Question: can i get help with this please? You are a shareholder in a C corporation. The corporation earns $1.79 per share before taxes. Once it

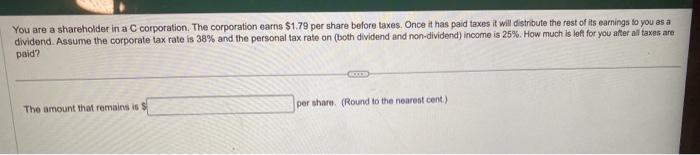

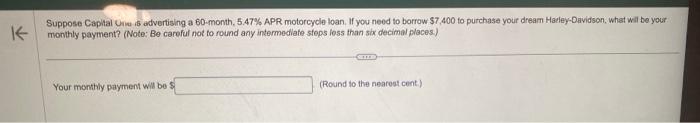

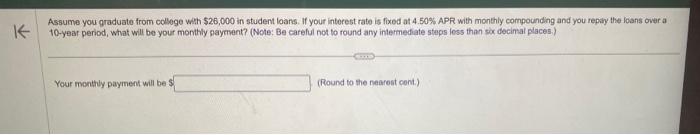

You are a shareholder in a C corporation. The corporation earns $1.79 per share before taxes. Once it has paid taxes it will distribute the rest of its earnings to you as a dividend. Assume the corporate tax rate is 38% and the personal tax rate on (both dividend and non-dividend) income is 25%. How much is lett for you ater al taxes are paid? The amount that remains is 5 per share. (Round to the nearest cent.) Suppose Capital Uive i6 advertising a 60-month, 5.47% APR motorcycle loan. If you need to borrow $7,400 to purchase your dream Hatey-Davidson, What wil be your monthly payment? (Note: Be careful not to round any intermedlate steps less than six decimal places) Your montinly payment will be 5 (Round to the nearest cent) Assume you graduate from colloge whth $26,000 in student loans. If your interest rate is fixed at 4.50% APR with monthly compounding and you repiny the loans over a 10-year period, what will bo your monthly payment? (Note: Be careful not to round any intermefiate steps less than six decimal places,) Your monthly payment will be s (Round to the nearest cent.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts