Question: Can i get some help with these 3 question. show me the steps plz. Cost of Capital: Weighted Average Cost of Capital The firm's target

Can i get some help with these 3 question. show me the steps plz.

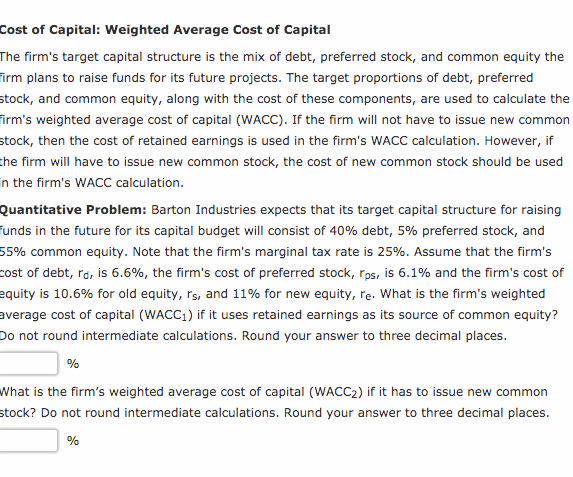

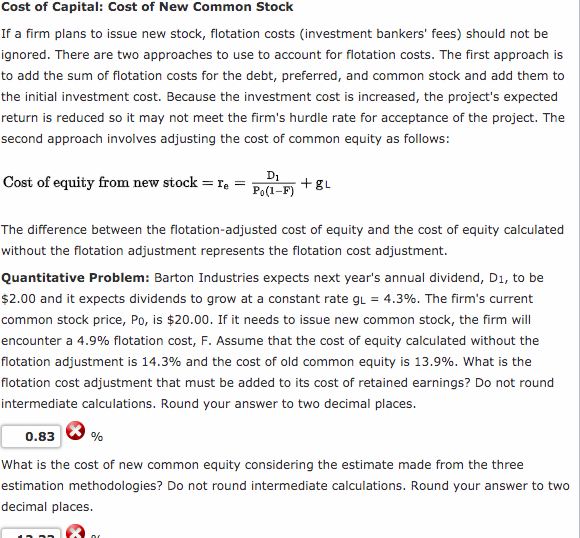

Cost of Capital: Weighted Average Cost of Capital The firm's target capital structure is the mix of debt, preferred stock, and common equity the Firm plans to raise funds for its future projects. The target proportions of debt, preferred stock, and common equity, along with the cost of these components, are used to calculate the Firm's weighted average cost of capital (WACC). If the firm will not have to issue new common stock, then the cost of retained earnings is used in the firm's WACC calculation. However, if the firm will have to issue new common stock, the cost of new common stock should be used in the firm's WACC calculation. Quantitative Problem: Barton Industries expects that its target capital structure for raising Funds in the future for its capital budget will consist of 40% debt, 5% preferred stock, and 55% common equity. Note that the firm's marginal tax rate is 25%. Assume that the firm's cost of debt, rd, is 6.6%, the firm's cost of preferred stock, Pos, is 6.1% and the firm's cost of equity is 10.6% for old equity, Is, and 11% for new equity, re. What is the firm's weighted average cost of capital (WACC) if it uses retained earnings as its source of common equity? Do not round intermediate calculations. Round your answer to three decimal places. % what is the firm's weighted average cost of capital (WACC2) if it has to issue new common stock? Do not round intermediate calculations. Round your answer to three decimal places. Cost of Capital: Cost of New Common Stock If a firm plans to issue new stock, flotation costs (investment bankers' fees) should not be ignored. There are two approaches to use to account for flotation costs. The first approach is to add the sum of flotation costs for the debt, preferred, and common stock and add them to the initial investment cost. Because the investment cost is increased, the project's expected return is reduced so it may not meet the firm's hurdle rate for acceptance of the project. The second approach involves adjusting the cost of common equity as follows Cost of equity from new stock = re = m +gL The difference between the flotation-adjusted cost of equity and the cost of equity calculated without the flotation adjustment represents the flotation cost adjustment. Quantitative Problem: Barton Industries expects next year's annual dividend, Di, to be $2.00 and it expects dividends to grow at a constant rate gL = 4.3%. The firm's current k price, Po, is $20.00. If it needs to issue new common stock, the firm will encounter a 4.9% flotation cost, F. Assume that the cost of equity calculated without the flotation adjustment is 14.3% and the cost of old common equity is 13.9%. What is the flotation cost adjustment that must be added to its cost of retained earnings? Do not round intermediate calculations. Round your answer to two decimal places. 0.83 % What is the cost of new common equity considering the estimate made from the three estimation methodologies? Do not round intermediate calculations. Round your answer to two decimal places. 22 Cost of Equity: CAPM Booher Book Stores has a beta of 0.8. The yield on a 3-month T-bill is 5% and the yield on a 10-year T-bond is 7%. The market risk premium is 7.5%, and the return on an average stock in the market last year was 14%. What is the estimated cost of common equity using the CAPM? Round your answer to two decimal places. 1.21 %

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts