Question: Can I have help with this this question a,b,c a) Inventory at 31 December 2013 was valued at 51,600,000. While doing the inventory count, errors

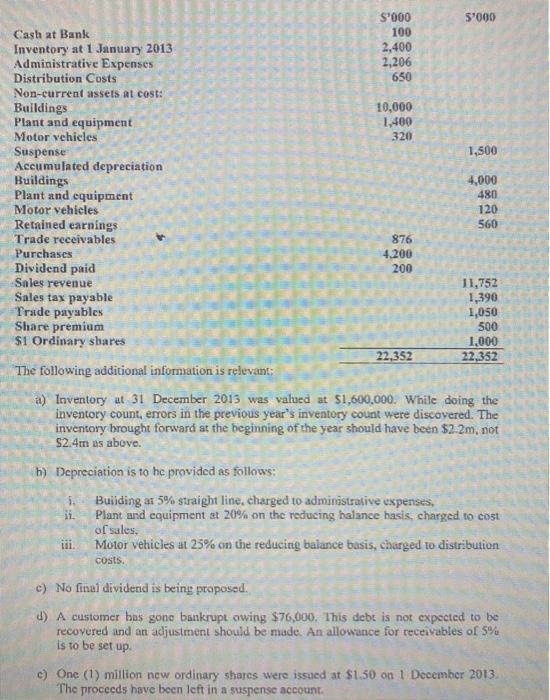

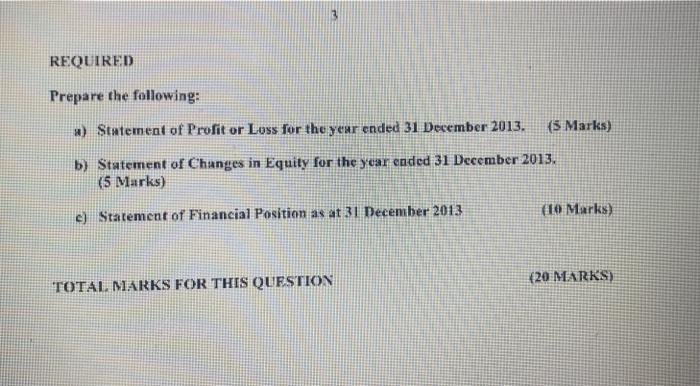

a) Inventory at 31 December 2013 was valued at 51,600,000. While doing the inventory count, errors in the previous year's inventory count were discovered. The inventory brought forward at the beginning of the year should have been $2.2m, not 52.4m as above. b) Depreciation is to he provided as follows: i. Buiiding at 5% straight line, charged to administrative expenses, ii. Plant and equipment at 20% on the reducing halance hasis, charged to cost of sales, iii. Motor vehicles at 25% on the reducing balance basis, charged to distribution costs. c) No finul dividend is being proposed. d) A customer bas gone bankrupt awing $76,000. This debt is not expected to be recovered and an adjustment should be made. An allowance for receivables of 5% is to be set up. c) One (1) million new ordinary shares were issued at $1.50 on 1 December 2013 The proceeds have been left in a suspense account. Prepare the following: a) Statement of Profit or Luss for the year ended 31 December 2013. (S Marks) b) Statement of Changes in Equity for the year ended 31 December 2013 . (5 lviarks) c) Statement of Financial Position as at 31 December 2013 (it)Marks) TOTAL. MIKKS FOR THIS QUESTION (20 M.ARKA a) Inventory at 31 December 2013 was valued at 51,600,000. While doing the inventory count, errors in the previous year's inventory count were discovered. The inventory brought forward at the beginning of the year should have been $2.2m, not 52.4m as above. b) Depreciation is to he provided as follows: i. Buiiding at 5% straight line, charged to administrative expenses, ii. Plant and equipment at 20% on the reducing halance hasis, charged to cost of sales, iii. Motor vehicles at 25% on the reducing balance basis, charged to distribution costs. c) No finul dividend is being proposed. d) A customer bas gone bankrupt awing $76,000. This debt is not expected to be recovered and an adjustment should be made. An allowance for receivables of 5% is to be set up. c) One (1) million new ordinary shares were issued at $1.50 on 1 December 2013 The proceeds have been left in a suspense account. Prepare the following: a) Statement of Profit or Luss for the year ended 31 December 2013. (S Marks) b) Statement of Changes in Equity for the year ended 31 December 2013 . (5 lviarks) c) Statement of Financial Position as at 31 December 2013 (it)Marks) TOTAL. MIKKS FOR THIS QUESTION (20 M.ARKA

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts