Question: can i get some help with this as soon as possible please The managers of Daytona Inc. currently employ a policy of marginal costing system,

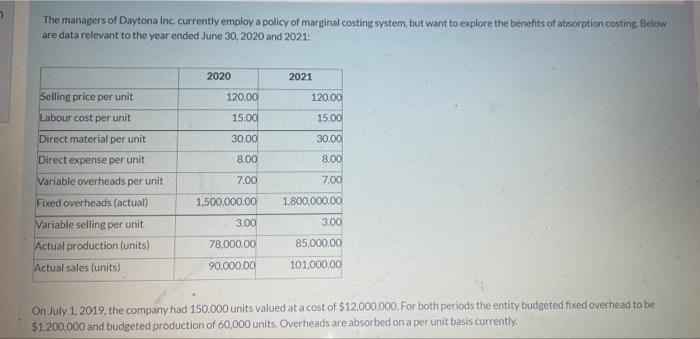

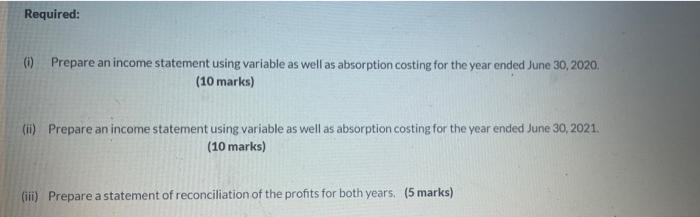

The managers of Daytona Inc. currently employ a policy of marginal costing system, but want to explore the benefits of absorption costing Below are data relevant to the year ended June 30, 2020 and 2021 2020 2021 Selling price per unit 120.00 120.00 Labour cost per unit 15.00 15.00 30,00 30.00 8.00 8.00 7.00 Direct material per unit Direct expense per unit Variable overheads per unit Fixed overheads (actual) Variable selling per unit Actual production (units) Actual sales (units) 7.00 1,500,000.00 1,800,000.00 3.00 3.00 78,000.00 85,000.00 90,000.00 101,000.00 On July 1, 2019, the company had 150.000 units valued at a cost of $12,000,000. For both periods the entity budgeted fixed overhead to be $1.200,000 and budgeted production of 60,000 units. Overheads are absorbed on a per unit basis currently, Required: 0 Prepare an income statement using variable as well as absorption costing for the year ended June 30, 2020, (10 marks) (m) Prepare an income statement using variable as well as absorption costing for the year ended June 30, 2021. (10 marks) (iii) Prepare a statement of reconciliation of the profits for both years

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts