Question: CAN I GET SOME HELP ON THIS PROBLEM, PLEASE? Sheridan Inc. has been producing basketballs, volleyballs, soccer balls, and footballs for many years. Its manager,

CAN I GET SOME HELP ON THIS PROBLEM, PLEASE?

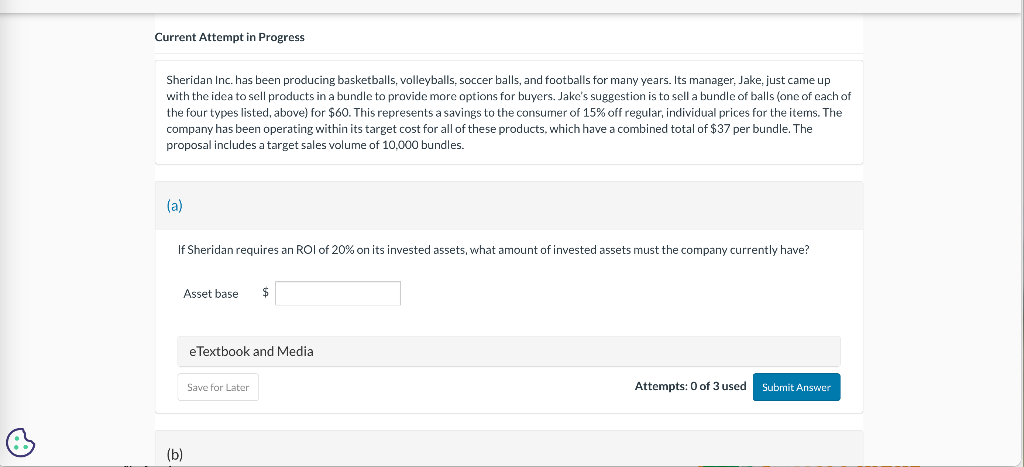

Sheridan Inc. has been producing basketballs, volleyballs, soccer balls, and footballs for many years. Its manager, Jake, just came up with the idea to sell products in a bundle to provide more options for buyers. Jake's suggestion is to sell a bundle of balls (one of each of the four types listed, above) for $60. This represents a savings to the consumer of 15% off regular, individual prices for the items. The company has been operating within its target cost for all of these products, which have a combined total of $37 per bundle. The proposal includes a target sales volume of 10,000 bundles. (a) If Sheridan requires an ROI of 20% on its invested assets, what amount of invested assets must the company currently have? Asset base

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts