Question: can i get some help with this please its intermediate accounting and its due in 2 hours Halifax Manufacturing allows its customers to return merchandise

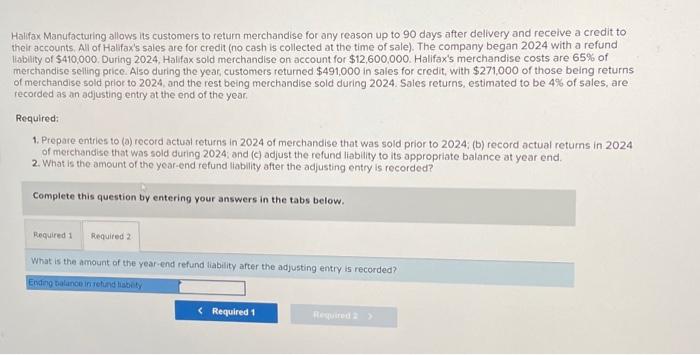

Halifax Manufacturing allows its customers to return merchandise for any reason up to 90 days after delivery and receive a credit to their accounts. All of Halfax's sales are for credit (no cash is collected at the time of sale). The company began 2024 with a refund liability of $410,000. During 2024, Halfax sold merchandise on account for $12,600,000. Halifax's merchandise costs are 65% of merchandise selling price. Also during the year, customers returned $491,000 in sales for credit, with $271,000 of those being returns of merchandise sold prior to 2024, and the rest being merchandise sold during 2024. Sales returns, estimated to be 4% of sales, are recorded as an adjusting entry at the end of the year. Required: 1. Prepare entries to (o) record actual returns in 2024 of merchandise that was sold prior to 2024: (b) record actual returns in 2024 of merchandise that was sold during 2024; and (c) adjust the refund liability to its appropriate balance at year end. 2. What is the amount of the year-end refund liability after the adjusting entry is recorded? Complete this question by entering your answers in the tabs below. What is the amount of the year-end refund liability after the adjusting entry is recorded

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts