Question: Can I get some help with the chapter 12 comprehensive review problem. I am stuck preparing the general journals. Its the CH 12 comprehensive problem

Can I get some help with the chapter 12 comprehensive review problem. I am stuck preparing the general journals. Its the CH 12 comprehensive problem for College Accounting, A career aproach 13e List of Accounts are as follows:

Assets:

111 Cash

112 Petty Cash Fund

113 Accounts Receivable

114 Merchandise Inventory

116 Supplies

118 Prepaid Insurance

122 Equipment

123 Accumulated Depreciation

Liabilities:

221 Accounts Payable

226 Employees Income Tax payable

227 Fica social security tax payable

228 fica medicare tax payable

229 state unemployment tax payable

230 federal unemployment tax payable

231 salaries payable

Owner's Equity:

311 M.L Langdon, capital

312 M.L.Langdon, drawing

313 Income summary

Revenue:

411 Sales

412 Sales returns and allowances

Cost of goods:

511 Purchases

512 Purchases returns and allowances

513 purchases discounts

514 freight in

Expenses:

611 sakarues expense

612 payroll expense

613 rent

614 utilities

616supplies

617 insurance expense

618 depreication, equipment

619 miscellaneous expense

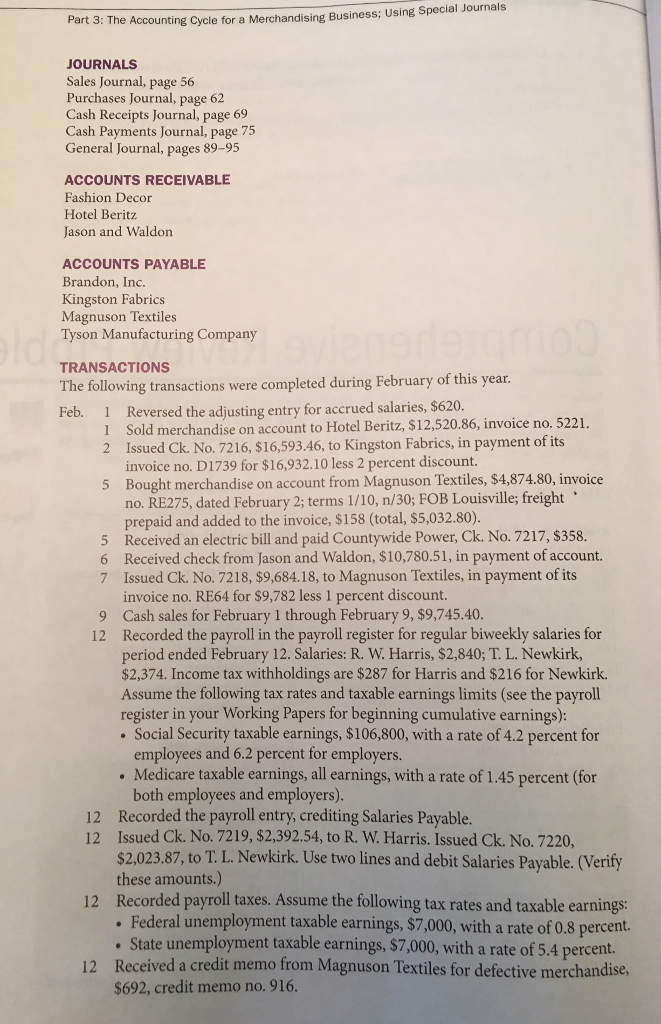

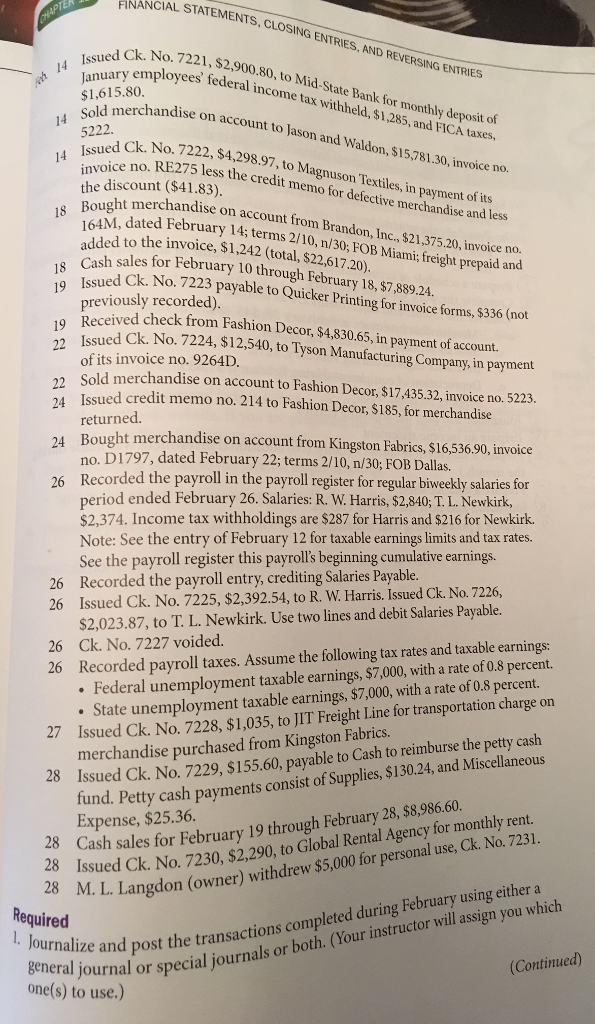

CIAL STATEMENTS, CLOSING ENTRIES, AND REVERSING ENTRIES No. 7221, $2,900.80, to Mid-State Bank for monthl ued Ck. No. 7221, $2,900.8 employees federal income tax withheld, $1,285, and FICA taxes. erchandise on account to lason and Waldon, $15,781.30, invoice no No. 7222, $4,298.97, to Magnuson Textiles, in payment of its $1,615.80 y deposit oft 14 Sold 5222 14 275 less the credit memo for defective merchandise and less the discount ($41.83) 18 unt trom Brandon, Inc.,$21,375.20, invoice no. Miami; freight prepaid and Issued Ck. No. 7223 payable to Quicker Printing for invoice forms, $336 (not 164M, dated February 14, terms 2/10, n/30, FOB M added to the invoice, S1,242 (total, $22,617.20). aash sales for February 10 through February 18, $7,889.24. 18 previously recorded) ceived check from Fashion Decor, $4,830.65, in payment of account ued Ck. No. 7224, $12,540, to lyson Manufacturing Company, in payment of its invoice no. 9264D 2Sold merchandise on account to Fashion Decor, $17,435.32, invoice no. 5223 4 Issued credit memo no. 214 to Fashion Decor, $185, for merchandise returned. Bought merchandise on account from Kingston Fabrics, $16,536.90, invoice no. D1797, dated February 22; terms 2/10, n/30; FOB Dallas Recorded the payroll in the payroll register for regular biweekly salaries for period ended February 26. Salaries: R. W. Harris, $2,840; T. L. Newkirk, $2,374. Income tax withholdings are $287 for Harris and $216 for Newkirk. Note: See the entry of February 12 for taxable earnings limits and tax rates. See the payroll register this payroll's beginning cumulative earnings Recorded the payroll entry, crediting Salaries Payabl Issued Ck. No. 7225, $2,392.54, to R. W. Harris. Issued Ck. No. 7226, $2,023.87, to T. L. Newkirk. Use two lines and debit Salaries Payable. 26 26 26 26 Ck. No. 7227 voided. 26 Recorded payroll taxes. Assume the following tax rates and taxable earnings: . Federal unemployment taxable earnings, $7,000, with a rate of 0.8 percent. State unemployment taxable earnings, $7,000, with a rate of 0.8 percent. Issued Ck. No.7228, $1,035, to JIT Freight Line for transportation charge on merchandise purchased from Kingston Fabrics Issued Ck. No. 7229, $155.60, payable to Cash to reimburse the petty cash tund. Petty cash payments consist of Supplies, $130.24, and Miscellaneous Expense, $25.36 27 8 Cash sales for February 19 through February 28, $8.986.60. 2 Issued Ck.No. 7230, $2,290, to Global Rental Agency for monthly rent. $5,000 for personal use, Ck. No. 7231 M. L. Langdon (owner) withdrew Required nd post the transactions completed during February using either a (Continued) al or special journals or both. (Your instructor will assign you which one(s) to use.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts