Question: Can I get help with both answer Using semiannual compounding, a 15-year, zero- coupon that has a par value of $1,000 and a required return

Can I get help with both answer

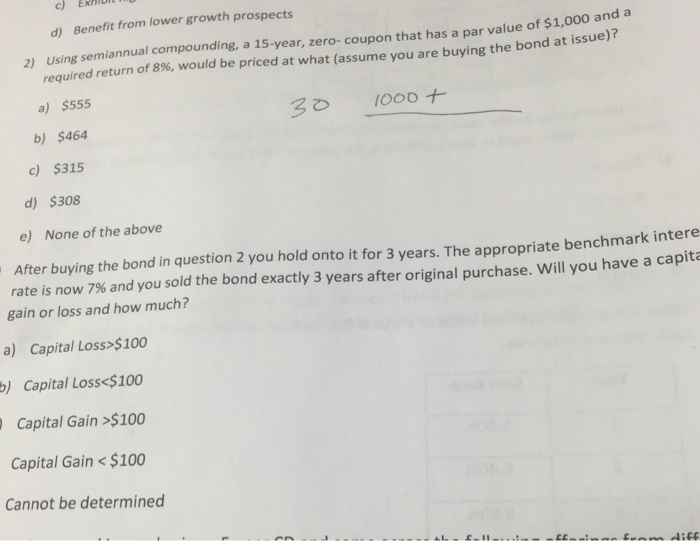

Using semiannual compounding, a 15-year, zero- coupon that has a par value of $1,000 and a required return of 8%, would be priced at what (assume you are buying the bond at issue)? $555 $464 $315 $308 None of the above After buying the bond in question 2 you hold onto it for 3 years. The appropriate benchmark interest rate is now 7% and you sold the bond exactly 3 years after original purchase. Will you have a capit gain or loss and how much? Capital Loss>$100 Capital Loss$100 Capital Gain

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock