Question: can I get help with this problem? I feel confident I'm supposed to be using the 1040SR form and I've attempted fill out the form

can I get help with this problem? I feel confident I'm supposed to be using the 1040SR form and I've attempted fill out the form but I'm struggling. I don't feel in filling in all the correct information.

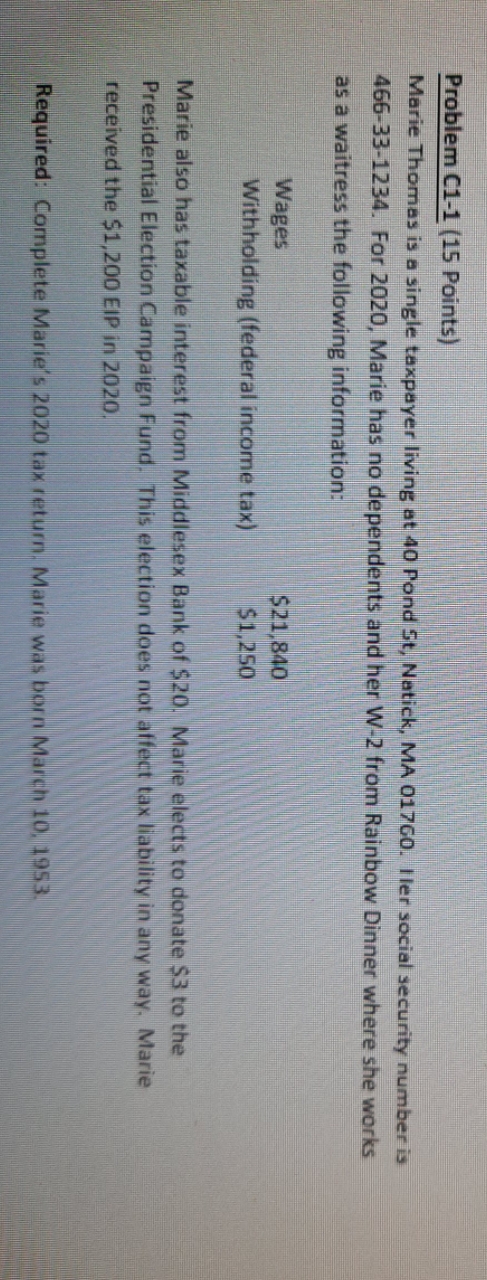

Problem C1-1 (15 Points) Marie Thomas is a single taxpayer living at 40 Pond St, Natick, MA 017GO. ller social security number is 466-33-1234. For 2020. Marie has no dependents and her W-2 from Rainbow Dinner where she works as a waitress the following information: Wages $21.840 Withholding (federal income tax) $1,250 Marie also has taxable interest from Middlesex Bank of $20. Marie elects to donate $3 to the Presidential Election Campaign Fund. This election does not affect tax liability in any way, Marie received the $1,200 EIP in 2020. Required: Complete Marie's 2020 tax return. Marie was born March 10, 1953

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts