Question: can i get some help pls INTRODUCTION Trading SA (TSA) is a commercial company dedicated to the import and commercialization of industrial machinery in Spain.

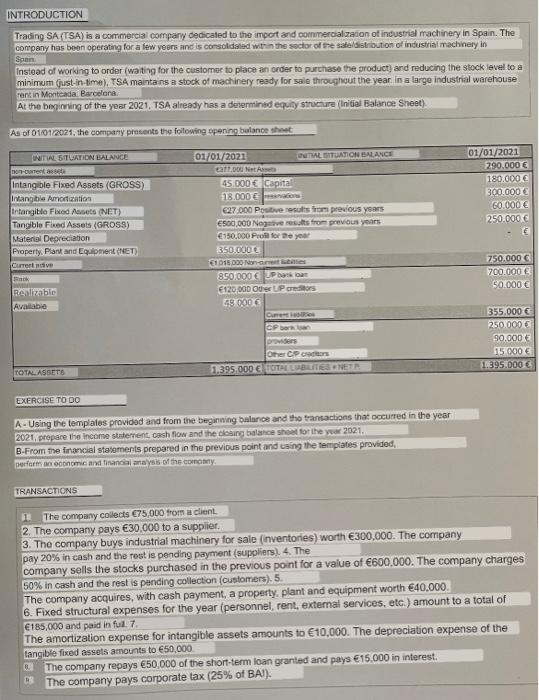

INTRODUCTION Trading SA (TSA) is a commercial company dedicated to the import and commercialization of industrial machinery in Spain. The company has been operating for a few years and is consolidated within the sector of the sale/distribution of industrial machinery in Spain Instead of working to order (waiting for the customer to place an order to purchase the product) and reducing the stock level to a minimum (just-in-time), TSA maintains a stock of machinery ready for sale throughout the year in a large industrial warehouse rent in Montcada Barcelona. At the beginning of the year 2021, TSA already has a determined equity structure (Initial Balance Sheet). As of 01/01/2021, the company presents the following opening balance sheet INITIAL SITUATION BALANCE 01/01/2021 non-current set Intangible Fixed Assets (GROSS) Intangible Amortization Intangible Fixed Assets (NET) Tangible Fixed Assets (GROSS) Material Depreciation Property, Plant and Equipment (NET) Current adve Back Realizable Available TOTAL ASSETS EXERCISE TO DO INITIAL SITUATION BALANCE TRANSACTIONS 377,000 Net Asell 45.000 Capital 18.000ations 27,000 Positive results from previous years 500,000 Negative results from previous years 150,000 Pro for the year 350.000 1018,000 Non-aret lubilles 850.000 UP bank loan 120,000 Other LP creditors 48.000 Current iss CF bark toan providers Other CP creditors 1.395.000 TOTAL LIABILITIES NETA A-Using the templates provided and from the beginning balance and the transactions that occurred in the year 21, prepare the income statement, cash flow and the closing balance sheet for the year 2021, B-From the financial statements prepared in the previous point and using the templates provided, perform an economic and financial analysis of the company. 11 The company collects 75,000 from a client. 2. The company pays 30,000 to a supplier. 3. The company buys industrial machinery for sale (inventories) worth 300,000. The company pay 20% in cash and the rest is pending payment (suppliers). 4. The 01/01/2021 290.000 180.000 300.000 60.000 250.000 8. The company repays 50,000 of the short-term loan granted and pays 15.000 in interest. The company pays corporate tax (25% of BAI). 750.000 700.000 50.000 355.000 250.000 90.000 15.000 1.395.000 company sells the stocks purchased in the previous point for a value of 600,000. The company charges 50% in cash and the rest is pending collection (customers). 5. The company acquires, with cash payment, a property, plant and equipment worth 40,000. 6. Fixed structural expenses for the year (personnel, rent, external services, etc.) amount to a total of 185,000 and paid in full. 7. The amortization expense for intangible assets amounts to 10,000. The depreciation expense of the tangible fixed assets amounts to 50,000 INTRODUCTION Trading SA (TSA) is a commercial company dedicated to the import and commercialization of industrial machinery in Spain. The company has been operating for a few years and is consolidated within the sector of the sale/distribution of industrial machinery in Spain Instead of working to order (waiting for the customer to place an order to purchase the product) and reducing the stock level to a minimum (just-in-time), TSA maintains a stock of machinery ready for sale throughout the year in a large industrial warehouse rent in Montcada Barcelona. At the beginning of the year 2021, TSA already has a determined equity structure (Initial Balance Sheet). As of 01/01/2021, the company presents the following opening balance sheet INITIAL SITUATION BALANCE 01/01/2021 non-current set Intangible Fixed Assets (GROSS) Intangible Amortization Intangible Fixed Assets (NET) Tangible Fixed Assets (GROSS) Material Depreciation Property, Plant and Equipment (NET) Current adve Back Realizable Available TOTAL ASSETS EXERCISE TO DO INITIAL SITUATION BALANCE TRANSACTIONS 377,000 Net Asell 45.000 Capital 18.000ations 27,000 Positive results from previous years 500,000 Negative results from previous years 150,000 Pro for the year 350.000 1018,000 Non-aret lubilles 850.000 UP bank loan 120,000 Other LP creditors 48.000 Current iss CF bark toan providers Other CP creditors 1.395.000 TOTAL LIABILITIES NETA A-Using the templates provided and from the beginning balance and the transactions that occurred in the year 21, prepare the income statement, cash flow and the closing balance sheet for the year 2021, B-From the financial statements prepared in the previous point and using the templates provided, perform an economic and financial analysis of the company. 11 The company collects 75,000 from a client. 2. The company pays 30,000 to a supplier. 3. The company buys industrial machinery for sale (inventories) worth 300,000. The company pay 20% in cash and the rest is pending payment (suppliers). 4. The 01/01/2021 290.000 180.000 300.000 60.000 250.000 8. The company repays 50,000 of the short-term loan granted and pays 15.000 in interest. The company pays corporate tax (25% of BAI). 750.000 700.000 50.000 355.000 250.000 90.000 15.000 1.395.000 company sells the stocks purchased in the previous point for a value of 600,000. The company charges 50% in cash and the rest is pending collection (customers). 5. The company acquires, with cash payment, a property, plant and equipment worth 40,000. 6. Fixed structural expenses for the year (personnel, rent, external services, etc.) amount to a total of 185,000 and paid in full. 7. The amortization expense for intangible assets amounts to 10,000. The depreciation expense of the tangible fixed assets amounts to 50,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts