Question: can i get some help please Question Red Stripe Ltd produces a single product at a variable cost per unit as follows: s 24 Direct

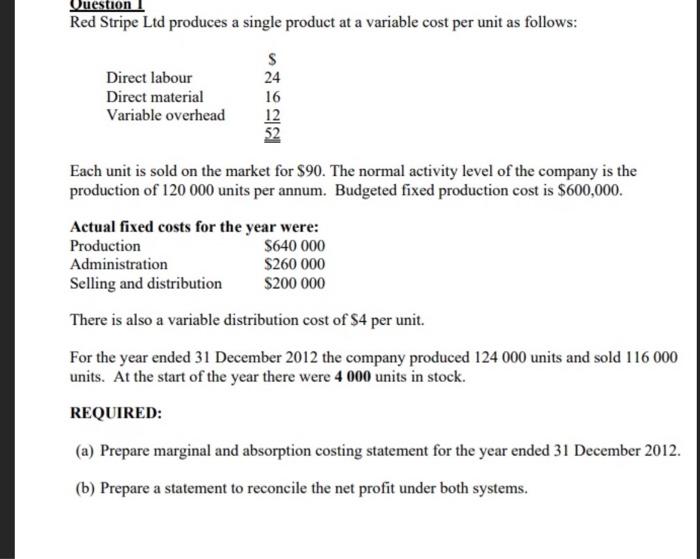

Question Red Stripe Ltd produces a single product at a variable cost per unit as follows: s 24 Direct labour Direct material Variable overhead 16 12 52 Each unit is sold on the market for $90. The normal activity level of the company is the production of 120 000 units per annum. Budgeted fixed production cost is $600,000. Actual fixed costs for the year were: Production $640 000 Administration $260 000 Selling and distribution $200 000 There is also a variable distribution cost of $4 per unit. For the year ended 31 December 2012 the company produced 124 000 units and sold 116 000 units. At the start of the year there were 4 000 units in stock. REQUIRED: (a) Prepare marginal and absorption costing statement for the year ended 31 December 2012. (b) Prepare a statement to reconcile the net profit under both systems

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts