Question: Can I get help with this question.... QUESTION 2 - FINANCIAL STATEMENT ANALYSIS (33 MARKS) Presented below are the recently issued (summarised) financial statements of

Can I get help with this question....

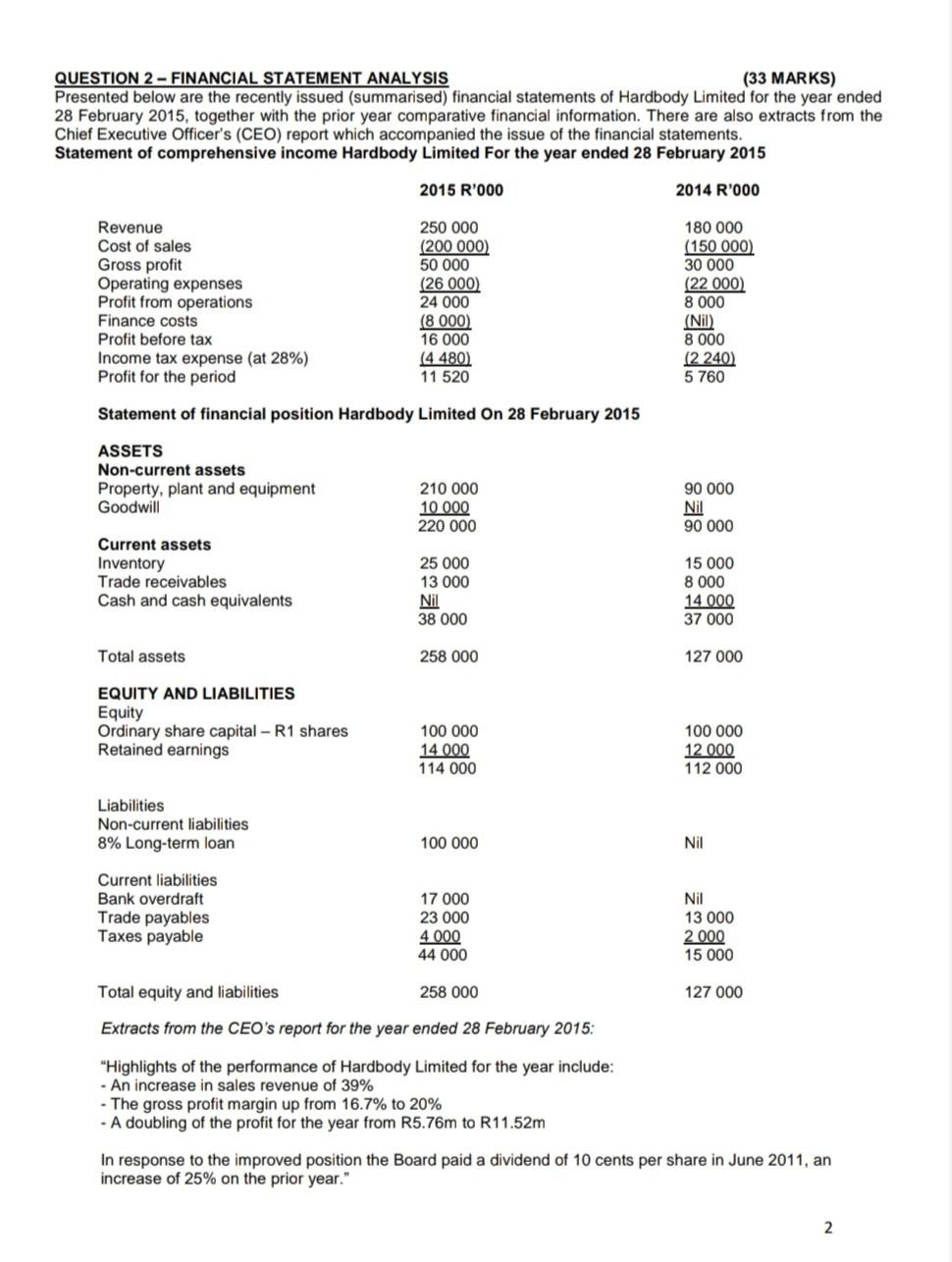

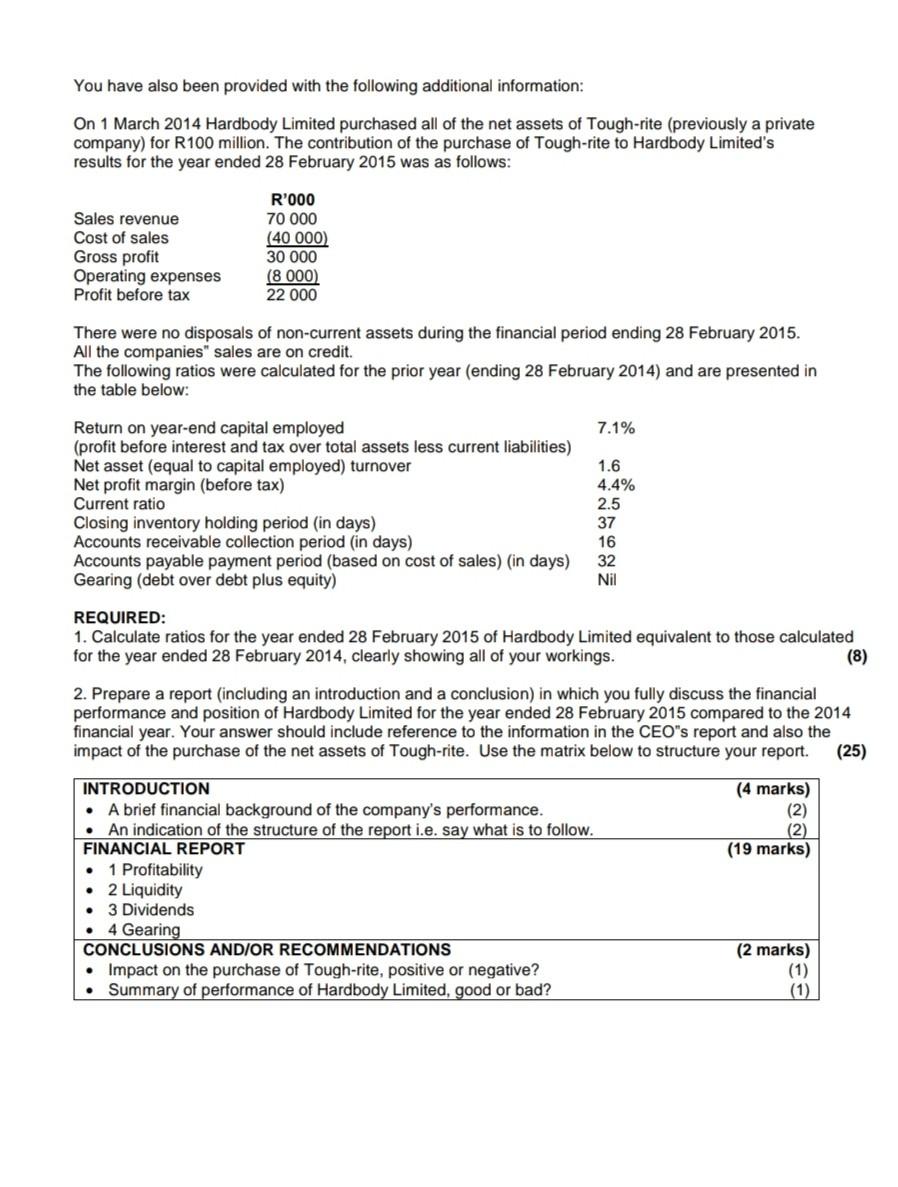

QUESTION 2 - FINANCIAL STATEMENT ANALYSIS (33 MARKS) Presented below are the recently issued (summarised) financial statements of Hardbody Limited for the year ended 28 February 2015, together with the prior year comparative financial information. There are also extracts from the Chief Executive Officer's (CEO) report which accompanied the issue of the financial statements. Statement of comprehensive income Hardbody Limited For the year ended 28 February 2015 2015 R'000 2014 R'000 Revenue Cost of sales Gross profit Operating expenses Profit from operations Finance costs Profit before tax Income tax expense (at 28%) Profit for the period 250 000 (200 000) 50 000 (26 000) 24 000 (8 000) 16 000 (4.480) 11 520 180 000 (150 000) 30 000 (22 000) 8 000 (Nil) 8 000 (2 240) 5 760 Statement of financial position Hardbody Limited On 28 February 2015 ASSETS Non-current assets Property, plant and equipment Goodwill 210 000 10 000 220 000 90 000 Nil 90 000 15 000 Current assets Inventory Trade receivables Cash and cash equivalents 25 000 13 000 Nil 38 000 8 000 14 000 37 000 Total assets 258 000 127 000 EQUITY AND LIABILITIES Equity Ordinary share capital - R1 shares Retained earnings 100 000 14 000 114 000 100 000 12 000 112 000 Liabilities Non-current liabilities 8% Long-term loan 100 000 Nil Current liabilities Bank overdraft Trade payables Taxes payable 17 000 23 000 4000 44 000 Nil 13 000 2000 15 000 Total equity and liabilities 258 000 127 000 Extracts from the CEO's report for the year ended 28 February 2015: "Highlights of the performance of Hardbody Limited for the year include: - An increase in sales revenue of 39% - The gross profit margin up from 16.7% to 20% - A doubling of the profit for the year from R5.76m to R11.52m In response to the improved position the Board paid a dividend of 10 cents per share in June 2011, an increase of 25% on the prior year." 2 You have also been provided with the following additional information: On 1 March 2014 Hardbody Limited purchased all of the net assets of Tough-rite (previously a private company) for R100 million. The contribution of the purchase of Tough-rite to Hardbody Limited's results for the year ended 28 February 2015 was as follows: Sales revenue Cost of sales Gross profit Operating expenses Profit before tax R'000 70 000 (40 000) 30 000 (8 000) 22 000 There were no disposals of non-current assets during the financial period ending 28 February 2015. All the companies" sales are on credit. The following ratios were calculated for the prior year (ending 28 February 2014) and are presented in the table below: 7.1% Return on year-end capital employed (profit before interest and tax over total assets less current liabilities) Net asset (equal to capital employed) turnover Net profit margin (before tax) Current ratio Closing inventory holding period (in days) Accounts receivable collection period (in days) Accounts payable payment period (based on cost of sales) (in days) Gearing (debt over debt plus equity) 1.6 4.4% 2.5 37 16 32 Nil REQUIRED: 1. Calculate ratios for the year ended 28 February 2015 of Hardbody Limited equivalent to those calculated for the year ended 28 February 2014, clearly showing all of your workings. (8) 2. Prepare a report (including an introduction and a conclusion) in which you fully discuss the financial performance and position of Hardbody Limited for the year ended 28 February 2015 compared to the 2014 financial year. Your answer should include reference to the information in the CEO's report and also the impact of the purchase of the net assets of Tough-rite. Use the matrix below to structure your report. (25) (4 marks) (2) (2) (19 marks) . INTRODUCTION A brief financial background of the company's performance. An indication of the structure of the report i.e. say what is to follow. FINANCIAL REPORT 1 Profitability 2 Liquidity 3 Dividends 4 Gearing CONCLUSIONS AND/OR RECOMMENDATIONS Impact on the purchase of Tough-rite, positive or negative? Summary of performance of Hardbody Limited, good or bad? (2 marks) (1) (1)Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock