Question: Can I get some help on this problem? Tax Drill - Tests for Qualifying Relative Complete the following statements regarding the gross income and support

Can I get some help on this problem?

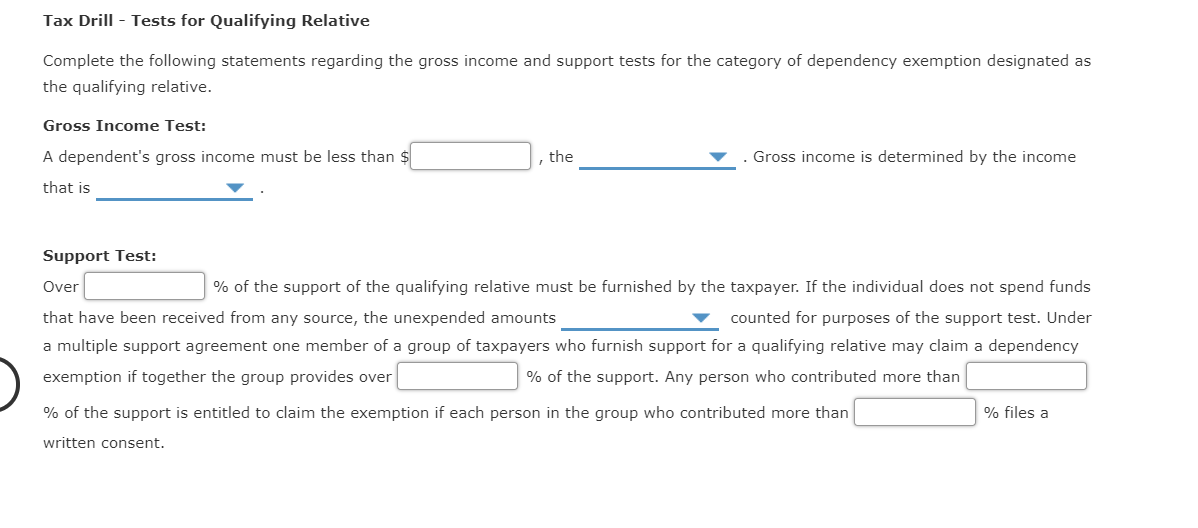

Tax Drill - Tests for Qualifying Relative Complete the following statements regarding the gross income and support tests for the category of dependency exemption designated as the qualifying relative. Gross Income Test: A dependent's gross income must be less than $ that is , the . Gross income is determined by the income Support Test: Over % of the support of the qualifying relative must be furnished by the taxpayer. If the individual does not spend funds that have been received from any source, the unexpended amounts counted for purposes of the support test. Under a multiple support agreement one member of a group of taxpayers who furnish support for a qualifying relative may claim a dependency exemption if together the group provides over % of the support. Any person who contributed more than % of the support is entitled to claim the exemption if each person in the group who contributed more than % files a written consent

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts