Question: Can i get help with the steps on how too solve these 4 problems please? 1. A company has $100,000,000 of debt and $80,000,000 of

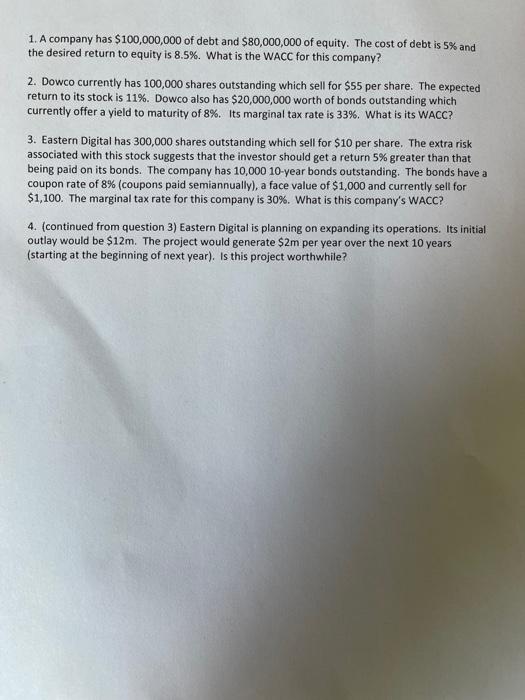

1. A company has $100,000,000 of debt and $80,000,000 of equity. The cost of debt is 5% and the desired return to equity is 8.5%. What is the WACC for this company? 2. Dowco currently has 100,000 shares outstanding which sell for $55 per share. The expected return to its stock is 11%. Dowco also has $20,000,000 worth of bonds outstanding which currently offer a yield to maturity of 8%. Its marginal tax rate is 33%. What is its WACC? 3. Eastern Digital has 300,000 shares outstanding which sell for $10 per share. The extra risk associated with this stock suggests that the investor should get a return 5% greater than that being paid on its bonds. The company has 10,000 10-year bonds outstanding. The bonds have a coupon rate of 8% (coupons paid semiannually), a face value of $1,000 and currently sell for $1,100. The marginal tax rate for this company is 30%. What is this company's WACC? 4. (continued from question 3) Eastern Digital is planning on expanding its operations. Its initial outlay would be $12m. The project would generate $2m per year over the next 10 years (starting at the beginning of next year). Is this project worthwhile

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts