Question: Can I get the solutions step by step from the questions? Appreciate it ! Problem #1: A bond issued on February 1, 2004 with face

Can I get the solutions step by step from the questions? Appreciate it !

Can I get the solutions step by step from the questions? Appreciate it !

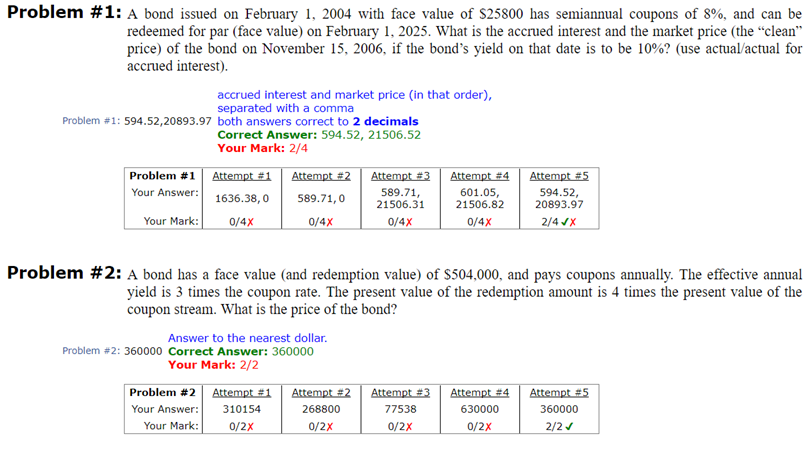

Problem #1: A bond issued on February 1, 2004 with face value of S25800 has semiannual coupons of 8%, and can be redeemed for par (face value) on February 1, 2025. What is the accrued interest and the market price (the "clean'" price) of the bond on November 15, 2006, if the bond's yield on that date is to be 10%? (use actual/actual for accrued interest) accrued interest and market price (in that order), separated with a comma Problem #1 : 594.52,20893.97 both answers correct to 2 decimals Correct Answer: 594.52, 21506.52 Your Mark: 2/4 Problem #1 | Attempt #1 | Attempt #2 | Attempt #3 | Attempt#4 | Attempt#S Your Answe1636.38,0 589.71 21506.31 601.05 21506.82 0/4X 594.52 20893.97 2/4X 589.71,0 Your Mark 0/4X 0/4X 0/4X Problem #2: A bond has a face value (and redemption value of $504,000, and pays coupons annually. The effective annual yield is 3 times the coupon rate. The present value of the redemption amount is 4 times the present value of the coupon stream. What is the price of the bond? Answer to the nearest dollar. Problem #2: 360000 Correct Answer: 360000 Your Mark: 2/2 310154 0/2X 77538 0/2X Your Answer: 268800 630000 360000 Your Mark 0/2X 0/2X 2/2

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts