Question: can i get help with this case questions ** A FTS2 DHD 1 Normal 1 No Spac... Heading 1 Heading 2 Title Subtitle Subtle Font

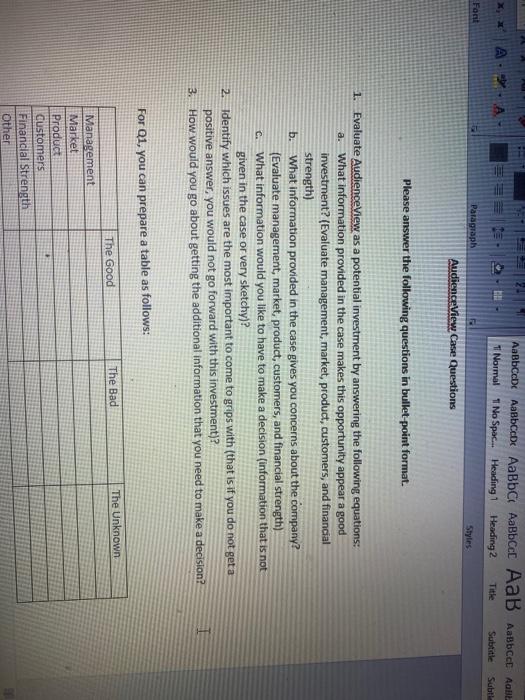

** A FTS2 DHD 1 Normal 1 No Spac... Heading 1 Heading 2 Title Subtitle Subtle Font Paragraph Styles AudienceView Case Questions Please answer the following questions in bullet-point format. 1. Evaluate AudienceView as a potential investment by answering the following equations: a. What information provided in the case makes this opportunity appear a good investment? (Evaluate management, market, product, customers, and financial strength) What information provided in the case gives you concerns about the company (Evaluate management, market, product, customers, and financial strength) What information would you like to have to make a decision (information that is not given in the case or very sketchy)? Identify which issues are the most important to come to grips with (that is if you do not get a positive answer, you would not go forward with this investment)? How would you go about getting the additional information that you need to make a decision? For Q1, you can prepare a table as follows: The Unknown The Good The Bad Management Market Product Customers Financial Strength Other AUDIENCEVIEW Techly Rosenberg wrote this case y lo provide material for class discussion. The autor does not intend to Austratecher effective or ineffective handling of a managerial situation. The author may have disguised certain names and other identifying information to protect considerably Ivey Margement Services prohibits any form of reproduction, storage or transmell without its written permission Reproduction of Jus material is not covered wider thorization by any reproduction rights organization. To order copies or request permission to reproduce materials, contact Ivey Publishing, Ivey Management Services, co Richard Ivey School of Business, The University of Western Ontario, London, Ontario, Canada, NGA 3K7, phone (519) 661-3208, fax (519) 661-3852, e-mail casesevey.uwo.ca Copyright 2007, Ivey Management Services Version (A) 2007-03-13 Robin Axon had an assignment and he wasn't happy about it. As a vice-president of Ventures West (VW). it had fallen to Axon to find a speaker for VW's CEO Event, an annual gathering where the chief executive officers (CEOS) of VW's portfolio companies met for networking and education. But Robin thought he might have found the right speaker in Kevin Kimsa, a co-founder and former chief operating officer (C00 of Solect, a telephone company billing software provider acquired in 2000 by Amdocs for $1.2 billion Surely Kimsa would have good advice for VW's CEOs, and Axon had only to drag Ted Andersen, his managing partner, across the street to meet Kimsa. And so, on January 11, 2005, Axon and Andersen walked across the street to see whether Kimsa would be an appropriate and willing speaker. An hour later, after listening to Kimsa and learning more about his past, especially his current venture, they headed back to their office believing not only had they found their speaker, they might also have stumbled on a company to invest in VENTURES WEST Ventures West was Canada's oldest and one of its most respected venture capital firms, focusing on early stage technology investments. Since its founding in 1968, Ventures West had formed eight venture capital funds totaling more than $700 million, and had invested in more than 130 companies. The company maintained offices in Vancouver, Toronto and Ottawa. THE VENTURE CAPITAL MARKET IN 2005 After several years in the doldrums, following the Intemet and telecommunications boom and bust in the late 1990s to 2000/01, the venture capital muket was starting to perk up. Venture capitalists (VC), who had been struggling with their problem companies coming out of the bust, were past those difficulties and still had a lot of money to invest, courtesy of large funds that had been raised during the boom but had not yet been invested. They were anxious to become active investors again. At the same time, more high quality companies were being formed, but the competition to invest in them was becoming increasingly intense. Ventures West found its best approach was to get in early with a promising company and then stay with it as it grew, increasing the VW stake as necessary and appropriate. In an early stage investment Ventures West liked to see the potential to return 10 times its money. THE FORTUITOUS FIND When Robin Axon and Ted Andersen met Kevin Kimsa, Kimsa was not resting on his considerable Solect laurels. In mid-2002, Kimsa and his Solect co-founder, Paul Atkinson, had founded another company Audience View. This was the company that piqued Axon and Andersen's interest in their meeting with Kimsa. The Ventures West process for considering a potential investment was straightforward. Any professional in the firm could identify a company of interest. It was then necessary to find another senior professional (1.e. a senior vice-president, often referred to as a partner) to co-sponsor the opportunity. Together these deal sponsors would conduct preliminary discussions with the company of interest and then, based on these discussions, and before doing any significant research, they would prepare an "Investment 2-Pager" that was presented to the whole investment team for feedback at the firm's regular Monday meetings During the meeting, the other partners would ask questions, poke holes in the thesis and ultimately decide whether the opportunity warranted a presentation by the company to a larger group of VW professionals. If that meeting went well, VW would proceed to conduct full due diligence, while beginning to think about the structure of the deal under which they might invest. Finally, if due diligence was positive, the deal sponsors would produce a comprehensive investment memo, including terms of the deal, for review by the VW partners, asking for agreement to present a term sheet to the company. But most of that activity was still well in the future for Axon and Audience View With that basic information and a few background checks Axon had done on the founders and a couple of calls to customers, Axon and Andersen were ready to put the company in front of a larger group from Ventures West THE PRESENTATION On March 4, 2005, Kevin Kimsa and Mark Cohon, the president and CEO of AudienceView, walked into the VW board room to make the initial presentation to more of the VW team. The Toronto partners were in the board room, while partners in Ottawa and Vancouver participated via videoconference. This meeting would determine not only whether the deal would proceed to the next stage but would also provide the basis on which Axon (primarily) and Andersen would conduct their due diligence. a presentation to morebident and CEO of Aus on while partners in WHAT NEXT? It was clear from the response during the meeting, that the VW team folt Axon should keep working on Audience View. For Axon, this meant conducting his due diligence and constructing a term sheet By now, Axon had several pieces of information: The PowerPoint presentation made by the company (see Exhibit 1) Biographies of the senior management team (see Exhibit 2) AudienceView's product literature (see Exhibit 3) His own notes from this meeting and a couple of earlier ones with Kimsa and Atkinson (see Exhibit 4) An estimate of the market size (Exhibit 5) In prior discussions with the company, Axon had been able to secure proprietary access to the deal for a limited period of time, which was a major concession on the part of management. Kimsa and Atkinson's previous success at Solect, also a venture-backed company, gave them access to leading VCs in the United States Axon knew if he didn't move fast, Kimsa and Atkinson would move on. With little time, Axon had to set priorities and work quickly. By the next group meeting, he wanted to be able to present his due diligence plan. In addition, he intended to fashion a term sheet, complete with valuation and financing structure on the assumption that Audience View checked out. ** A FTS2 DHD 1 Normal 1 No Spac... Heading 1 Heading 2 Title Subtitle Subtle Font Paragraph Styles AudienceView Case Questions Please answer the following questions in bullet-point format. 1. Evaluate AudienceView as a potential investment by answering the following equations: a. What information provided in the case makes this opportunity appear a good investment? (Evaluate management, market, product, customers, and financial strength) What information provided in the case gives you concerns about the company (Evaluate management, market, product, customers, and financial strength) What information would you like to have to make a decision (information that is not given in the case or very sketchy)? Identify which issues are the most important to come to grips with (that is if you do not get a positive answer, you would not go forward with this investment)? How would you go about getting the additional information that you need to make a decision? For Q1, you can prepare a table as follows: The Unknown The Good The Bad Management Market Product Customers Financial Strength Other AUDIENCEVIEW Techly Rosenberg wrote this case y lo provide material for class discussion. The autor does not intend to Austratecher effective or ineffective handling of a managerial situation. The author may have disguised certain names and other identifying information to protect considerably Ivey Margement Services prohibits any form of reproduction, storage or transmell without its written permission Reproduction of Jus material is not covered wider thorization by any reproduction rights organization. To order copies or request permission to reproduce materials, contact Ivey Publishing, Ivey Management Services, co Richard Ivey School of Business, The University of Western Ontario, London, Ontario, Canada, NGA 3K7, phone (519) 661-3208, fax (519) 661-3852, e-mail casesevey.uwo.ca Copyright 2007, Ivey Management Services Version (A) 2007-03-13 Robin Axon had an assignment and he wasn't happy about it. As a vice-president of Ventures West (VW). it had fallen to Axon to find a speaker for VW's CEO Event, an annual gathering where the chief executive officers (CEOS) of VW's portfolio companies met for networking and education. But Robin thought he might have found the right speaker in Kevin Kimsa, a co-founder and former chief operating officer (C00 of Solect, a telephone company billing software provider acquired in 2000 by Amdocs for $1.2 billion Surely Kimsa would have good advice for VW's CEOs, and Axon had only to drag Ted Andersen, his managing partner, across the street to meet Kimsa. And so, on January 11, 2005, Axon and Andersen walked across the street to see whether Kimsa would be an appropriate and willing speaker. An hour later, after listening to Kimsa and learning more about his past, especially his current venture, they headed back to their office believing not only had they found their speaker, they might also have stumbled on a company to invest in VENTURES WEST Ventures West was Canada's oldest and one of its most respected venture capital firms, focusing on early stage technology investments. Since its founding in 1968, Ventures West had formed eight venture capital funds totaling more than $700 million, and had invested in more than 130 companies. The company maintained offices in Vancouver, Toronto and Ottawa. THE VENTURE CAPITAL MARKET IN 2005 After several years in the doldrums, following the Intemet and telecommunications boom and bust in the late 1990s to 2000/01, the venture capital muket was starting to perk up. Venture capitalists (VC), who had been struggling with their problem companies coming out of the bust, were past those difficulties and still had a lot of money to invest, courtesy of large funds that had been raised during the boom but had not yet been invested. They were anxious to become active investors again. At the same time, more high quality companies were being formed, but the competition to invest in them was becoming increasingly intense. Ventures West found its best approach was to get in early with a promising company and then stay with it as it grew, increasing the VW stake as necessary and appropriate. In an early stage investment Ventures West liked to see the potential to return 10 times its money. THE FORTUITOUS FIND When Robin Axon and Ted Andersen met Kevin Kimsa, Kimsa was not resting on his considerable Solect laurels. In mid-2002, Kimsa and his Solect co-founder, Paul Atkinson, had founded another company Audience View. This was the company that piqued Axon and Andersen's interest in their meeting with Kimsa. The Ventures West process for considering a potential investment was straightforward. Any professional in the firm could identify a company of interest. It was then necessary to find another senior professional (1.e. a senior vice-president, often referred to as a partner) to co-sponsor the opportunity. Together these deal sponsors would conduct preliminary discussions with the company of interest and then, based on these discussions, and before doing any significant research, they would prepare an "Investment 2-Pager" that was presented to the whole investment team for feedback at the firm's regular Monday meetings During the meeting, the other partners would ask questions, poke holes in the thesis and ultimately decide whether the opportunity warranted a presentation by the company to a larger group of VW professionals. If that meeting went well, VW would proceed to conduct full due diligence, while beginning to think about the structure of the deal under which they might invest. Finally, if due diligence was positive, the deal sponsors would produce a comprehensive investment memo, including terms of the deal, for review by the VW partners, asking for agreement to present a term sheet to the company. But most of that activity was still well in the future for Axon and Audience View With that basic information and a few background checks Axon had done on the founders and a couple of calls to customers, Axon and Andersen were ready to put the company in front of a larger group from Ventures West THE PRESENTATION On March 4, 2005, Kevin Kimsa and Mark Cohon, the president and CEO of AudienceView, walked into the VW board room to make the initial presentation to more of the VW team. The Toronto partners were in the board room, while partners in Ottawa and Vancouver participated via videoconference. This meeting would determine not only whether the deal would proceed to the next stage but would also provide the basis on which Axon (primarily) and Andersen would conduct their due diligence. a presentation to morebident and CEO of Aus on while partners in WHAT NEXT? It was clear from the response during the meeting, that the VW team folt Axon should keep working on Audience View. For Axon, this meant conducting his due diligence and constructing a term sheet By now, Axon had several pieces of information: The PowerPoint presentation made by the company (see Exhibit 1) Biographies of the senior management team (see Exhibit 2) AudienceView's product literature (see Exhibit 3) His own notes from this meeting and a couple of earlier ones with Kimsa and Atkinson (see Exhibit 4) An estimate of the market size (Exhibit 5) In prior discussions with the company, Axon had been able to secure proprietary access to the deal for a limited period of time, which was a major concession on the part of management. Kimsa and Atkinson's previous success at Solect, also a venture-backed company, gave them access to leading VCs in the United States Axon knew if he didn't move fast, Kimsa and Atkinson would move on. With little time, Axon had to set priorities and work quickly. By the next group meeting, he wanted to be able to present his due diligence plan. In addition, he intended to fashion a term sheet, complete with valuation and financing structure on the assumption that Audience View checked out

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts