Question: can i get help with two questions CAPM is confusing Fair Financial Group is planning to make an equity investment in PayPal Inc. You estimate

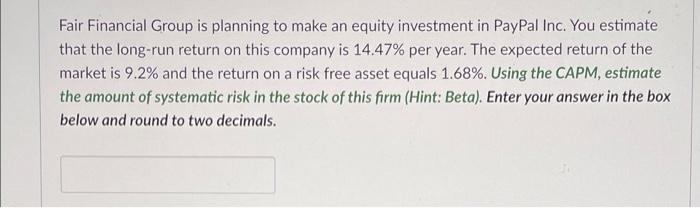

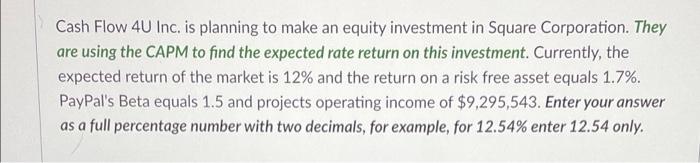

Fair Financial Group is planning to make an equity investment in PayPal Inc. You estimate that the long-run return on this company is 14.47% per year. The expected return of the market is 9.2% and the return on a risk free asset equals 1.68%. Using the CAPM, estimate the amount of systematic risk in the stock of this firm (Hint: Beta). Enter your answer in the box below and round to two decimals. Cash Flow 4U Inc. is planning to make an equity investment in Square Corporation. They are using the CAPM to find the expected rate return on this investment. Currently, the expected return of the market is 12% and the return on a risk free asset equals 1.7%. PayPal's Beta equals 1.5 and projects operating income of $9,295,543. Enter your answer as a full percentage number with two decimals, for example, for 12.54% enter 12.54 only

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts