Question: Can I get help with the wrong ones. Recording Entries for Bonds Sold Between Interest Dates On May 1, 2020, Setup Inc. sold an issue

Can I get help with the wrong ones.

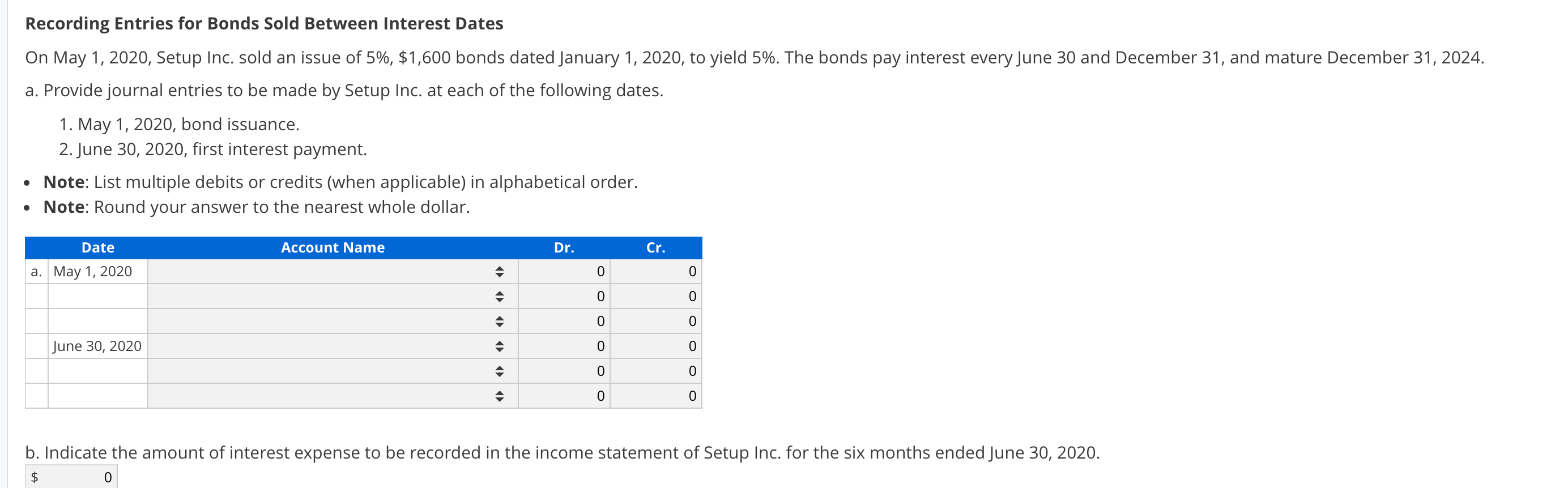

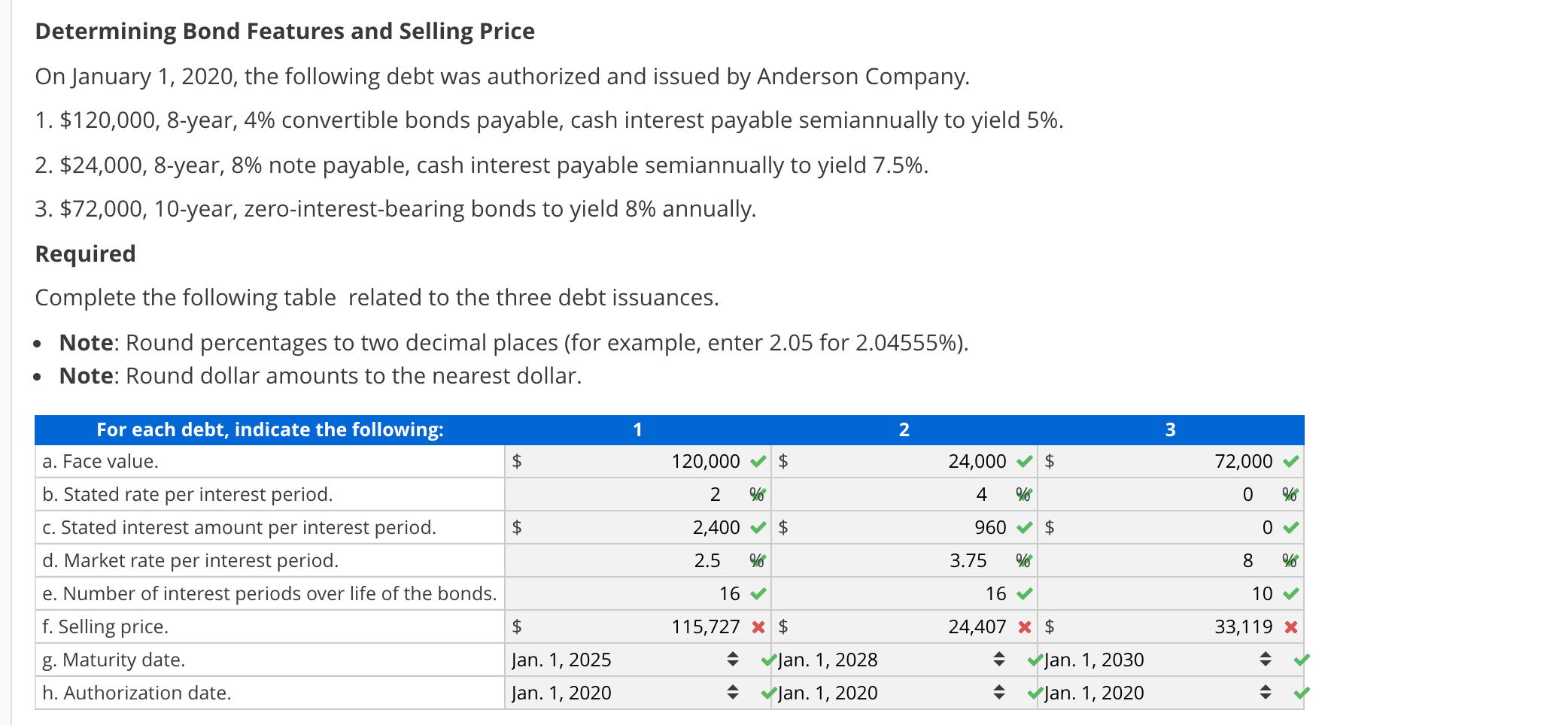

Recording Entries for Bonds Sold Between Interest Dates On May 1, 2020, Setup Inc. sold an issue of 5%, $1,600 bonds dated January 1, 2020, to yield 5%. The bonds pay interest every June 30 and December 31, and mature December 31, 2024. a. Provide journal entries to be made by Setup Inc. at each of the following dates. 1. May 1, 2020, bond issuance. 2. June 30, 2020, first interest payment. Note: List multiple debits or credits (when applicable) in alphabetical order. Note: Round your answer to the nearest whole dollar. Date Account Name Dr. Cr. a. May 1, 2020 A 0 o 0 0 0 0 June 30, 2020 0 0 0 0 0 0 b. Indicate the amount of interest expense to be recorded in the income statement of Setup Inc. for the six months ended June 30, 2020. $ 0 Determining Bond Features and Selling Price On January 1, 2020, the following debt was authorized and issued by Anderson Company. 1. $120,000, 8-year, 4% convertible bonds payable, cash interest payable semiannually to yield 5%. 2. $24,000, 8-year, 8% note payable, cash interest payable semiannually to yield 7.5%. 3. $72,000, 10-year, zero-interest-bearing bonds to yield 8% annually. Required Complete the following table related to the three debt issuances. Note: Round percentages to two decimal places (for example, enter 2.05 for 2.04555%). Note: Round dollar amounts to the nearest dollar. 1 2 3 $ 120,000 24,000 $ 72,000 2 % 4 % 0 % $ 2,400 $ 960 $ 0 For each debt, indicate the following: a. Face value. b. Stated rate per interest period. C. Stated interest amount per interest period. d. Market rate per interest period. e. Number of interest periods over life of the bonds. f. Selling price. g. Maturity date. h. Authorization date. 2.5 % 3.75 % 8 % 16 16 10 $ 115,727 * $ 33,119 X Jan. 1, 2025 Jan. 1, 2020 Jan. 1, 2028 Jan. 1, 2020 24,407 * $ - Jan. 1, 2030 Jan. 1, 2020

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts