Question: Can i Get help with Exercise 2 DEDUCTIONS EXERCISE 2: CALCULATING DEDUCTIONS AND NET PA For each of the following, calculate each deduction and net

Can i Get help with Exercise 2

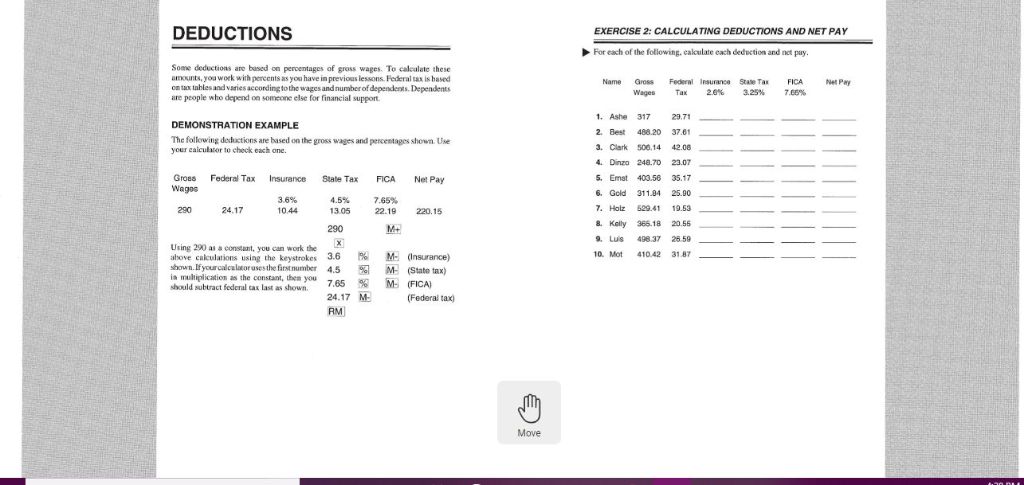

DEDUCTIONS EXERCISE 2: CALCULATING DEDUCTIONS AND NET PA For each of the following, calculate each deduction and net pay. Some deductions are based on percentages of gross wages. To calcalate these amounts, yoa work with percents as you have in previous lessons. Federal tax is based tx tables and varies acconding to the wages andnumber of dependents. Dependents are people who depend on someone else for financial support. Name Gross Federal Insurance State Ta FICA Net Pay Wages Tax 28% 3.29% 7.66% DEMONSTRATION EXAMPLE The following dedactions are based on the gross wages and pencentages shown Use your calculator to check each one. Dinzo 248.70 23.07 S. Emst 403.58 35.17_ 6. Gold 311.04 25.00 7. Holz 529.41 19.53_ 8. Kelly 36518 20.55 9. Lus 498.37 26.59_ 10. Mot 410.42 31.87_- Gross Federal Tax Insurance State Tax FICA Net Pay Wagos 3.6% 10 44 4.5% 13.05 7.65% 22.19 220.15 290 24.17 290 M+ Using 290 as a consant, you can work the above calculations using the keystrokes 3.6M(Insurance) shown. Ifyourcalculatoruses thefint is multiplication as the constant, them you should subtract federal tax last as shown number 4.5 7.65 24.17 RM M- M- (State tax) (FICA) (Federal tax) Move DEDUCTIONS EXERCISE 2: CALCULATING DEDUCTIONS AND NET PA For each of the following, calculate each deduction and net pay. Some deductions are based on percentages of gross wages. To calcalate these amounts, yoa work with percents as you have in previous lessons. Federal tax is based tx tables and varies acconding to the wages andnumber of dependents. Dependents are people who depend on someone else for financial support. Name Gross Federal Insurance State Ta FICA Net Pay Wages Tax 28% 3.29% 7.66% DEMONSTRATION EXAMPLE The following dedactions are based on the gross wages and pencentages shown Use your calculator to check each one. Dinzo 248.70 23.07 S. Emst 403.58 35.17_ 6. Gold 311.04 25.00 7. Holz 529.41 19.53_ 8. Kelly 36518 20.55 9. Lus 498.37 26.59_ 10. Mot 410.42 31.87_- Gross Federal Tax Insurance State Tax FICA Net Pay Wagos 3.6% 10 44 4.5% 13.05 7.65% 22.19 220.15 290 24.17 290 M+ Using 290 as a consant, you can work the above calculations using the keystrokes 3.6M(Insurance) shown. Ifyourcalculatoruses thefint is multiplication as the constant, them you should subtract federal tax last as shown number 4.5 7.65 24.17 RM M- M- (State tax) (FICA) (Federal tax) Move

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts