Question: Can I have help finding the solutions to question 14 on my practice guide. Questions 15,16,17,18 and 19 are just true or false can I

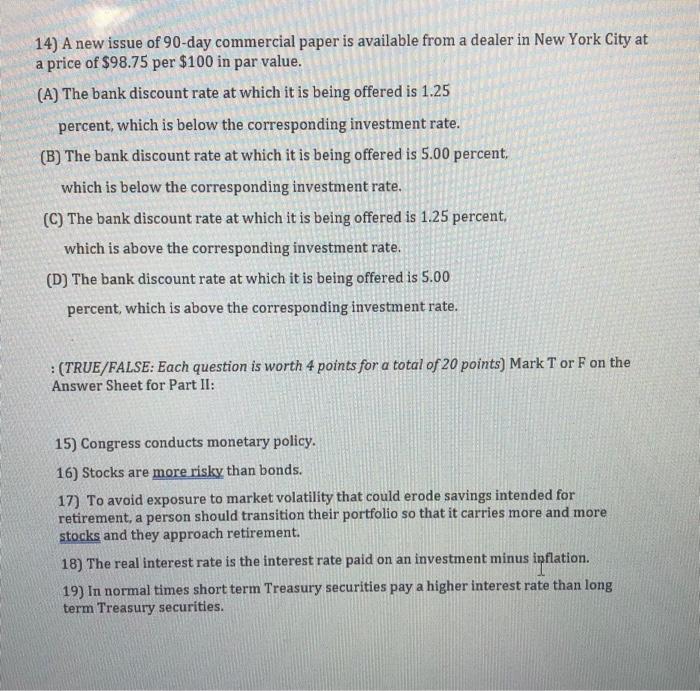

14) A new issue of 90-day commercial paper is available from a dealer in New York City at a price of $98.75 per $100 in par value. (A) The bank discount rate at which it is being offered is 1.25 percent, which is below the corresponding investment rate. (B) The bank discount rate at which it is being offered is 5.00 percent. which is below the corresponding investment rate. (C) The bank discount rate at which it is being offered is 1.25 percent, which is above the corresponding investment rate. (D) The bank discount rate at which it is being offered is 5.00 percent, which is above the corresponding investment rate. :(TRUE/FALSE: Each question is worth 4 points for a total of 20 points) Mark T or F on the Answer Sheet for Part II: 15) Congress conducts monetary policy. 16) Stocks are more risky than bonds. 17) To avoid exposure to market volatility that could erode savings intended for retirement, a person should transition their portfolio so that it carries more and more stocks and they approach retirement. 18) The real interest rate is the interest rate paid on an investment minus inflation. 19) In normal times short term Treasury securities pay a higher interest rate than long term Treasury securities

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts