MBA.

Based on your answers to Questions and what advice would you give to Natasha? What if the two programs are mutually exclusive? That is if Natasha undertakes one of the programs, there is no further benefit to undertaking the other program. Would your advice be different?

Create a timeline in Excel for Natasha's current situation, as well as the certification program and MBA degree options, using the following assumptions:

Salaries for the year are paid only once, at the end of the year.

Note: You can use the Excel templates provided for the certification program, and for the MBA degree,

Calculate the present value of the salary differential for completing the certification program. Subtract the cost of the program to get the value of undertaking the certification program.

The present value of the salary differential for completing the certification program is $Round the to nearest cent.

The value of undertaking the certification program is $Round the to nearest cent.

The present value of the salary differential for completing the MBA degree is $Round the to nearest cent.

The value of undertaking the MBA is $Round the to nearest integer.

Based on your answers to Questions and what advice would you give to Natasha? Select all that apply.

A Natasha should enrol in the certification program.

Natasha should enrol in the MBA program.

: Natasha should enrol in neither program.

Natasha should enrol in both programs.

A Natasha should enrol in the certification program.

B Natasha should enrol in both programs.

VC Natasha should enrol in the MBA program.

D Natasha should enrol in neither program.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock