Question: Can I get some help with this practice question Question 8. lCapital Gains Tax. During 2019, Taylor sells two capital assets The rst results 11110103.

Can I get some help with this practice question

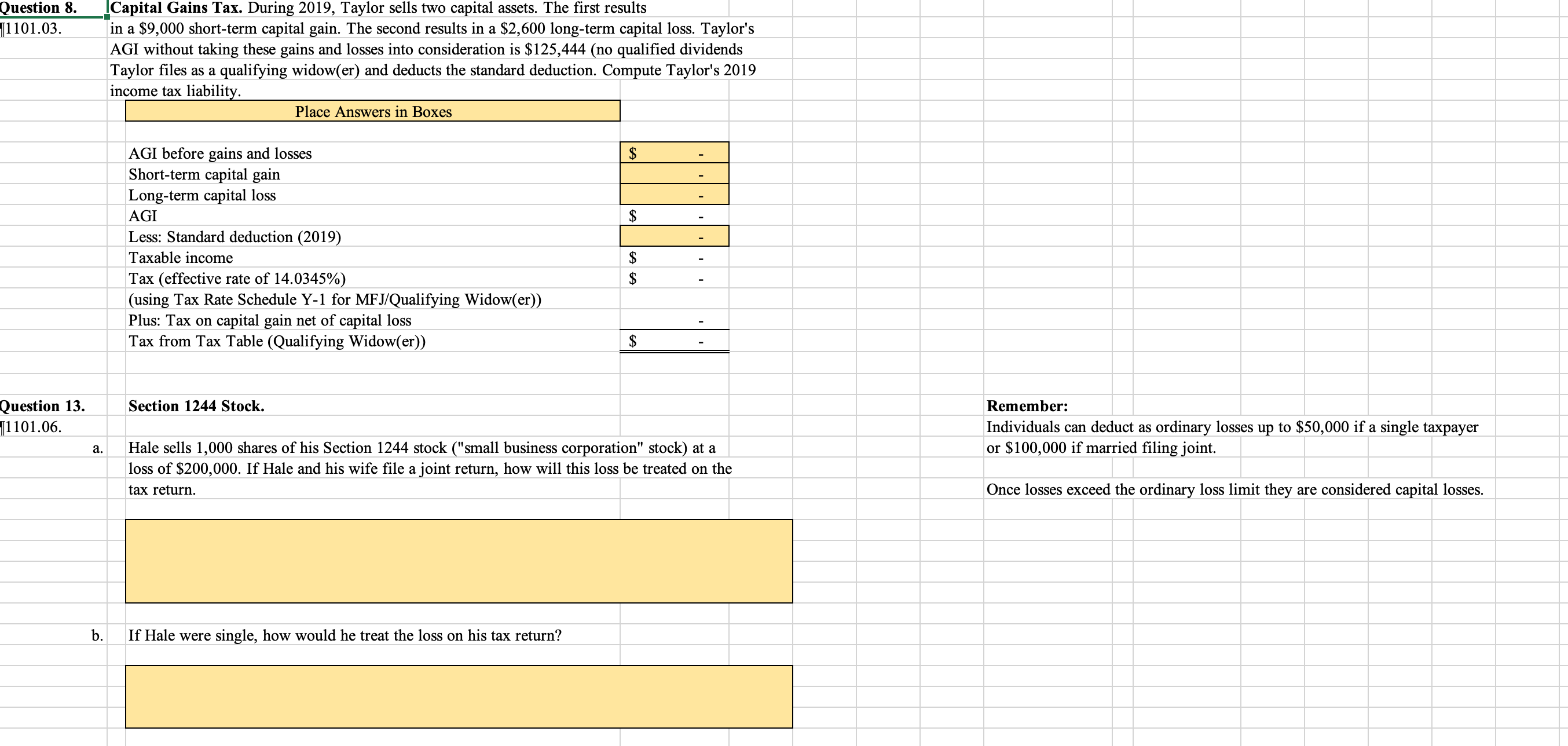

Question 8. lCapital Gains Tax. During 2019, Taylor sells two capital assets The rst results 11110103. in a $9,000 shortterm capital gain, The second results in a $2,600 long-term capital loss Taylor's AGI without taking these gains and losses into consideration is $125,444 (no qualied dividends Taylor les as a qualifying widow(er) and deducts the standard deduction. Compute Taylor's 2019 income tax liability. Place Answers in Boxes AGI before gains and losses $ - Short-term capital gain - Long-term capital loss - AGI $ _ Less: Standard deduction (2019) - Taxable income $ - Tax (effective rate of 14,0345%) $ - (using Tax Rate Schedule Y-1 for MFJ/Qualifying Widow(er)) Plus: Tax on capital gain net of capital loss - Tax from Tax Table (Qualifying Widow(er)) $ Question 13. Section 1244 Stock. 111101.06. a. Hale sells 1,000 shares of his Section 1244 stock ("small business corporation" stock) at a loss of $200,000, If Hale and his wife le a joint return, how will this loss be treated on the tax return. b. If Hale were single, how would he treat the loss on his tax return? Remember: Individuals can deduct as ordinary losses up to $50,000 if a single taxpayer or $100,000 if married lingjointi Once losses exceed the ordinary loss limit they are considered capital losses

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts