Question: can I have help on this matter please :) Score: 0 of 2 pts 2 of 5 (0 complete) HW Score: 0%, 0 of 16

can I have help on this matter please :)

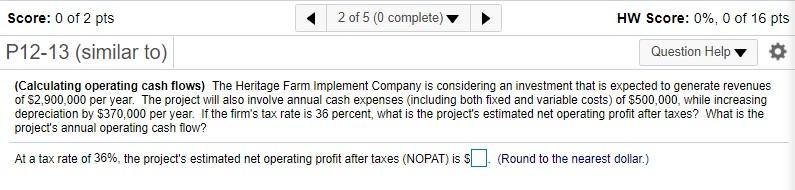

Score: 0 of 2 pts 2 of 5 (0 complete) HW Score: 0%, 0 of 16 pts P12-13 (similar to) Question Help (Calculating operating cash flows) The Heritage Farm Implement Company is considering an investment that is expected to generate revenues of $2,900,000 per year. The project will also involve annual cash expenses (including both fixed and variable costs) of $500,000, while increasing depreciation by $370,000 per year. If the firm's tax rate is 36 percent, what is the project's estimated net operating profit after taxes? What is the project's annual operating cash flow? At a tax rate of 36%, the project's estimated net operating profit after taxes (NOPAT) is SL (Round to the nearest dollar.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts