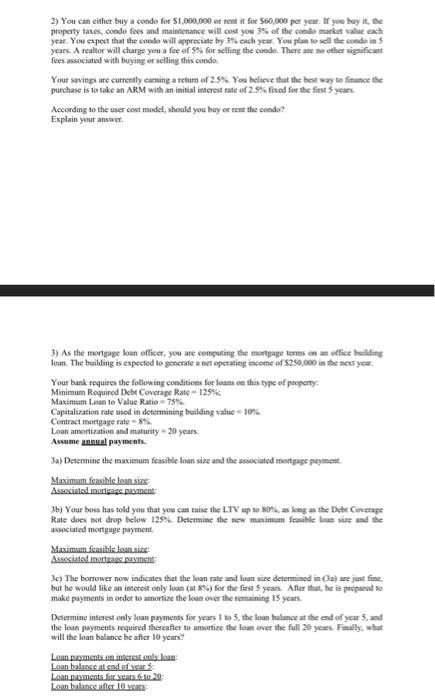

Question: can i get help with 2 and 3 as well? 2) You can either buy a condo for $1,000,000 or tent it for $60,000 per

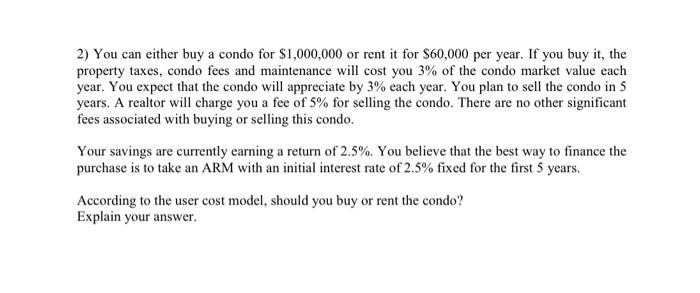

2) You can either buy a condo for $1,000,000 or tent it for $60,000 per year. Ir yoe buy it, the property taxes, condo fees and maimenance will cost you 3% of the coodo murket valse each year. You expect that the cooda will appreciate by 3 the each year. You plan lo sell the coedo in 5 years. A reallor will charge you a fee of 5% for selling the condo. There ate no other sigeificant fees associaled with buying of selling this condo Your sevines are currently earning a return of 2.5%. You belicve that the best way to finance the purchase is to take an ARM with an initial interes rade of 2.57 fixed for the fint 5 years According to the user cost model, should you buy or sent the coodo? Explain your answer. 3) As the mortgage loan etficer, you are conpenting the mortyage terms on as office beilfine loan. The beilding is expected io prncrate a set eperating income of 5250,000 in the neat year. Your bank requires the following conditions for leans on this type of ptoperty? Minimum Required Debx Coverage Rate - 125\% Maximum Loaa te Value Ratie =75 * Capialization rate ased in determiniag benilding value =100h Contraci mortgage rate =8% Loan amortization and maturity =20 years. Assume annual payments. 3a) Detenmine the maximum feasible loan size and the associated mortgage puymeit. Maximom feasible lonsize: Asseciated marigage pument: 3b) Your bois has told you that yow can maise the LTV enp to sohk, as heg as the Debe Covenge Rate does bot drop below 125%. Dedenniae the new maximam feasible loas sire and the asseialed mortgape paynent. Maximum fcasible loansies: Associadnd mattease payment 3c) The borrower now indicates that the loan rate and loun sre delermined in (3a) are juat fine, but be would like an inerest only loan (at shs) for the first 5 yean. Antar that, he is propured so make payments in arder to amontize the loas over the ramaining 15 years. Determine intesest only loan payments for years 1 to 5 , the loan tolance at the end of yeur 5 , and the lous payments required thereafter to ansontize the loun over the full 20 yeark. Fially, what will the loan bulance be after 10 years? Loan owments. ot inserest ooly bua: Loan baluake at caxl of vear 5 - Loan poymients far xears 6.1020 : Loin bolunge after 10 yers: 2) You can either buy a condo for $1,000,000 or rent it for $60,000 per year. If you buy it, the property taxes, condo fees and maintenance will cost you 3% of the condo market value each year. You expect that the condo will appreciate by 3% each year. You plan to sell the condo in 5 years. A realtor will charge you a fee of 5% for selling the condo. There are no other significant fees associated with buying or selling this condo. Your savings are currently earning a return of 2.5%. You believe that the best way to finance the purchase is to take an ARM with an initial interest rate of 2.5% fixed for the first 5 years. According to the user cost model, should you buy or rent the condo? Explain your answer. 3) As the mortgage loan officer, you are computing the mortgage terms on an office building loan. The building is expected to generate a net operating income of $250,000 in the next year. Your bank requires the following conditions for loans on this type of property: Minimum Required Debt Coverage Rate =125%; Maximum Loan to Value Ratio =75%. Capitalization rate used in determining building value =10%. Contract mortgage rate =8%. Loan amortization and maturity =20 years. Assume annual payments. 3a) Determine the maximum feasible loan size and the associated mortgage payment. Maximum feasible loan size: Associated mortgage payment: 3b) Your boss has told you that you can raise the LTV up to 80%, as long as the Debt Coverage Rate does not drop below 125%. Determine the new maximum feasible loan size and the associated mortgage payment. Maximum feasible loan size: Associated mortgage payment: 3c) The borrower now indicates that the loan rate and loan size determined in (3a) are just fine, but he would like an interest only loan (at 8% ) for the first 5 years. After that, he is prepared to make payments in order to amortize the loan over the remaining 15 years. Determine interest only loan payments for years 1 to 5 , the loan balance at the end of year 5 , and the loan payments required thereafter to amortize the loan over the full 20 years. Finally, what will the loan balance be after 10 years? Loan payments on interest only loan: Loan balance at end of year 5 : Loan payments for years 6 to 20 : Loan balance after 10 years

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts