Question: can I have help setting up these tables from the word problem with formulas thanks! Sony is considering introducing a new Playstation controller with advanced

can I have help setting up these tables from the word problem with formulas thanks!

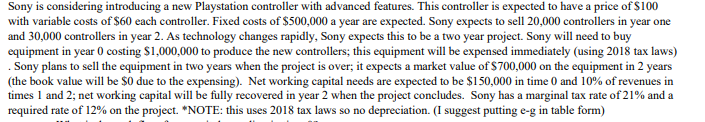

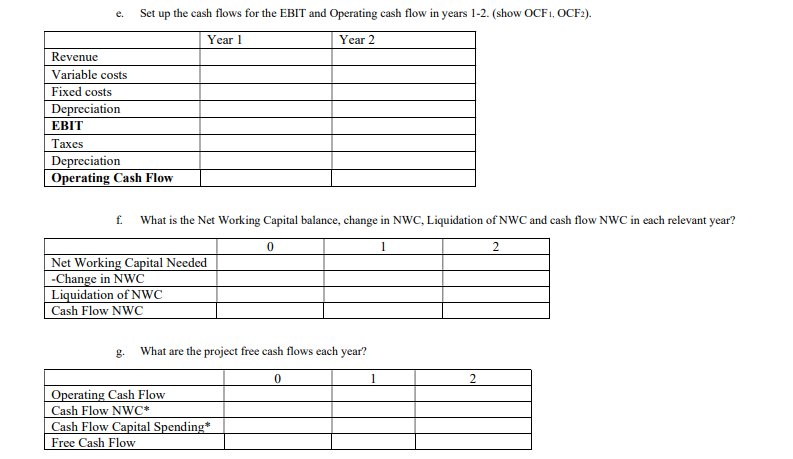

Sony is considering introducing a new Playstation controller with advanced features. This controller is expected to have a price of $100 with variable costs of $60 each controller. Fixed costs of $500,000 a year are expected. Sony expects to sell 20,000 controllers in year one and 30,000 controllers in year 2. As technology changes rapidly, Sony expects this to be a two year project. Sony will need to buy equipment in year 0 costing $1,000,000 to produce the new controllers; this equipment will be expensed immediately (using 2018 tax laws) Sony plans to sell the equipment in two years when the project is over; it expects a market value of $ 700,000 on the equipment in 2 years (the book value will be $0 due to the expensing). Net working capital needs are expected to be $150,000 in time 0 and 10% of revenues in times 1 and 2; net working capital will be fully recovered in year 2 when the project concludes. Sony has a marginal tax rate of 21% and a required rate of 12% on the project. *NOTE: this uses 2018 tax laws so no depreciation. (I suggest putting e-g in table form) e. Set up the cash flows for the EBIT and Operating cash flow in years 1-2. (show OCF1, OCF2). Year 1 Year 2 Revenue Variable costs Fixed costs Depreciation EBIT Taxes Depreciation Operating Cash Flow f. What is the Net Working Capital balance, change in NWC, Liquidation of NWC and cash flow NWC in each relevant year? 0 2 Net Working Capital Needed -Change in NWC Liquidation of NWC Cash Flow NWC g. What are the project free cash flows each year? 0 1 2 Operating Cash Flow Cash Flow NWC* Cash Flow Capital Spending* Free Cash Flow Sony is considering introducing a new Playstation controller with advanced features. This controller is expected to have a price of $100 with variable costs of $60 each controller. Fixed costs of $500,000 a year are expected. Sony expects to sell 20,000 controllers in year one and 30,000 controllers in year 2. As technology changes rapidly, Sony expects this to be a two year project. Sony will need to buy equipment in year 0 costing $1,000,000 to produce the new controllers; this equipment will be expensed immediately (using 2018 tax laws) Sony plans to sell the equipment in two years when the project is over; it expects a market value of $ 700,000 on the equipment in 2 years (the book value will be $0 due to the expensing). Net working capital needs are expected to be $150,000 in time 0 and 10% of revenues in times 1 and 2; net working capital will be fully recovered in year 2 when the project concludes. Sony has a marginal tax rate of 21% and a required rate of 12% on the project. *NOTE: this uses 2018 tax laws so no depreciation. (I suggest putting e-g in table form) e. Set up the cash flows for the EBIT and Operating cash flow in years 1-2. (show OCF1, OCF2). Year 1 Year 2 Revenue Variable costs Fixed costs Depreciation EBIT Taxes Depreciation Operating Cash Flow f. What is the Net Working Capital balance, change in NWC, Liquidation of NWC and cash flow NWC in each relevant year? 0 2 Net Working Capital Needed -Change in NWC Liquidation of NWC Cash Flow NWC g. What are the project free cash flows each year? 0 1 2 Operating Cash Flow Cash Flow NWC* Cash Flow Capital Spending* Free Cash Flow

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts