Question: can i get some help with this Requirement 2 Prepare the stockholder's equity section of the balance sheet as of December 31, 2018. Assume Naxion

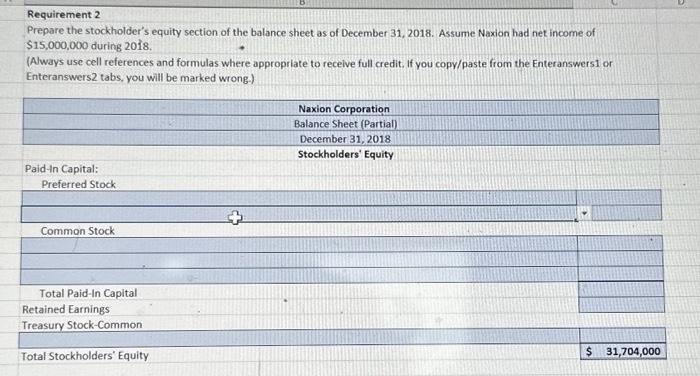

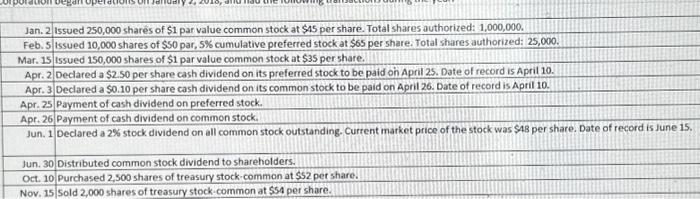

Requirement 2 Prepare the stockholder's equity section of the balance sheet as of December 31, 2018. Assume Naxion had net income of $15,000,000 during 2018 . (Always use cell references and formulas where appropriate to recelve full credit. If you copy/paste from the Enteranswers1 or Enteranswers 2 tabs, you will be marked wrong.) Jan. 2 Issued 250,000 shars of $1 par value common stock at $45 per share. Total shares authorized: 1,000,000. Feb. 5 issued 10,000 shares of $0 par, 5% cumulative preferred stock at $65 per share. Total shares authorized: 25,000. Mar. 15 issued 150,000 shares of $1 par value common stock at $35 per share. Apr. 2 Declared a \$2.50 per share cash dividend on its preferred stock to be paid on April 25. Date of record is April 10. Apr. 3 Declared a $0.10 per share cash dividend on its common stock to be paid on April 26. Date of record is Aprill 10. Apr. 25 payment of cash dividend on preferred stock. Apr. 26 Payment of cash dividend on common stock. Jun. 1 Declared a 2% stock dividend on all common stock outstanding. Current market price of the stock was $48 per share. Date of record is June 15 . Jun. 30 Distributed common stock dividend to shareholders. Oct. 10 Purchased 2,500 shares of treasury stock-common at $2 pet share. Nov, 15 Sold 2,000 shares of treasury stock-common at $54 per share. Requirement 2 Prepare the stockholder's equity section of the balance sheet as of December 31, 2018. Assume Naxion had net income of $15,000,000 during 2018 . (Always use cell references and formulas where appropriate to recelve full credit. If you copy/paste from the Enteranswers1 or Enteranswers 2 tabs, you will be marked wrong.) Jan. 2 Issued 250,000 shars of $1 par value common stock at $45 per share. Total shares authorized: 1,000,000. Feb. 5 issued 10,000 shares of $0 par, 5% cumulative preferred stock at $65 per share. Total shares authorized: 25,000. Mar. 15 issued 150,000 shares of $1 par value common stock at $35 per share. Apr. 2 Declared a \$2.50 per share cash dividend on its preferred stock to be paid on April 25. Date of record is April 10. Apr. 3 Declared a $0.10 per share cash dividend on its common stock to be paid on April 26. Date of record is Aprill 10. Apr. 25 payment of cash dividend on preferred stock. Apr. 26 Payment of cash dividend on common stock. Jun. 1 Declared a 2% stock dividend on all common stock outstanding. Current market price of the stock was $48 per share. Date of record is June 15 . Jun. 30 Distributed common stock dividend to shareholders. Oct. 10 Purchased 2,500 shares of treasury stock-common at $2 pet share. Nov, 15 Sold 2,000 shares of treasury stock-common at $54 per share

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts