Question: can i get solution for this Question 5 09 View Policies Current Attempt in Progress Sandhill Company has accounts receivable of $184,000 at September 30,

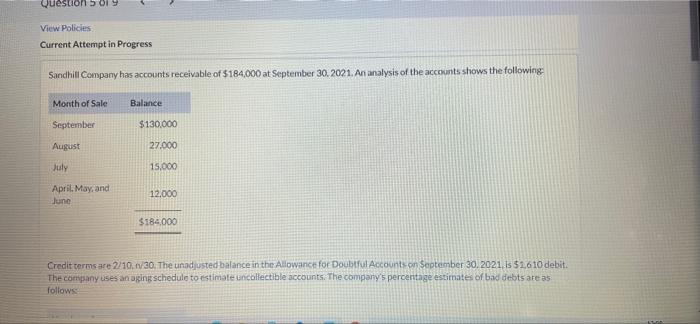

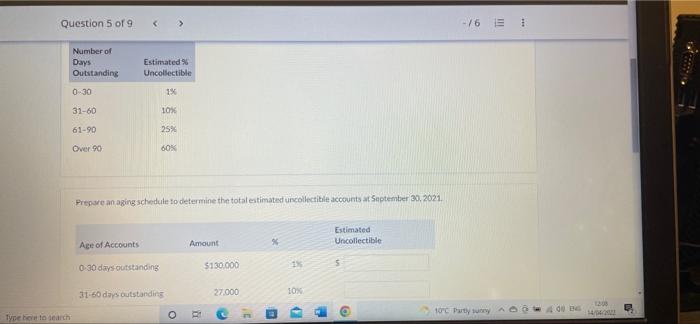

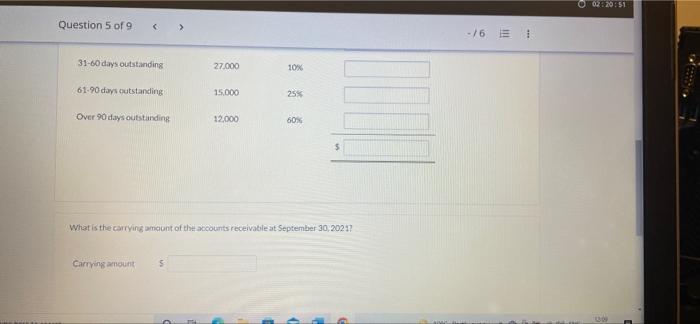

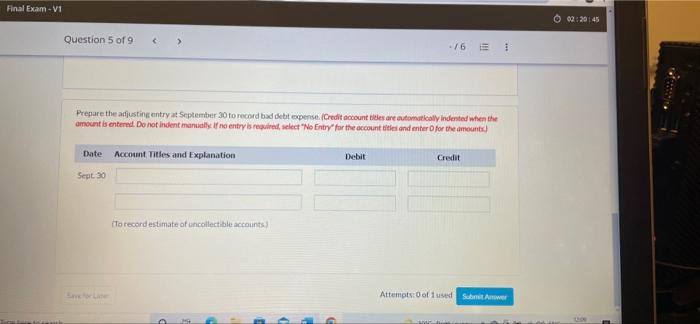

Question 5 09 View Policies Current Attempt in Progress Sandhill Company has accounts receivable of $184,000 at September 30, 2021. An analysis of the accounts shows the following Month of Sale Balance September $130,000 August 27.000 July 15,000 April, May, and June 12.000 $184,000 Credit terms are 2/10.1730. The unadjusted balance in the Allowance for Doubtful Accounts on September 30, 2021, is 51,610 debit. The company uses an aging schedule to estimate incollectible accounts. The company 5 percentage estimates of bad debts are as follows Question 5 of 9 > -76 Number of Days Outstanding Estimated Uncollectible 0-30 1% 31-60 10% 61-90 25% Over 90 60% Prepare an aging schedule to determine the total estimated uncollectible accounts at September 30, 2021 Estimated Uncollectible Ace of Accounts Amount 0 30 days outstanding $130.000 18 31-60 days outstanding 27.000 SOX 100 Partly sunny O DUBE 14 Type here to search O 02:20:51 Question 5 of 9 - /6 31-60 days outstanding 27.000 10% 61-90 days outstanding 15.000 25 Over 90 days outstanding 12.000 60% 5 What is the carrying amount of the accounts receivable at September 30,2027 Carrying amount 5 Final Exam - VI O 02:20:45 Question 5 of 9 > -76 E 1 Prepare the adjusting entry at September 30 to record bad debit expense. (Credit accounts are automatically indented when the amount is enter. Do not indent manual i no entry is required, select "No Entry for the account title and enter for the amounts) Date Account Tities and Explanation Debit Credit Seat 30 To record estimate of uncollectible accounts Smetor Line Attempts of used Subm 2 C

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts